Asia-Pacific airline fleet shifts, Part 2: contrasting fortunes. A380s and 747s grounded

This two-part analysis takes a close look at aircraft fleet trends in the Asia-Pacific region, and how they have changed during the course of the COVID-19 pandemic.

Part 1 analysed the shifts that have occurred over the past few years for widebodies and narrowbodies, the variations between sub-regions, and the encouraging recent signs of fleet recovery.

Part 2 examines how certain aircraft models are affected, and how specific airlines are adjusting their fleet plans. Most A380s still grounded and 747s may stay that way. MOst 787s and A350s are flying

Summary:

- Only 12 A380s are in service in the Asia-Pacific region, with 53 inactive.

- Airlines have accelerated the retirement of 747s and the 777-200 range.

- A350s and 787s have been returned to service more quickly than others.

- Many airlines have deferred or cut orders, although a few are placing new orders.

Most A380s will eventually return to the skies, but 747s are disappearing

Some aircraft types have been particularly affected by the COVID-19 crisis.

Good examples of this are the largest passenger aircraft - Airbus A380s and Boeing 747s.

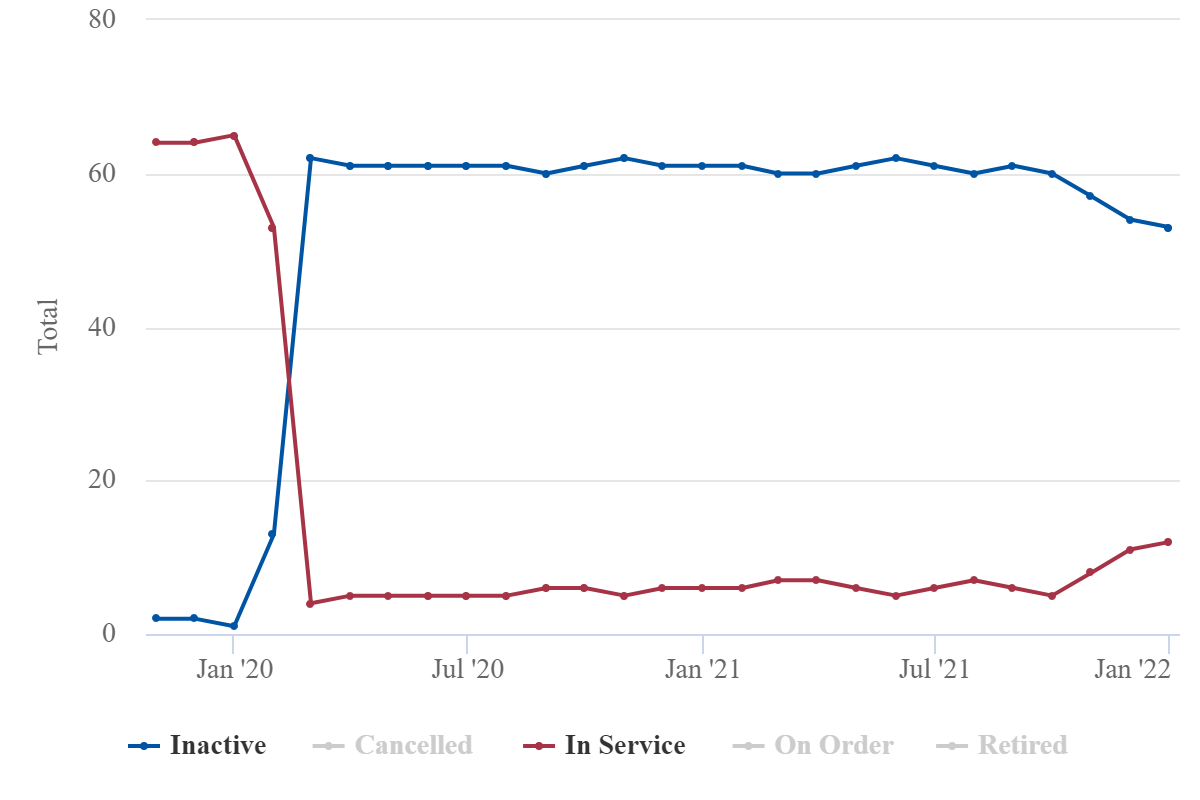

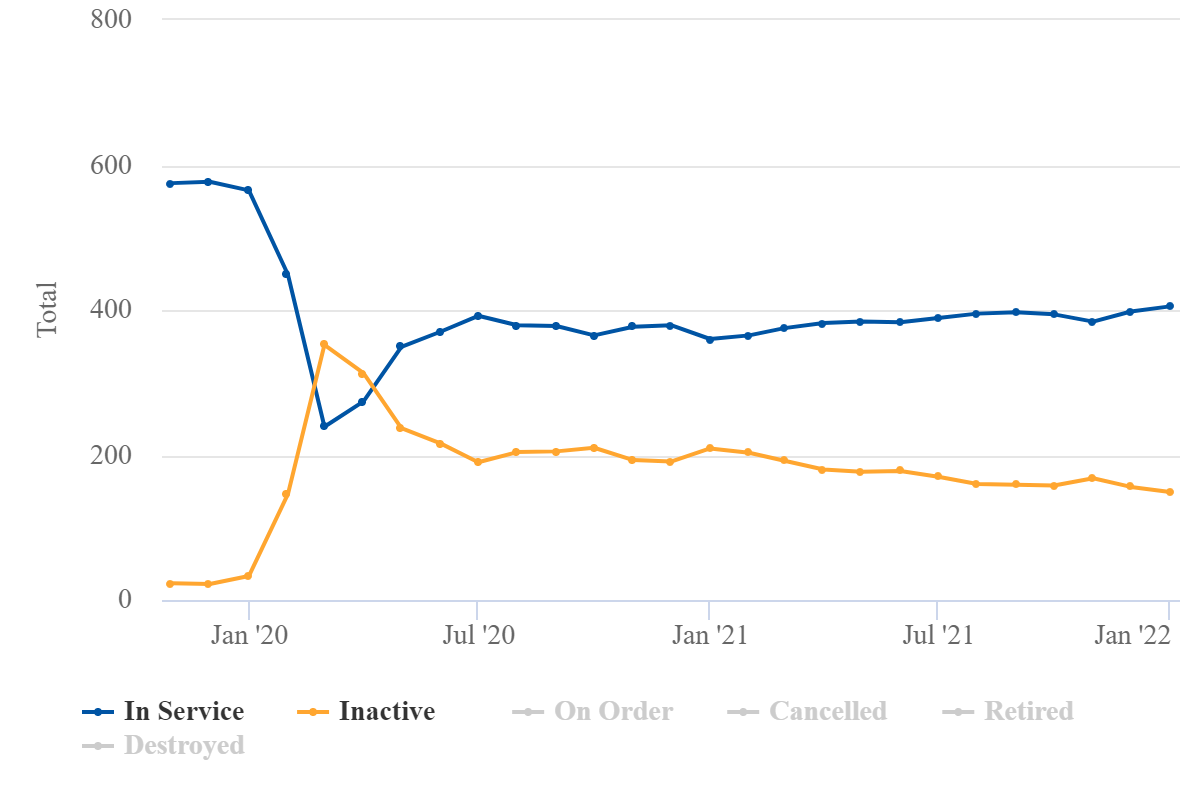

There were 65 A380s in service in the Asia-Pacific region at the end of Jan-2020 versus one inactive, according to the CAPA fleet database. The active number fell to just five by Apr-2020 and didn't increase appreciably until around Oct-2021. As of 24-Jan-2022 the active number had risen to 12, with 53 inactive.

Of the 12 currently active in the region, Singapore Airlines accounts for seven, China Southern three, and Qantas and Korean Air one each.

The chart below shows A380 status for the four Asia-Pacific sub-regions: Northeast Asia, Southeast Asia, South Asia and Southwest Pacific. The other Asia-Pacific data cited elsewhere is also for these four sub-regions combined.

Asia-Pacific passenger A380s: active vs inactive, to Jan-2022

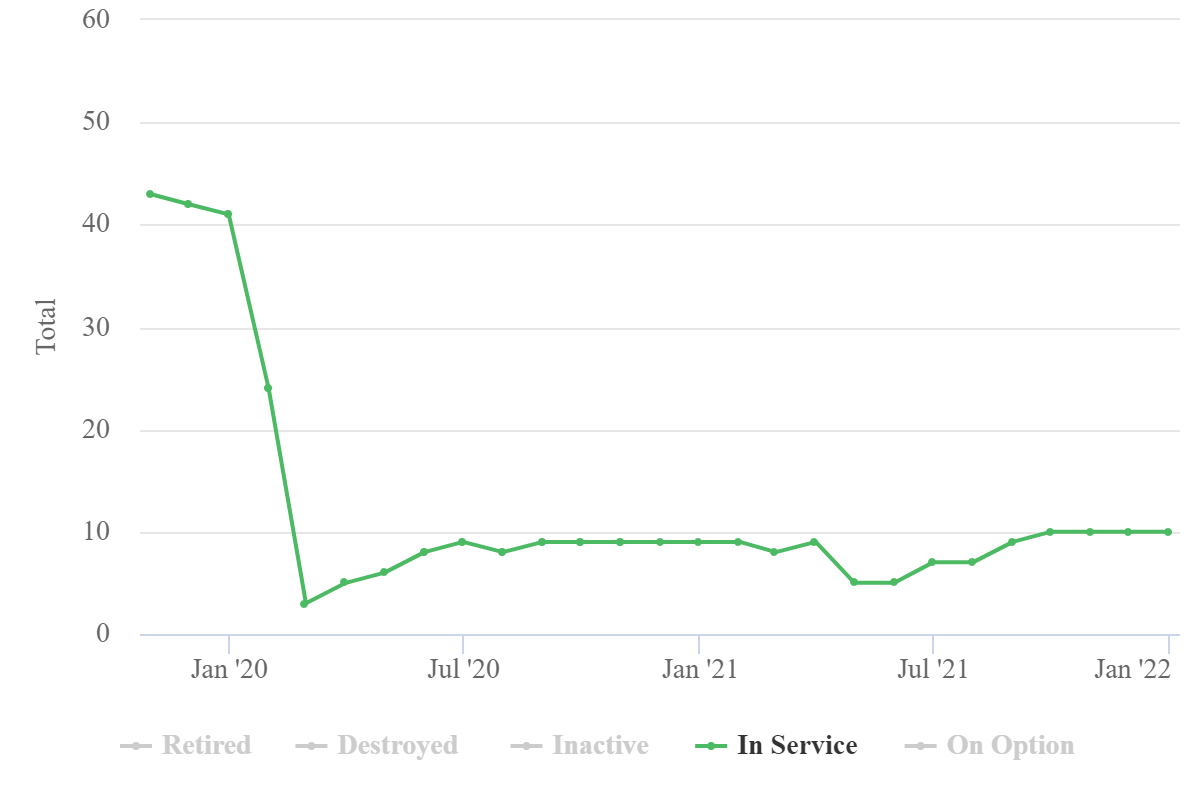

Boeing 747s have also become more scarce during the pandemic period.

There were 41 passenger 747s still active in the Asia-Pacific region in Jan-2019. Two years later, there are 10 in service.

Korean Air operates three, all of which are the relatively new 747-8 variant. Air China accounts for seven 747s, a mix of -8s and -400s.

Airlines such as Qantas decided to accelerate the retirement of their 747-400s.

Asia-Pacific passenger 747s: active aircraft, to Jan-2022

Older models are being phased out more quickly, while most 787s and A350s are already flying again

Generally, older widebody types have been the most likely to be put into long term storage.

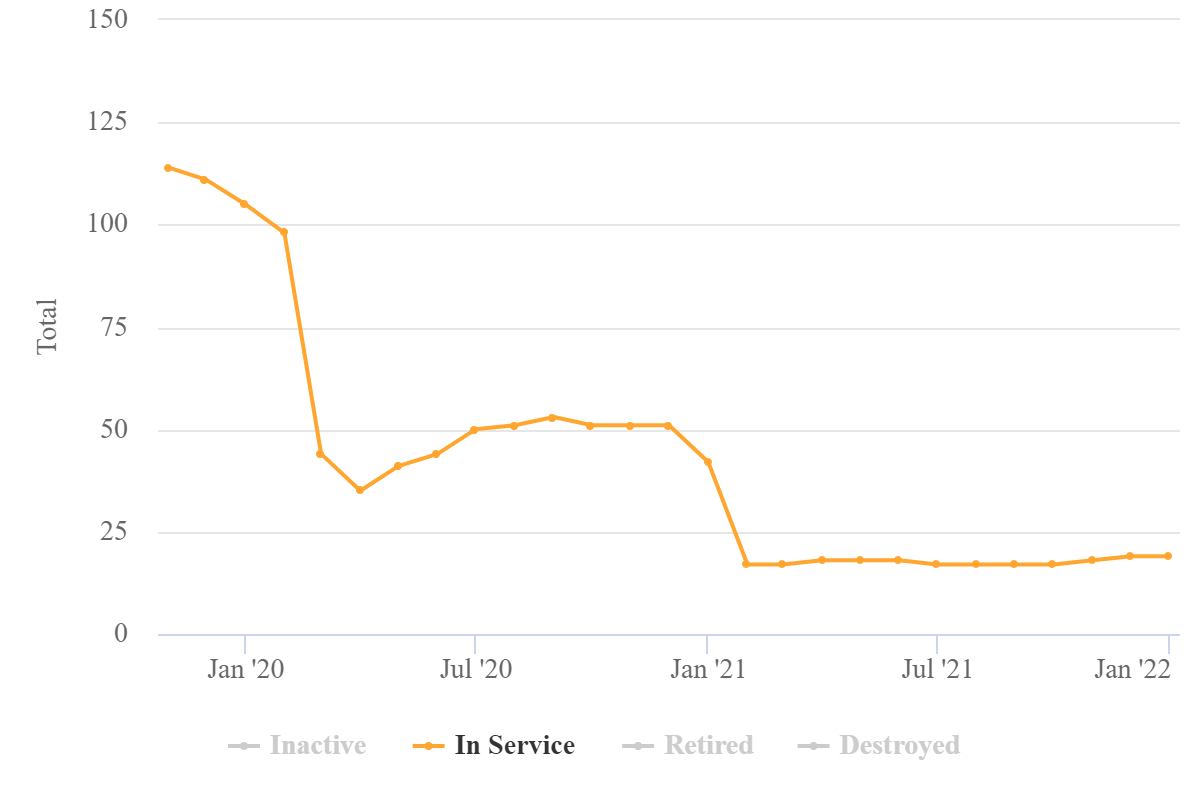

There were 114 Boeing 777-200 variants in service in the Asia-Pacific region before the pandemic, including -200ERs and -200LRs. Now, however, there are just 19 of the passenger versions active.

Asia-Pacific passenger 777-200 family: active aircraft, to Jan-2022

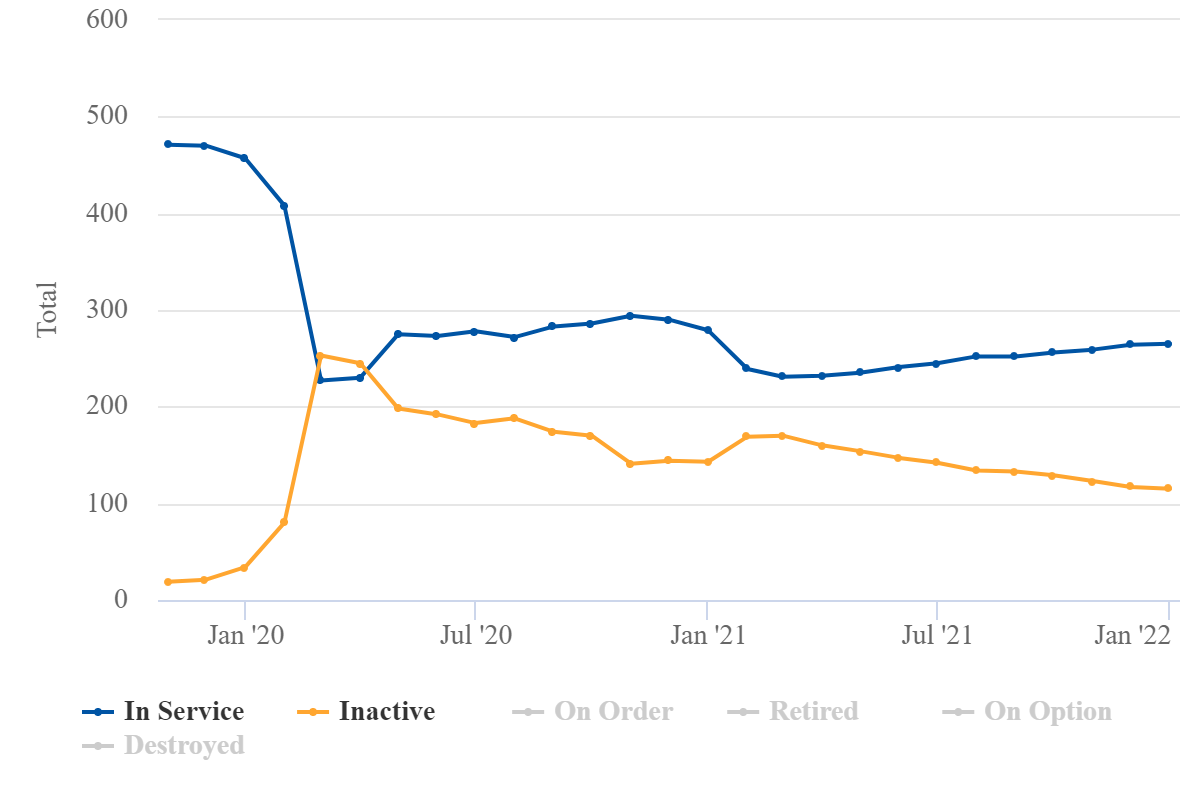

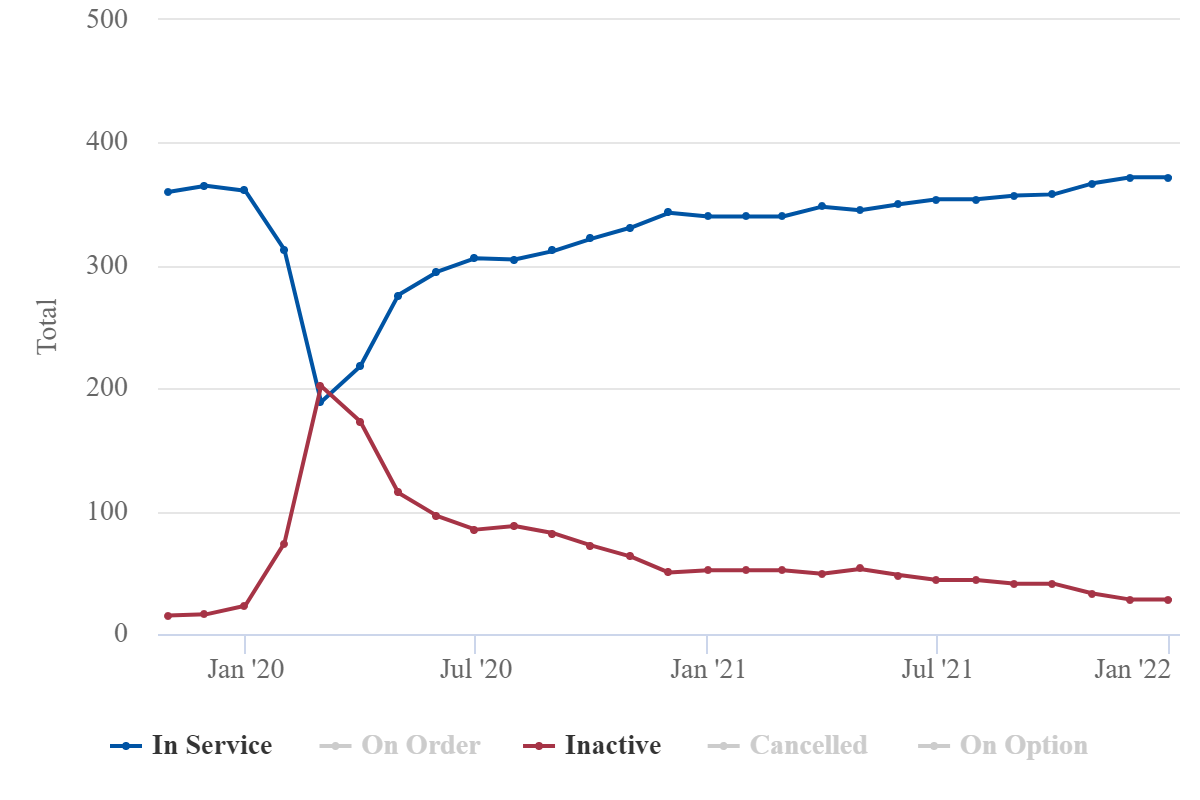

The numbers are considerably better when all 777 variants are included.

For the broader 777 family, 265 of the passenger versions in the region - or 69.7% - are active in Asia-Pacific, with 115 inactive.

The situation is broadly similar for A330s, with 73.1% of the 554 aircraft in service.

Asia-Pacific passenger 777s, all variants, inactive or in service, to Jan-2022

Asia-Pacific passenger A330s, all variants, inactive or in service, to Jan-2022

In contrast, newer widebody types have returned to service far more quickly. Airlines are more inclined to use their newer and more efficient aircraft before bringing older types out of storage.

There are 372 Boeing 787s in service in Asia-Pacific and just 28 inactive. New deliveries mean there are actually slightly more 787s in service now than before the coronavirus pandemic began.

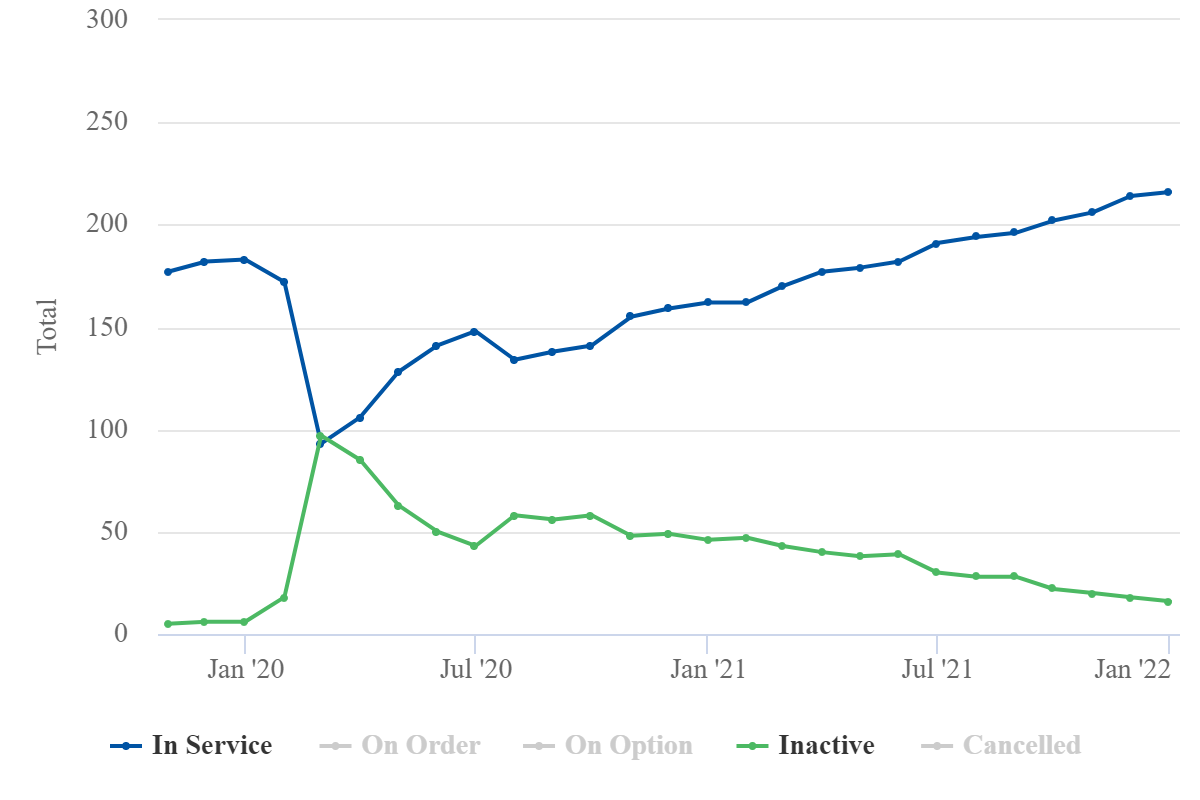

The trend is similar for Airbus A350s. There are 216 in service and 16 inactive. The A350 total in service has increased beyond pre-pandemic levels even faster than number of 787s.

Asia-Pacific Boeing 787s, active vs inactive, to Jan-2022

Asia-Pacific Airbus A350s, active vs inactive, to Jan-2022

Asia-Pacific airlines are retiring some widebodies earlier than planned

Many of the aircraft that have been placed in storage during the pandemic will not be returned to service by their current owners.

Malaysia Airlines has decided to phase out and attempt to sell all six of its A380s. Qantas, Singapore Airlines and Thai Airways also intend to cut down their A380 fleets.

In another example, Air New Zealand announced last year that its stored 777-200s will not return to service.

Several Asia-Pacific airlines opted to accelerate retirement plans for older widebodies as a result of the pandemic. Both of Japan's major airlines have done this, phasing out many of their 777s earlier than they had previously planned.

All Nippon Airways retired 22 of its 777s in the fiscal year ending 31-Mar-2021. Japan Airlines has phased out all 13 of the 777-200s and -300s that were used on domestic routes before the pandemic and has retired six of its 11 777-200ERs.

JAL will continue to operate 13 777-300ERs on international routes and they will eventually be replaced by the A350-1000s that the airline has on order.

Many airlines have deferred or reduced their aircraft orders…

Most airlines have reached deals to push back planned deliveries to varying degrees - an exception to this is the Indian low-cost carrier IndiGo, which has continued to take narrowbody deliveries as scheduled.

In some cases airlines have cancelled or reduced their orders instead of merely delaying them.

Malaysia-based AirAsia X had 78 A330neos and 30 A321XLRs on order before the pandemic. However, it reached agreement with Airbus last year to cut the order to 15 A330neos and 20 A321XLRs. The change is significant for the A330neo program, as AirAsia X was the largest airline customer for this model.

Virgin Australia is another example of an airline that has scaled back its aircraft orders while restructuring through the courts, cutting its Boeing 737 MAX orders by almost half.

The airline previously had 25 of the 737-10 version due from July 2021 and 23 of the -8 version due from 2025. Under the revised agreement, it will only take the 25 737-10s, with first delivery pushed back to mid-2023.

Singapore Airlines has also restructured part of its order book. The airline reached a deal with Airbus in December to cut orders for 15 A320neos and two A350-900s, while also adding orders for seven A350F freighters with options for another five. SIA is expected to be the first airline to operate the A350F when deliveries begin in late 2025.

…while others are looking to place new orders

Despite the bleak demand environment, there are some airlines that have placed significant passenger aircraft orders or are preparing to do so. These airlines are expecting to secure advantageous deals as manufacturers chase relatively scarce opportunities.

In December Qantas selected Airbus to replace its current narrowbody fleet. The airline intends to buy up to 134 aircraft from the A320neo and A220 families, comprising 40 firm orders and 94 purchase rights.

The initial 40 aircraft will be split between 20 A321XLRs and 20 A220s. The order is expected to be finalised by mid-2022, subject to board approval.

Deliveries are due to begin in the second half of 2023. The purchase rights would be converted in stages, with deliveries spread over more than 10 years.

The Indian start-up LCC Akasa Air placed an order for 72 737 MAXs during the Dubai Air Show in November. The order includes two variants: the 737-8 and the higher capacity 737-8-200.

Akasa intends to begin operations around the middle of this year. The airline is set to receive 18 aircraft by the end of March 2023 and then plans to add another 14-16 aircraft every 12 months, CEO Vinay Dube said during a recent televised interview.

Other start-up or relaunched airlines may also place orders for narrowbody aircraft. These include Hong Kong-based Greater Bay Airlines, which intends to begin operations this year, and India's Jet Airways, which plans to resume services after an extended hiatus.

A more modern Asia-Pacific fleet will emerge as aircraft numbers in service recover

The COVID-19 crisis has affected the Asia-Pacific airline fleet in multiple ways.

On one hand, the early retirement of older types will help reduce the average age of various airline's fleets. But on the other hand many airlines have deferred or even cut back aircraft orders, thus delaying fleet refresh plans.

Overall, the competing trends should have the effect of accelerating the move to a younger fleet when the dust settles. This will have obvious benefits for efficiency and for reducing emissions.

Narrowbodies have returned to service more quickly than widebodies, which is to be expected given that domestic services have been less affected by border closures. The ratio in service has also varied widely between Asia-Pacific subregions, with China and Southeast Asia at opposite ends of the spectrum. However, it appears that there has been a general sustained increase in the region's active fleet in recent months.

Despite setbacks in demand due to the Omicron wave of COVID-19, this trend should continue as 2022 progresses. There will be different ceilings for the return of various fleet types, and some aircraft models will clearly have a much smaller presence in this region than before the pandemic.