Canada’s strong incumbents paint uncertain future for new market entrants

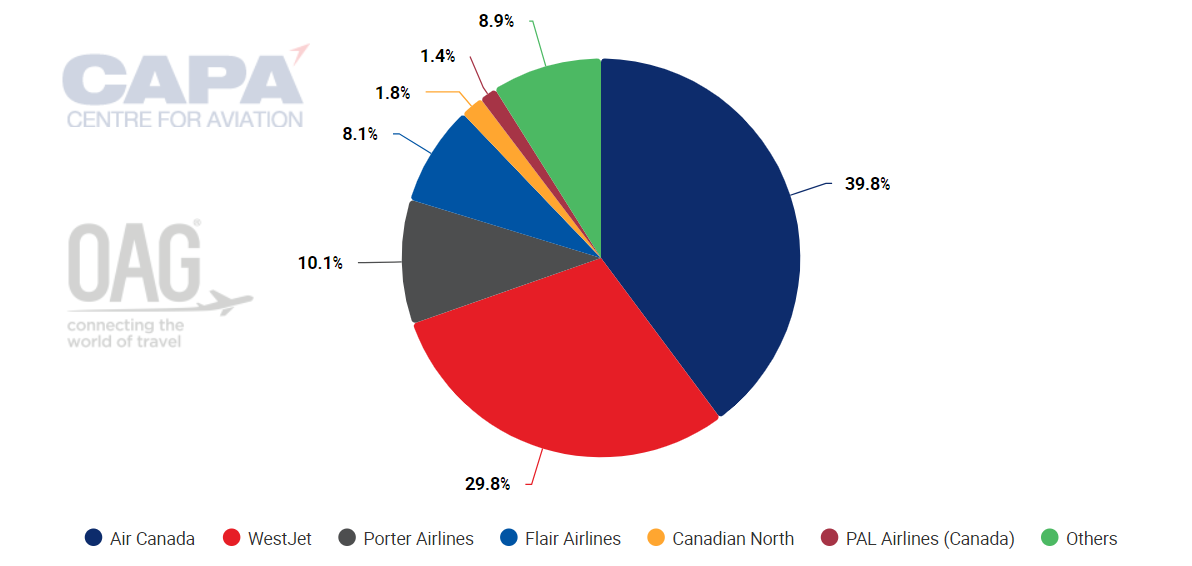

Unfavourable market conditions and a challenging regulatory environment have prompted the Canada Competition Bureau to launch a market study of the domestic airline industry, which remains dominated by Air Canada and WestJet with a combined 69.8% market share.

As Flair Airlines looks to shake up the market, urgent changes are needed to support competition.

Canada's domestic market undergoing constant change

Canada's domestic airline market has seen a series of entries and exits over the past 12 months.

In Oct-2023, ULCC Swoop ceased independent operations and was integrated into WestJet Group, which also plans to integrate Sunwing Airlines operations into its main business by late 2024.

Lynx Air exited the market in Feb-2024, less than two years after it launched operations and in Aug-2024 Canada Jetlines suspended its flights.

Canada domestic seats for all business models, week commencing 12-Aug-2024

New study to examine status quo

On 29-Jul-2024, Canada's Competition Bureau launched its market study of domestic airline competition, aiming to evaluate the current state of competition in the industry and barriers to market entry and expansion.

This development was welcomed by Flair, which hopes the study "will highlight the inhospitable environment for low-fare airlines in Canada".

Flair CEO Maciej Wilk has called for airport slot allocations at major hubs, including Vancouver, Calgary, Toronto and Montreal, to be managed by a neutral third party rather than by airports which "may have set agendas".

At its base at Edmonton International Airport, Flair maintains a domestic capacity share of approximately 14.8%, paling in comparison to WestJet at 49%. Even at their own hubs, competitors remain overshadowed by incumbent carriers.

WestJet points towards government-led barriers

In response to the study launch, WestJet VP external affairs Andy Gibbons stated the study's terms of reference ignore government-led barriers unique to Canada, including a "highly uncompetitive" tax and regulatory environment, increasing airport charges and high mandatory third-party fees that drive up ticket prices.

WestJet has not shied away from pointing out government shortfalls in the industry. In May-2024, the carrier called for an immediate freeze on mandatory imposed government fees that increase travel costs and for the federal government to cease collecting airport rents.

However, WestJet continues to enjoy the benefits of government partnerships.

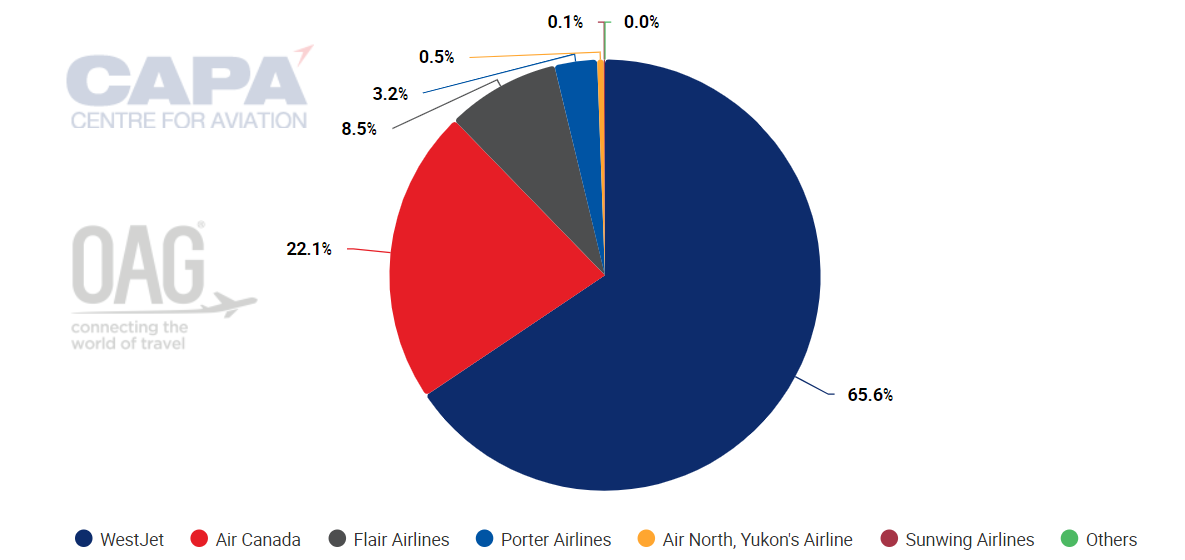

In Oct-2022, the carrier partnered with the Government of Alberta to base its operations at YYC Calgary International Airport, where it maintains a domestic market share of approximately 65.6% in Calgary.

YYC Calgary International Airport, domestic seats, week commencing 12-Aug-2024

As the LCC solidifies its western Canada network, a lack of viable competition only fuels the carrier's growth prospects in a market rife with uncertainty.

Smaller competitors battle internal challenges - will study alleviate external pressures?

Flair Airlines continues to face a myriad of challenges, from the seizure of four Boeing narrowbody aircraft by lessor Airborne Capital in early 2023 to accumulating CAD67.1 million (USD49.4 million) in debt incurred from the import of 20 Boeing 737 MAX aircraft in Jan-2024.

The carrier's expansion plans may be on pause until early 2025 at the earliest, however shifting dynamics in Canada's domestic market do not guarantee its survival until then.

Canada's Competition Bureau plans to publish the results of its study in a final report with recommendations to improve market competition for the benefit of all Canadians.

While lower fees and airport charges would be a welcome relief to Flair's bottom line, it may be too little, too late to disturb the dynamics of Canada's airline sector.