Southwest and Spirit Airlines shake up business models amid financial performance concerns

On 25-Jul-2024, Southwest Airlines announced plans to introduce assigned and premium seating, ending its open seating policy that has been in place since the carrier's inception in 1971.

Days later, Spirit Airlines reported it will launch premium seating and new fare types from Aug-2024, a significant shift from the carrier's 'no-frills' business model.

As economic pressures mount and passengers pivot toward premium travel experiences, the days of low fare models in the US could be numbered.

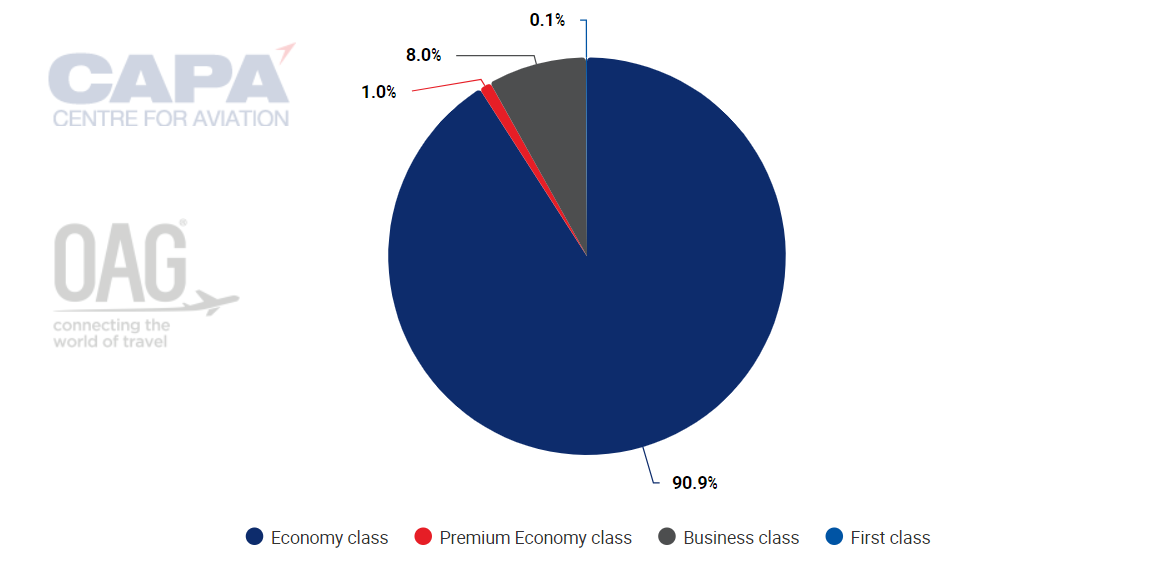

Despite premium seating accounting for less than 8% of systemwide seats in the US, Southwest Airlines announced plans to revamp its inflight seating from 2025 with premium options and an assigned seating policy, eliminating arguably the carrier's most unique selling point.

Spirit Airlines followed suit with plans to attract customers with wider seats, extra legroom and other amenities.

Customers are continuing to open their wallets to travel comfortably - a Deloitte survey published in May-2024 showed 43% of travellers are willing to pay for increased inflight comfort including seat upgrades, up from 39% in 2023.

While recent developments may solely be airlines responding to demand, the timing of two of the largest American low fare carriers announcing pivots to premium offerings within days of each other prompts questions about the financial viability of low cost airline operations amid mounting cost pressures.

US systemwide seating by class for the week commencing 05-Aug-2024

Money troubles? Or an opportunity to diversify

Southwest's shift away from its longstanding economy model may point towards financial challenges, with the carrier posting a net profit of USD137 million in 1H2024, down 73.9% from the same period last year.

The carrier's economic downturn has not gone unnoticed, with activist investor and major shareholder Elliott Management calling for an overhaul of Southwest's "outdated" business model and management. Southwest has responded strongly, with executive shuffles to support its transformation plan and new red-eye flights to launch Feb-2025.

Much hinges on Southwest's diversification strategy as fare differences that once enticed customers to choose Southwest over legacy carriers continue to shrink.

The case for Spirit

Spirit's anticipated Aug-2024 rollout of its new premium products indicates an urgency to its transformation plan.

This was seemingly confirmed by the carrier posting a net loss of USD192.9 million for 2Q2024, which Spirit CEO Ted Christie described as "disappointing".

Mr Christie pointed to the carrier's planned premium offerings as "the right path" amid a "continued competitive battle for the price-sensitive leisure traveller".

Spirit's 'Go Big' option includes a Big Front Seat, snacks and drinks, one carry-on bag, one checked bag, priority check-in and boarding, and streaming access

Legacy carriers have demonstrated continued success in premium investments, with Delta Air Lines attributing 55% of its 2023 revenue to premium products and loyalty.

As post-pandemic premium demand shows no signs of slowing and legacy carriers' investments into premium products pay off, Spirit's strategy may be its best option.

Who wins?

Only time will tell of the success of Southwest and Spirit's bold initiatives, with Southwest to reveal further information at its Sep-2024 Investors Day and Spirit to roll out its new offerings in the coming weeks.

Investors of both carriers will be keenly watching as Elliott Management continues to call for "a bold new plan to turn around Southwest" and Spirit works to negotiate USD1.1 billion in debt due in Sep-2025.

No doubt Southwest and Spirit are hoping their daring new ventures in the premium market are well received.