CAPA Profiles

CAPA Profiles help you identify new business opportunities and make better business decisions, by providing accurate and up-to-date data on airports, airlines, suppliers, investors, MROs, lessors and countries/territories around the world. Each profile offers comprehensive news and analysis, as well as the ability to drill down into data on schedules, capacity share, fleet, traffic, financial results and more.

Become a CAPA MemberOur full profiles are only available to CAPA Members. CAPA Membership provides exclusive access to the information you need to monitor the competitive landscape and guide your organisation towards success.

It’s ideal for industry analysts, managers and executives who need a snapshot of the latest news, analysis and data from our global team, with the ability to export or email PDF reports in one click.

- 5000+ airports

- 3000+ airlines

- 1600+ suppliers

- 800+ airport investors

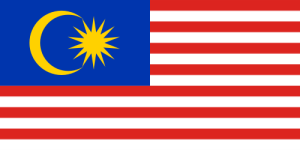

- 250+ countries/territories and regions

- And more

CAPA Membership also gives you access to a customised selection of more than 1,000 global News Briefs every week, as well as a comprehensive Data Centre, Analysis Reports and Research Publications. You can also choose from our range of premium add-ons, including Route Maps, Fleet Data and more.