In 2023 CAPA - Centre for Aviation (CAPA) published three reports on investors in the airport business by sector - sovereign wealth funds; private equity; and pension funds. Together they form a substantial block of investors into airports, and their numbers continue to grow. The fourth and final report follows, on airline investors.

There are just as many of them, but their overall impact is limited compared to the other groups. In most cases their investment level is low, and they may amount to being as little as a small part of a consortium (for example, in Japan). There is no airline or group that can be considered a significant investor in a major airport or group, with the single exception of Lufthansa, which has equity in Fraport and a share in a terminal at Munich.

Most of the players are 'Full Service Carriers' and alliance members, but they also embrace regional airlines and LCCs. Management at the latter are often keen to let their opinion on airports be known, and to suggest that they could "do things better" without actually making much of an effort to prove it. The Capital A (AirAsia) group is one such entity, which has recently been vocally active on the matter - and not for the first time - but which has yet to put pen to paper. Ryanair did much the same in the past, but has not so much nowadays.

In the immediate future the greatest opportunities will probably come in the US, where the public and private partnership method of airport development has increasingly found favour with airport operators, constructors, and both domestic and foreign airlines at major airports. It stands ready to be repeated at smaller airports throughout the country. This report also contains a brief overview of the regulatory issues connected to such investments in the various world regions.

The concept of the airport city is now 25 years old and there are many examples of it around the world. It is one of a cluster of economic activity that is related to the need to travel by air, congregating around an airport (airport city) and subsequently expanding along nodes into surrounding areas (aerotropolis).

This report looks at what are considered to be the 10 leading examples of airport cities and aerotropolises and summarises the various factors and influences that apply to them.

It concludes by examining the commonalities where they can be found, asks why airport cities have not grown up in two cases where they rightly should have, questions the role of the private sector in their development and looks at the social and economic arguments against them.

Format: PDF on receipt of payment

Extent: 91 pages

Publication Date: Mar-2017

Conflict usually invokes the tendency to respond with either ‘fight or flight.’ The competition between air and rail as travel modes, at least over short distances and often driven by the demands of environmental considerations, shows no signs of abating and frequently verges on confrontation. What this report asks, fundamentally, is this. Is there a better alternative for those disparate modes, let us call it ‘fight or co-operate?’

It seems there is. There are already known to be over 600 designated air-rail links with another 200 planned.

This report does not attempt to catalogue every functioning and proposed air-rail link, though many of the main ones will be found here. Rather, it is more concerned with how the air-rail industry has developed, how it continues to do so and with ‘what’s new’ in the business.

Possibly the most comprehensive single report on this subject it ranges over critical subject areas such as intermodality and sectoral collaboration; interaction with airport city development; ‘low cost rail’; historically unsuccessful links; and the skills required to build air rail links. And most importantly – who pays?

Covering developments on each continent, the report includes four highly relevant case studies: Lyon Saint Exupéry Airport, London Luton Airport, Los Angeles airports (general) and the Western Sydney Badgerys Creek airport.

Format: PDF on receipt of payment

Extent: 112 pages

Publication Date: June-2017

CAPA launches historic, first of its kind airline sustainability benchmarking report

Globally, consumers, communities and countries are increasingly demanding climate action. So too are investors, who now want proof, not just talk of climate plans and results. Now more than ever, airlines are under pressure to cut flight emissions through sustainable aviation fuels, efficient aircraft and propulsion systems, as well as carbon pricing and reduction strategies. These are expensive solutions at any time, let alone post-COVID, when airlines are posting record losses. But the cost of inaction is even higher.

The CAPA-Envest Airline Sustainability Benchmarking Report 2021 is the industry’s first single source of truth on emissions, benchmarking airlines and their performance as they transition the net zero operations. The 130+ page report includes:

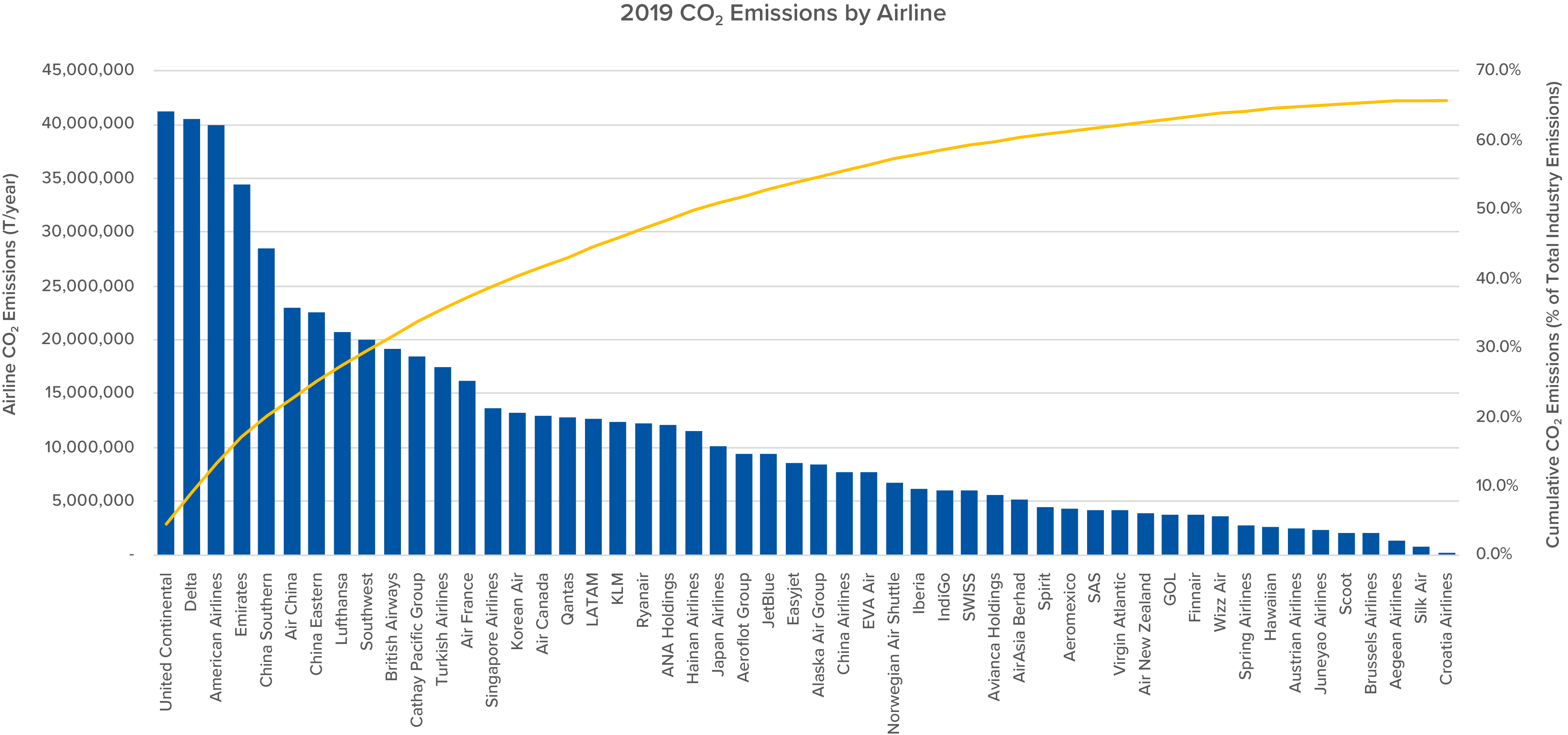

- 52 airlines benchmarked using their reported emissions for 2019 and 2020;

- Analysis on the most important airline comparisons for the year pre-COVID, 2019;

- Insights into global corporations’ decarbonisation strategies and implications for corporate travel; and

- Perspectives on investor demands for the airline industry and how these will continue to lead to increased pressure on airline boards and senior management.

REPORT SNEAK PREVIEW! The total CO2 emissions by airlines in 2019 highlight the largest emitters and the significance of the top 10 airlines relative to total industry emissions.

Notes:

- CAPA Members receive a USD1,000 discount off purchases. Contact your account manager for the code.

- Ensure you are purchasing the correct version:

- Individual/Restricted: For internal use only.

- Enterprise Usage: For subsidiary sharing, external use and resale e.g., consulting.

- Airline Only: Special discounted version for airlines.

Deepen your research with the CAPA Airline Sustainability Benchmarking Dashboards and Data Compendium

Also available for purchase is the CAPA Airline Sustainability Benchmarking Dashboards and Data Compendium. Each document allows the reader to delve further into the data collated by CAPA and Envest Global to benchmark the relevant airlines. The dashboards show individual airline results, highlighted for ease of visualisation and the compendium provides raw data for further analysis.

Contact us or reach out to your dedicated Account Manager for access.

The CAPA-Envest Airline Sustainability Benchmarking Report 2021 is the first industry single source of truth on emissions, benchmarking airlines and their performance

Key facts about the Report

- 50 page report

- Benchmarking of 52 airlines and their reported emissions for 2019 and 2020

- 8 Figures/graphics and analysis showing the most important airline comparisons for pre-COVID 2019.

- Insights into global corporations’ decarbonisation strategies and implications for corporate travel reduction

Why Travel Managers need this report, the data is contains and what you can do with it

- Provides relevant and credible reporting metrics to support traveller’s/ corporates’ own emission targets/objectives

- May guide and influence future buyer behaviours sector and opportunities for partnering programs, joint investment with airlines

- Provides a broader industry benchmarking tool at a more micro level to that available via other sources.

- Supports travel managers who are under pressure from internal ESG / sustainability teams for provision of reliable data for current emissions, but also for defining and implementing an ongoing program for reduction of the carbon emission footprint generated by the travel program.

Want to know more?

Live music events attract high numbers of people prepared to travel to watch the performers they support. Further, in the case of festivals, to experience others that are new to them – both in their own countries and, increasingly, abroad.

This groundswell of travel adds to that undertaken by the artists themselves to perform, record, collaborate or sign contracts, as well as that of their supporting musicians, sound and lighting experts, A&R experts (talent spotters), managers and entrepreneurs. In all, it is big business, and getting both bigger and more global.

Indeed, both the aviation and music industries are populated by global brands. And yet, strangely, it is only a handful of airlines and even fewer airports that have grasped its significance and made any significant attempt to work with the music industry to the benefit of both parties.

This report, using five case studies, examines the credentials of a number of airlines and airports that are actively involved in the promotion of musical events, including performances on their own property (e.g. on board or in-terminal).

It looks at how music business entrepreneurs regard the air transport and tourism industries when they start to examine the prospects for international expansion of their events. And it considers an example of a country which does not as yet stage large scale western-style events, but is in a position to do so on account of its air connectivity and advanced surface infrastructure at selected locations.

The purpose is to attempt to set out some guidelines that will be useful to any aviation or tourism entity seeking to enter the potentially lucrative music world in a collaborative manner. At the same time, it offers the music industry some insight into how the aviation and tourism businesses work.

Format: PDF on receipt of payment

Extent: 81 pages

Publication Date: Aug-2017

The CAPA 2014 Airport Privatisation Review was published in Jan-2015, followed by a much bigger management report on FY2014 in Mar-2015. Despite both these reports having been published in the recent past it is pertinent to revisit the subject now. Both of them referred to a continuing paucity of deals but there has since been a discernible uptick in both actual and putative ones. While money is still tight it is perhaps not as tight as it was, infrastructure bonds are popular and with interest rates low just about any investment of this kind is likely to provide a better return, albeit with greater risk. With traffic figures rising and airport EBITDAs rising, along with the multiples when they are sold, air transport infrastructure is coming back into fashion. What is more, the activity is across the board - in PPPs, BOTs, trade sales, even a couple of IPOs.

But some caution needs to be exercised. As ever, national and regional economies and exogenous world events – or Black Swans if you prefer - will dictate airport values and their investment potential every bit as much – or more so – than the start up of a handful of new routes. All but one of the BRICs for example (i.e. India) have lost their patina recently and in the case of Russia the stand-off with the west over Ukraine means not only that aviation growth will be severely diminished there by economic sanctions but also that a military confrontation could take place. Aeroflot just cancelled its order for 22 B787s and is also reviewing its order for 22 A350s

Publication Date: Sep-2016

This 186-page document is the eighth in a series of reports on airport privatisation and investment published by CAPA and the first since Sep-2016. The report picks up on events since the beginning of 2017, in some ways a turning point for airport privatisation activities, and looks to the future.Commentary and data may be found, inter alia, on who the main players and rising stars are; the number and type of transactions and their values; public-private partnership transactions (P3s or PPPs); the continuing increase in international funds investing in the sector; the prospect for IPOs; the disproportionate impact of exogenous events on the sector; and the likelihood of individual transactions taking place.The second part of the report looks at ongoing, completed, anticipated, and abandoned transactions on a country-by-country basis within a continental framework and within the context of economic and political activity where appropriate. There are Special Reports on airport privatisation in the United States, Brazil, Japan, Serbia, Spain, Japan, India, Russia and Saudi Arabia.

Throughout the report the text is supported by CAPA’s renowned graphical representations.

Researched and produced by leading CAPA Analysts and backed by industry data, the report lists airports and airport groups which could be attractive to investors and identifies other airports that may be a target for mergers or acquisitions. The report features a case study on the move from Hungarian government to enact a sort of partial reverse privatisation by acquiring the equity of the majority shareholder, AviAlliance, in Budapest Ferenc Liszt International Airport. Finally, the report concludes with pinpointing the operators and investors to watch, based partly on their participation in the sector already and partly on their level of activity before the pandemic.

Report Length: 71 Pages

Report Summary:

For evident reasons the last 18 months have been the quietest known for airport M&A transactions since the early 1990s. While some that were already in train did continue, for example in Brazil (with hardly any delays to the concession programme there), and in Japan (with some, but not for long), and some long-standing others like the Sofia concession were completed, new opportunities for investors have been very hard to find.

Investors with a penchant for airports couldn’t be blamed for walking away from a business where the ultimate customer base – the passenger – collapsed by up to 99% along with most of the auxiliary revenue streams, where uncertainty abounds, and where its future prospects are at the whim of ultra cautious governments, many of which may use the ‘opportunity’ presented by the pandemic to ‘reset’ aviation within the context of a rapidly carbon-free future. Aviation will not

be carbon-free ‘rapidly’ or even for a long time, which classifies it as a dinosaur to many of those in power. Then, out of the blue, a tentative but unsolicited bid emerged by a consortium of investors to buy Sydney’s Kingsford Smith International Airport, which is listed on the stock exchange.

That consortium’s bid essentially hangs on: continuing ‘local’ ownership and retained management; investment experience; the promise of improved operational and financial performance; and a commitment to ‘green’ ideals and targets.

Section 1 – Review of listed airports/groups which could be attractive to investors

Those credentials are likely to become the norm as deals begin to reappear – and especially the last one.

This bid, a rare one for a publicly listed company and similar to the one for BAA plc in 2006, also raises the question of whether other wholly or partially floated airport companies, most of them dating from the 1990s, might also become hostile investor targets.

The majority of them have since established themselves as multi-ownership companies in which the public float has reduced and sometimes considerably so. Additionally, there are still occasionally investment level caps preventing single entity equity investment beyond, say, 5% or 10%. So opportunities will be rare.

But it can be done, as the case of Vienna Airport proves, where an Australian fund, the lead member of the Sydney consortium as it happens, ate into the free float in two tranches, leaving itself in a close-to-controlling position.

There is a wide range of airports that are publicly or privately owned, or with no stock market float component, or where there has been, and even where there actually is but the government remains firmly at the helm of strategic development, that could also become targets for investors in the coming months and years.

Section 2 – Other airports that might be M&A targets

Section 2 of the report reviews some of the more likely candidates, including Berlin, where the new airport began life long ago as a private-sector enterprise before a crippling public-sector construction debacle set in, and where the private sector might yet be required to fly to the rescue of an entity that had the misfortune to open nine years late – in the middle of the pandemic.

It examines the prospects for greater competition between airports in the US – and even within cities there, where public private-partnership development is becoming commonplace, despite the failure of a 25-year privatisation scheme designed to lease airports out wholly – and in Canada, which retains its unique ‘not for profit, stakeholder’ ownership system.

Section 3 – Budapest Ferenc Liszt International Airport

Section 3 of the report looks inter alia at a move by the Hungarian government to enact a sort of partial reverse privatisation by acquiring the equity of the majority shareholder, AviAlliance, in Budapest Ferenc Liszt International Airport.

While such state grabs are rare, they do happen. One of them, in Bolivia, helped end the participation of the Spanish company Abertis in the sector as well as causing international friction, and there have been several other examples of national government interference in airport ownership in Europe.

The government’s decision in Hungary is driven by politics and raises questions about future ownership of airports and state protectionism across Eastern Europe as not only Hungary, but also several other countries in the region, could well leave the European Union in the following years.

Section 4 – Who are the buyers and concessionaires?

Finally, the report looks at which might be the operators and investors to watch in the future, based partly on their participation in the sector already, and partly on their level of activity before the pandemic.

Inevitably much of that renewed activity will likely arise from a small group (20 of them are examined here) which have a track record in the sector, and it is interesting to note how so many of them were chasing the same deals up to Jan-2020.

There are many other investors and potential new ones, and throughout the text reference is frequently made to various CAPA databases (Global Airport Investors; Airport Construction and Cap Ex; and a shortly forthcoming one on the major airports and airports groups in FY2020 as measured by revenues and other metrics), which will enable professionals in the industry better to understand this complex segment of it.

CAPA – Centre for Aviation Managing Director, Derek Sadubin said:

“Airport transactions for the most part have ground to a halt as the pandemic bites. But as we begin to see some light at the end of the tunnel, opportunities across the sector are beginning to re-emerge. This new CAPA report supports investors, financers, government and infrastructure planning departments to look beyond just the next few weeks or months ahead and take the first step towards identifying real opportunities for the future.”

The impacts of the global pandemic have meant the last 18 months have been the quietest for airport merger and acquisition transactions since the early 1990s. While some that were already in the works did continue, for example in Brazil and Japan, new opportunities for investors have been very hard to find.

Investors with a penchant for airports couldn’t be blamed for walking away from a business where the ultimate customer base – the passenger – collapsed by up to 99% along with most of the auxiliary revenue streams. Nevertheless, after a lengthy period with little activity in the airports sector, prospects in the future look bright and a few key bids may just pave the way for more to come.

The new CAPA Airport Mergers & Acquisition Opportunities for 2H2021 and Beyond is available now for USD795.

Are you a CAPA Member? Contact your account manager now to receive a 50% discount code.