A tale of two countries: Comparing the dynamics of Australia and Canada's domestic markets

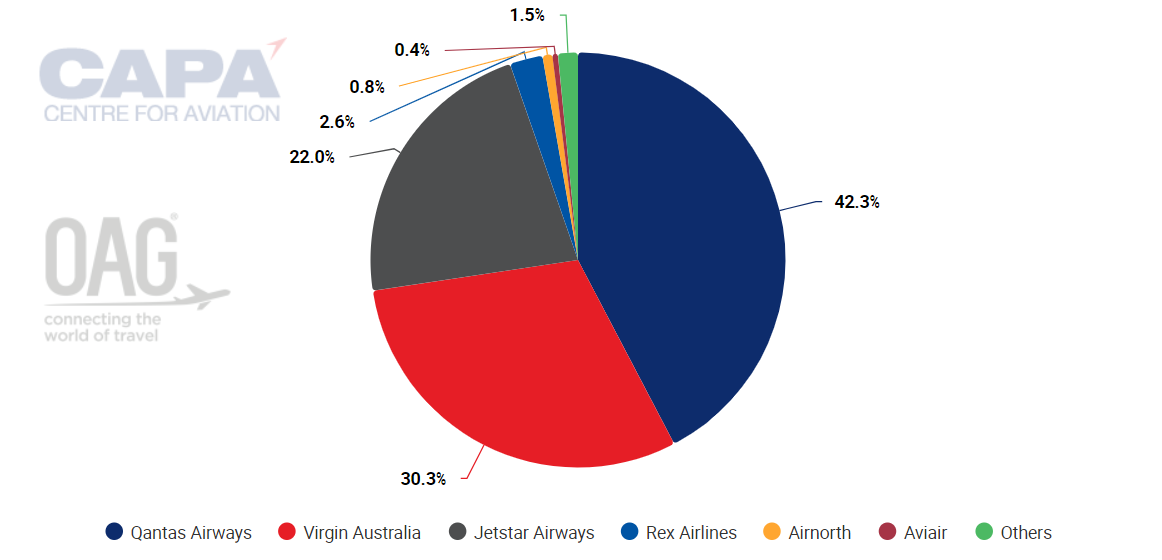

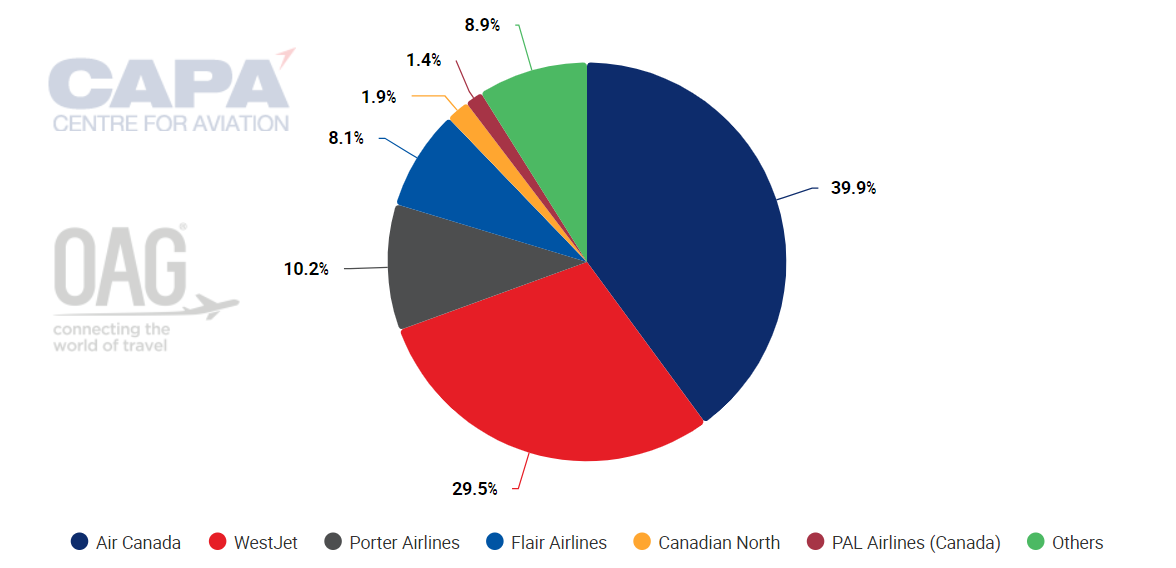

The domestic airline markets of Australia and Canada are each dominated by two airline groups. Qantas Group and Virgin Australia maintain a 94.6% share in the domestic Australian air market, while Air Canada and WestJet hold a 69.4% market share in Canada.

Challenging market conditions and a complex regulatory environment render it difficult for new entrants to succeed, as seen with the shutdown of Lynx Air, Bonza, and Canada Jetlines in recent months, as well as for long-standing independent carriers including Rex Airlines, which has entered voluntary administration.

Incumbent airlines have developed deep-rooted footholds while facing little competition

The dominance of Qantas Group and Virgin Australia in the Australian market has been long-established since the latter's launch in 2000, followed by the inception of Qantas-owned LCC Jetstar Airways in 2004.

Similarly in Canada, WestJet's entry in 1997 as the country's first LCC paved the way for a domestic market dominated by Air Canada and the WestJet Group.

Over 25 years later, the carriers have developed deep-rooted footholds while facing little competition.

Australia, domestic market share by seat capacity for the week commencing 19-Aug-2024

Canada, domestic market share by seat capacity for the week commencing 19-Aug-2024

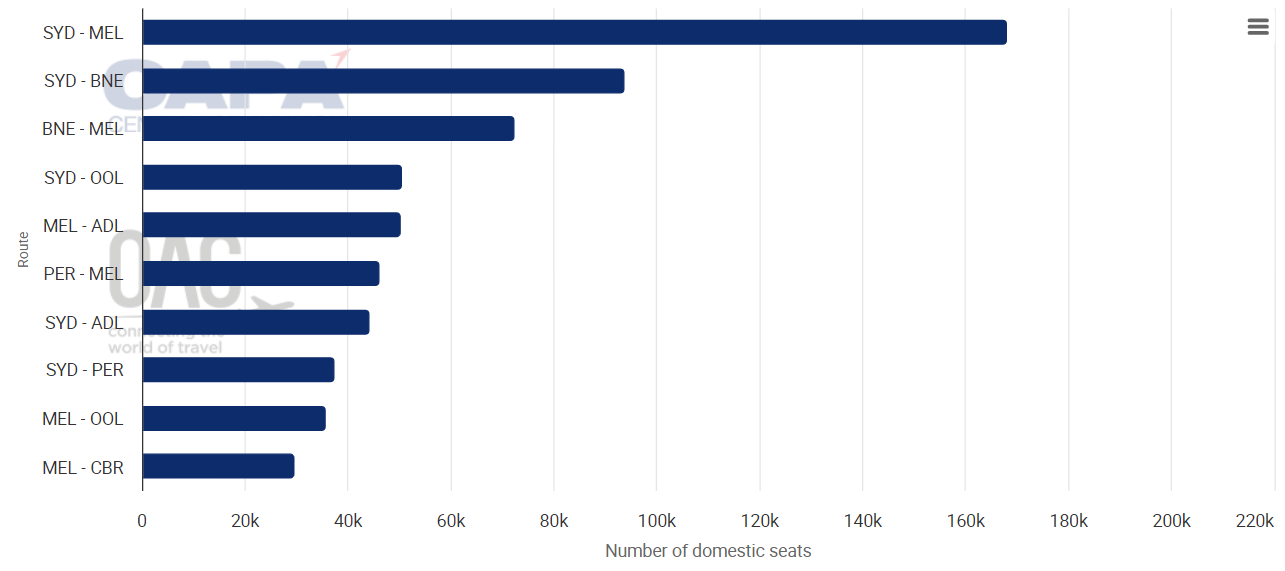

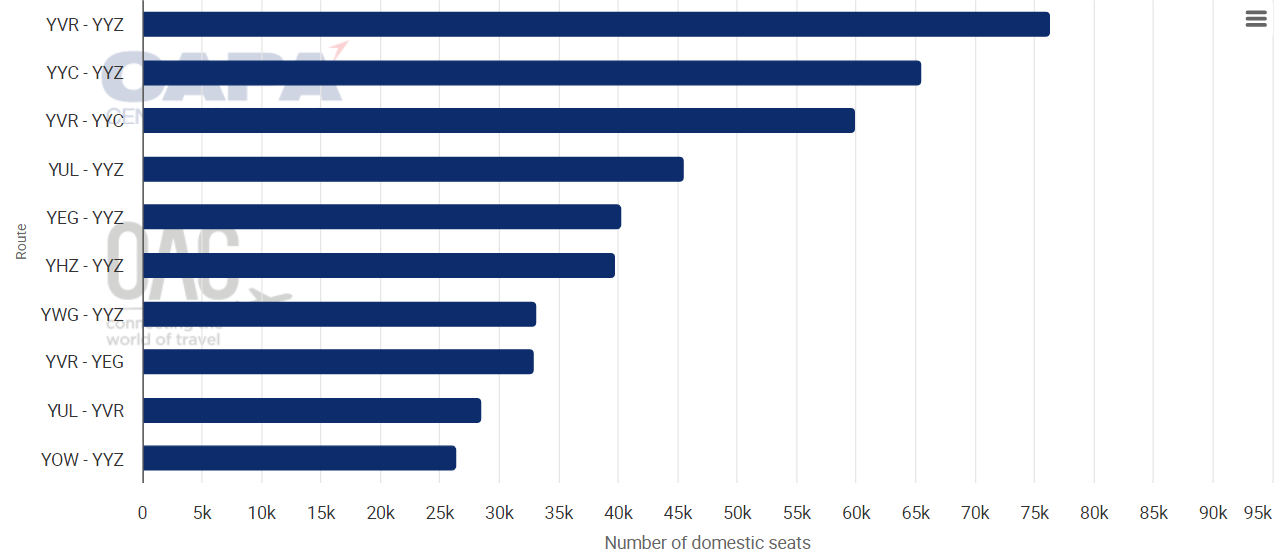

The majority of Australia and Canada's geographies consist of inhospitable natural environments, rendering populations densely packed into small areas. Resultantly, each domestic market is concentrated on routes between major cities with a notable absence of medium-sized city markets and a reliance on essential air services.

Well-established O&D pairs and population distributions result in limited possibilities to generate new routes and demand, preventing new carriers from finding a 'niche' in each market.

Smaller airlines in Canada often turn to US/Caribbean leisure routes, shifting capacity away from domestic services and reinforcing the market status quo, while small Australian carriers including Rex Airlines and Airnorth focus on providing regional air services catering to the FIFO market.

Australia, top 10 domestic routes by seats for the week commencing 19-Aug-2024

Canada, top 10 domestic routes by seats for the week commencing 19-Aug-2024

There are notable market differences between Australia and Canada

While competition in Canada may be heavily lopsided in favour of incumbent carriers, the country benefits from the presence of competitors like Flair Airlines and regional carrier Porter Airlines, bringing some balance to a skewed market.

This is a stark contrast from Australia's lack of independent LCCs and no history of ULCCs. The Australian domestic market is also heavily impacted by curfews, noise restrictions and slot regulation at Sydney Kingsford Smith Airport, which is currently not a factor at any major airports in Canada.

Australian regulators have taken action

Prior to its shutdown, Bonza CEO Tim Jordan criticised obstructions to accessing peak slots at Sydney Kingsford Smith Airport, where Bonza intended to base aircraft and operate 20 services.

Mr Jordan said: "It just seems wrong that we are unable to bring low-cost services to the Sydney basin, where almost a quarter of Australians choose to call home".

His remarks were in response to a statement from the Australian Competition and Consumer Commission (ACCC) on 05-Jun-2024 that "the most effective way the Australian Government could enhance airline competition for the benefit of consumers would be to implement reforms to the way Sydney Airport slots are allocated to airlines".

In Feb-2024, Australia's Government announced a package of reforms to the demand management scheme at Sydney Kingsford Smith Airport.

The competitive process would require prospective tenderers to demonstrate how they plan to manage and mitigate conflicts of interest transparently. Once appointed, they will be required to comply with a statement of expectations, including governance and transparency requirements.

In Oct-2023, Australia's Transport Minister Catherine King announced the government will direct the ACCC to monitor domestic air passenger services, complementing the commission's monitoring role concerning certain airports and engagement within the aviation sector. In Mar-2024, the Parliament of Australia recommended the government also explore which longer-term competition policy settings can provide appropriate oversight of airlines.

With the potential loss of Rex Airlines looming over Australia's domestic aviation industry, the consequences of an airline duopoly on consumers are at the forefront of discussions.

The Australian Airports Association (AAA) called for the long-term survival of Rex, noting Australia would face "a significant competitive issue" if it loses another airline. AAA research showed Rex's entry into the Melbourne-Perth route led to airfares falling by 40%, whilst adding 46,000 seats per year.

Canada is investigating domestic competition

The Canada Competition Bureau launched a market study of domestic airline competition in late Jul-2024. In its draft market study notice, the Bureau acknowledged that low-cost and ultra-low-cost carriers "seem to face more difficulties in Canada compared to other countries", adding Air Canada and WestJet are estimated to account for almost 95% of industry revenue.

Flair Airlines expressed its support for the study, stating low-fare airlines in Canada face an "inhospitable environment" as incumbent airlines "dominate smaller airlines by sheer force, with the ultimate goal of eliminating competition and raising airfares unchecked".

The Bureau also pointed out that Air Canada and WestJet have scaled back operations into Eastern and Western Canada, respectively, resulting in higher fares in each region. The carriers' dominance in each area prevents new market entrants from disrupting and offering lower fares.

As such, domestic airfares in Canada are "relatively high", with average fares remaining above pre-pandemic levels.

The Bureau stated regulatory support of industry competition "will help reduce prices for consumers, improve quality of service and working conditions, increase productivity, and boost innovation".

Canada's Competition Bureau plans to publish the results of its study in a final report in mid 2025 and issue recommendations to help policymakers further support airline entry and expansion.

Incumbent airlines hold market power; regulators hold key to any change

With decreasing competition in each market, passengers are left with limited alternatives, reinforcing the market power of incumbent airlines.

Dynamics are unlikely to change unless regulators take strong action.