European aviation: recovery slides further as travel restrictions rise

IATA says increased international travel restrictions are a "knee jerk" response to the Omicron variant of COVID-19. It points out that there is no clear relationship between COVID case numbers and international travel restrictions.

Unfortunately, there is however a clear relationship between travel restrictions and aviation demand. Europe's capacity recovery, which had already lost impetus, has now been on a sliding trend for six weeks.

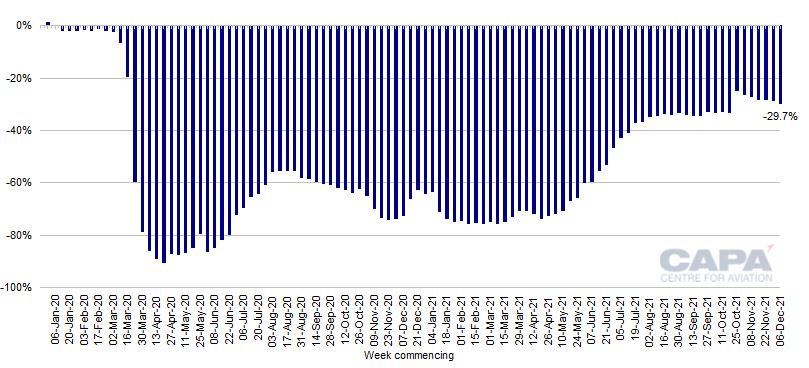

Seat numbers for Europe are 29.7% below 2019 levels in the week of 6-Dec-2021. This represents a decline of 5.1ppts over the past six weeks.

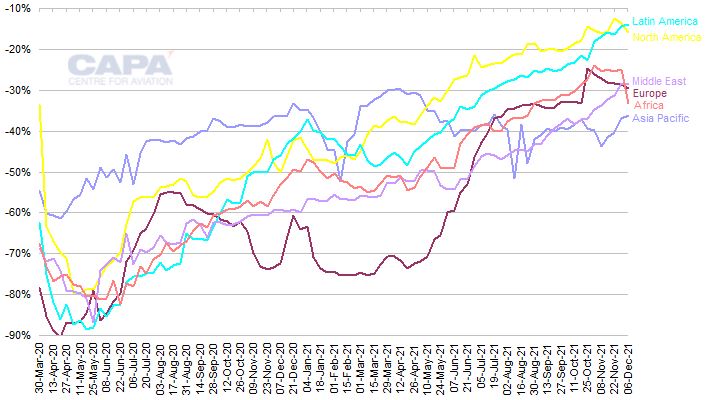

Europe is fourth in the regional capacity recovery ranking. Asia Pacific capacity is down by 36.1%, Africa by 33.2%, the Middle East by 28.6%, North America by 15.8%, and Latin America by 13.9% (taking Latin America to the top of the ranking for the first time during the pandemic).

Traffic data are not yet available for the 'Omicron era', but the additional travel restrictions and the consequent erosion of traveller confidence may have a bigger impact on demand than on capacity, at least in the short term.

Vaccination programmes to mitigate the effects of all COVID-19 variants remain the best long term solution.

Summary

- Europe has 19.6 million seats this week, down 30% vs 27.9 million in the same week of 2019. Europe is fourth, above Africa and Asia Pacific.

- Europe's 4Q2021 capacity is still projected at 71% of 2019 levels. 1Q2022 capacity is projected at 87% of 2019 levels, which is down from 88% last week.

- IATA: new travel restrictions are "knee jerk" reaction to the Omicron variant. There is no clear relationship between COVID case numbers and travel restrictions.

Europe has 19.6 million seats vs 27.9 million in 2019 - down 30%

In the week commencing 6-Dec-2021 total European seat capacity is scheduled to be 19.6 million, according to OAG schedules and CAPA seat configurations.

This is 29.7% below the 27.9 million seats of the equivalent week of 2019. This is 1.0ppts worse than last week's -28.7% and down from a pandemic era high of -24.6% six weeks ago.

This week's total seat capacity for Europe is split between 6.0 million domestic seats, versus 7.2 million in the equivalent week of 2019; and 13.6 million international seats, versus 20.7 million.

Europe's domestic seats are down by 16.1% versus 2019, not much different from -15.8% last week.

International seat capacity is down by 34.4% versus 2019, a bigger slide from last week's -33.2%.

Europe: percentage change in weekly airline seat capacity vs equivalent week of 2019, weeks of 06-Jan-20 to 06-Dec-2021

Europe has climbed to fourth among world regions by capacity as percentage of 2019

Europe has climbed from fifth to fourth place in the ranking of regions measured by seats as a percentage of 2019 levels. This is due to a big slide in Africa capacity.

With capacity down by 29.7%, Europe is above Asia Pacific, where capacity is down by 36.1%; and also above Africa, where seat count is down by 33.2%. Seat capacity is down by 28.6% in the Middle East, by 15.8% in North America, and by 13.9% in Latin America.

North America has lost the top spot it had occupied since mid-May-2021.

Asia Pacific and Latin America have taken upward steps in the trend this week, whereas Europe, North America and Africa (particularly) have taken downward steps. Middle East is broadly flat on last week.

Percentage change in passenger seat capacity vs 2019 by region, week of 30-Mar-2020 to week of 6-Dec-2021

Europe's 4Q2021 capacity is still projected at 71% of 2019 levels

According to data from OAG and CAPA, capacity as a percentage of 2019 levels has improved with each successive quarter of 2021. It was 30% in 1Q2021, 34% in 2Q2021 and 64% for 3Q2021.

Schedules filed for 4Q2021 are stabilising at 71% of 4Q2019 levels, a further upward step relative to 3Q2021, although projected Dec-2021 capacity has fallen by 1% since the week of 29-Nov-2021.

Annual capacity for 2021 is projected to be 50% of 2019's capacity, compared with 42% in 2020 (although 2021 has improved significantly with each quarter).

1Q2022 capacity is projected at 87% of 2019 levels, vs 88% projected last week

Projections for 1Q2022 based on current schedules indicate seat numbers for Europe at 87% of 1Q2019 levels.

This is down by more than 1ppt since last week, but would still represent a significant upward step from 4Q2021.

As noted in CAPA's 2-Dec-2021 analysis of Europe's capacity trend, the Omicron variant of the coronavirus is likely to be a crucial factor in determining the final outcome for 1Q2022 capacity.

See related report: Europe's air travel impetus was waning before Omicron

IATA: new travel restrictions are "knee jerk" reaction to Omicron

The discovery of the Omicron variant of the coronavirus in South Africa has led to a tightening of international travel restrictions by many governments - a reaction described by IATA as "knee jerk".

A number of countries have banned or severely restricted travellers from southern Africa, and this has had a swift impact on airline capacity. This week's big downward movement in Africa's seat capacity as a percentage of 2019 levels illustrates this clearly.

In addition, nations such as China, Israel, Japan and Morocco have effectively closed their borders, while others have placed additional requirements on all international travellers.

For example, the UK has now added a requirement for a pre-departure test (PCR or lateral flow) to the required test within 48 hours of arrival announced last week. This is adding to the cost of travel and undermining the improvements in consumer confidence in international travel that had built since the spring of 2021.

No clear relationship between COVID case numbers and travel restrictions

However, IATA has questioned whether increased international travel restrictions actually reduce new COVID-19 infections?

In its DG's blog of 30-Nov-2021, the airline trade body quoted a number of health experts, who suggest that the impact of travel bans is limited.

As IATA's Economics team observed on 3-Dec-2021, "The Omicron variant has already been detected in at least 30 countries on each of the main continents as of 3 December, so it is too late to prevent the variant from leaving southern Africa".

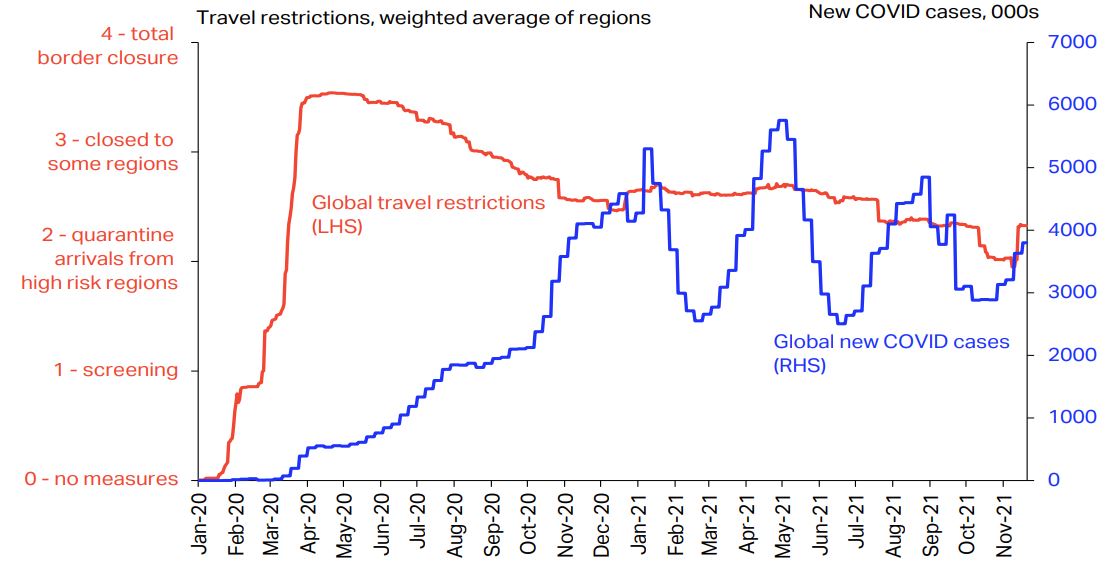

The chart below, from IATA Economics using data from ECDC and Oxford University, plots an index of global travel restrictions against the global number of new COVID cases from Jan-2020 to late Nov-2021.

Through much of 2021, while international travel restrictions remained fairly stable, there were significant peaks and troughs in new infections.

Travel restrictions and new COVID cases, Jan-2020 to late Nov-2021

Vaccination remains the most effective tool

The key to the longevity and stringency of international travel restrictions imposed in response to Omicron lies in gaining a fuller understanding of its impact on numbers of hospitalisations and deaths, on the treatment of symptoms, and its response to vaccination.

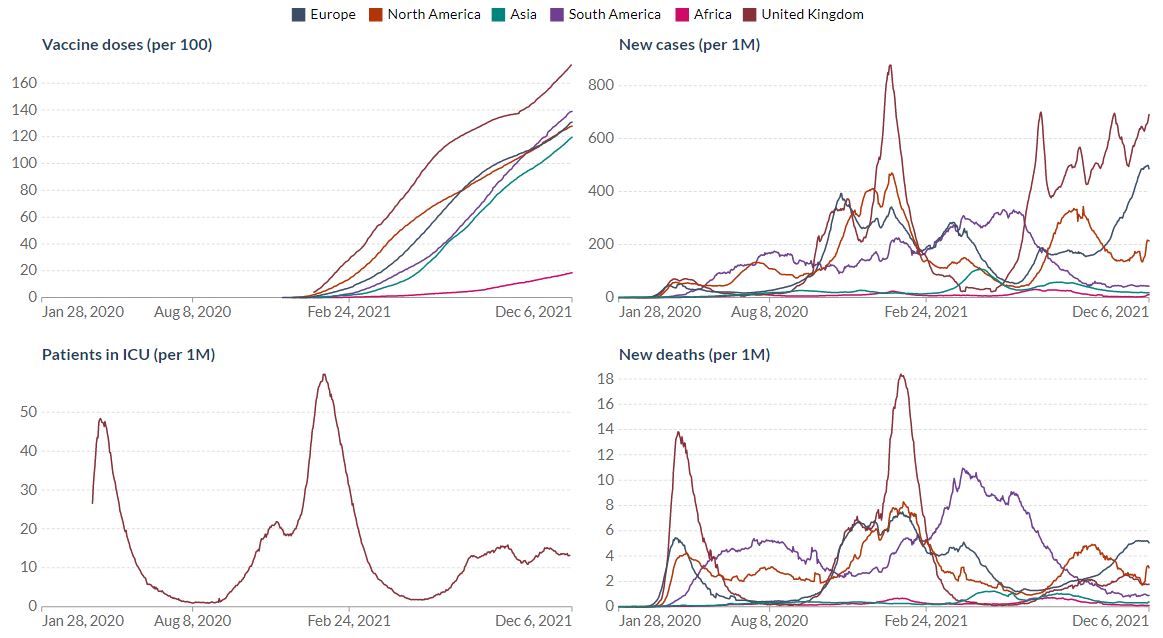

Recent increases in new COVID-19 cases in Europe have not been accompanied by as rapid an increase in deaths from COVID, thanks to high levels of vaccination.

Vaccine doses (per 100), patients in ICU (per 1 million), daily new confirmed COVID-19 cases, and deaths per million people (7-day rolling average), 28-Jan-2020 to 06-Dec-2021

The Omicron variant may add further impetus to case numbers, but if vaccination proves effective against it and it does not lead to higher numbers of hospitalisations and deaths, its impact on international travel may not last. For now the evidence is still being accumulated.

Vaccination is likely to remain the most effective way to deal with COVID-19, whether in its Omicron variant or other variants yet to be discovered. And the longer it is until less affluent nations are provided the opportunity to vaccinate their populations, the more predictable it is that new variants will continue to appear.