Aircraft leasing in equilibrium at just over half the world fleet

According to the CAPA - Centre for Aviation Fleet Database, 53% of commercial aircraft are leased.

This is slightly below the level before the COVID pandemic, but lessors' share of the global fleet has been fairly stable for a number of years. The share is higher in Europe and lower in North America.

Lessors' share of orders is 23%, much lower than their share of leased aircraft in current fleet. The difference is explained by sale and leaseback, where aircraft that are ordered by airlines end up being owned by leasing companies - particularly for narrowbodies.

Leasing offers considerable benefits to airlines, such as availability of aircraft, fleet flexibility, residual value risk management and access to capital.

Nevertheless, at just over half of the world's commercial aircraft, leasing's share of the global fleet may have found an equilibrium.

Summary

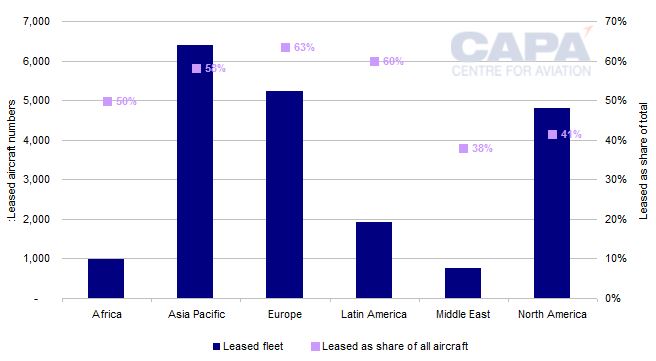

- Globally, 53% of commercial aircraft are leased, slightly below the level before the COVID pandemic. The share is higher in Europe and lower in North America.

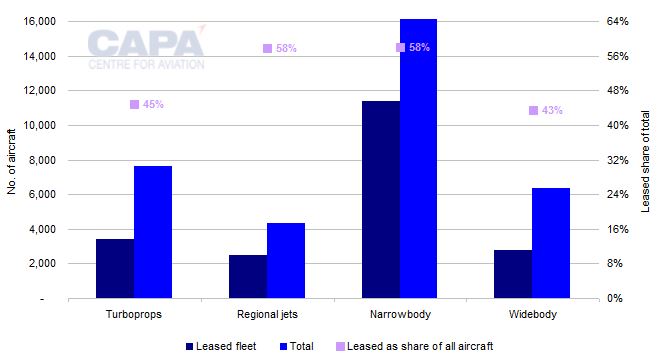

- Leasing accounts for 58% of narrowbodies and regional jets, but only 45% of turboprops and 43% of widebodies.

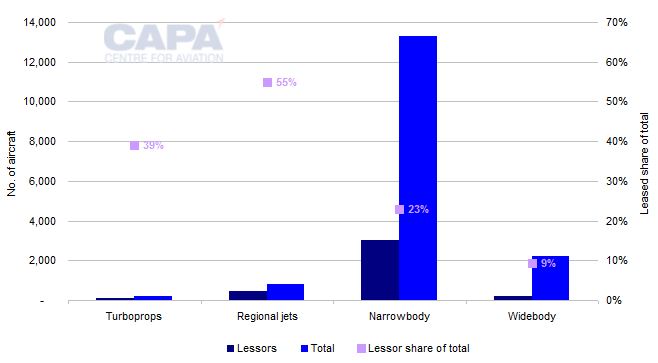

- Lessors' share of orders is 23% - much lower than their share of leased aircraft in current fleet. Sale and leaseback makes up the difference.

- Leasing accounts for 23% of orders for narrowbodies, 39% for turboprops, 55% for regional jets, and only 9% of widebody orders.

Globally, 53% of commercial aircraft are leased, slightly below the level before the pandemic

The CAPA - Centre for Aviation Fleet Database records 20,000 leased commercial aircraft with the world's airlines at 5-Feb-2024, both in service and inactive (i.e. their leased current fleet). This number represents just over half (53%) of the total current fleet of 38,000 commercial aircraft.

Note that these numbers include all aircraft types in commercial airline use, i.e. turboprops, regional jets, narrowbodies and widebodies.

World commercial aircraft current fleet*: leased and total aircraft numbers, by region, at 5-Feb-2024

According to data from the CAPA - Centre for Aviation Fleet Database, the 20,000 leased aircraft in the current fleet today - around 15,300 - is up by more than 3,700 over the past decade.

However, it is only 1,000 more than it was five years ago (at the end of 2018).

The share of leased aircraft in the commercial airline fleet was in the region of 54%-55% in the six years leading up to the COVID-19 pandemic, but since then it has fallen very slightly, to its current 53%.

…but the share is higher in Europe and lower in North America

Asia Pacific has the highest number of leased aircraft, close to 6,400, representing 53% of the total.

Europe has the second largest leased fleet, with more than 5,200, but this represents 63% of its total fleet - the highest proportion of any region.

In North America leased units exceed 4,800, but the total fleet is the largest of any region, with more than11,600. Its leased fleet is 41% of the total.

Latin America has only 1,900 leased aircraft, but they represent 60% of the fleet in service, which is the second highest proportion among the regions.

Africa has just under 1,000 leased aircraft, representing 50% of its total fleet.

Middle East has the fewest leases, both in absolute numbers (fewer than 800) and as a percentage of the fleet (38%).

Leasing accounts for 58% of narrowbodies and regional jets…

Narrowbodies are the world's most popular aircraft type by numbers in the current fleet (there are over 19,600 of them), so it is no surprise that they are also the most popular leased aircraft type (more than 11,300 are leased, accounting for 57% of all leased aircraft).

The proportion of narrowbodies that are leased, 58%, is matched by regional jets. However, the regional jet fleet is the smallest aircraft class globally, both in terms of the total current fleet of 24,300 and the leased fleet of 2,500.

In both cases, this is higher than the overall 53% share of global aircraft that are leased, signalling that narrowbodies and regional jets are more tradeable.

Lessors prefer aircraft that can have a productive and profitable life independent of any particular operator.

…but only 45% of turboprops and 43% of widebodies

By contrast, only 45% of turboprops and 43% of widebodies are leased.

Turboprops have become an increasingly niche product, and there are fewer potential alternative markets for widebodies than there are for regional jets and narrowbodies.

World commercial aircraft current fleet*: leased and total aircraft numbers, by aircraft type, at 5-Feb-2024

Lessor share of orders is 23% - much lower than share of leased aircraft in current fleet

Analysis of the commercial aircraft order backlog reveals that lessor orders as a share of total order numbers is much lower than the share of leased aircraft in service.

According to the CAPA - Centre for Aviation Fleet Database, there are just over 3,700 outstanding lessor orders for commercial aircraft out of a total of 16,500 orders, representing a 23% share. This share has been broadly stable over a number of years, but it has fallen a little since pre-pandemic.

Note that 75% of lessor orders do not yet have a disclosed operator and therefore cannot be assigned a region, which means a regional analysis of the lessor order backlog is meaningless.

Sale and leaseback makes up the difference

The low share of lessor orders (23%) compared with the higher share of leased aircraft in the current fleet (53%) is explained by the use of sale and leaseback.

Typically, annual aircraft purchases by lessors are approximately evenly divided between direct orders from the OEMs (i.e. those originally ordered by lessors) and sale and leasebacks (i.e. those originally ordered by airlines).

Leasing accounts for 23% of narrowbody orders…

As with aircraft in the current fleet, the largest number of lessor orders is for narrowbodies. There are more than 3,000 lessor orders for narrowbodies, accounting for 81% of the lessor order backlog.

However, lessors have only 23% of all narrowbody orders, a figure that is approaching 13,300. This percentage matches lessors' 23% share of all aircraft orders.

This relatively low share of narrowbody orders will translate into a significantly higher share of the current fleet, thanks to sale and leaseback agreements with airlines.

…39% of turboprop orders…

Lessors have 39% of turboprop orders, only a little lower than their share of 45% of turboprops in the current fleet.

However, turboprops make up only 2% of total lessor order numbers and so it is not possible to read much into this.

…55% of regional jet orders…

With respect to regional jet orders, lessors are responsible more than half of the backlog, 55%, which is close to their 58% share of regional jets in the current fleet. This implies that sale and leaseback is only a small factor in regional jets.

…and only 9% of widebody orders

However, lessors account for just 9% of widebody orders, compared with 43% of widebodies in the current fleet. This highlights the importance of sale and leaseback in the widebody fleet (or the possibility of a decline in the leased widebody fleet share in the future).

World commercial aircraft order backlog: lessor and total aircraft orders by aircraft type at 5-Feb-2024

Leasing's share of the global fleet appears to have found an equilibrium

The use of leasing to finance aircraft can give airlines greater flexibility, allowing them to rotate their aircraft portfolios without taking residual value risk.

Lessors also play a role in improving airline access to capital funding, whether for small airlines with insufficient cash flow to make their own acquisitions, or more widely in more challenging times for the airline industry.

Moreover, lessors can provide aircraft from their order backlogs sooner than the OEMs. This is particularly relevant now, at a time when OEMs are struggling to meet demand due to production delays caused by a variety of factors.

The price of this flexibility is that leasing typically comes at a higher cost compared with ownership.

With just over half of all commercial aircraft leased, a level that has been maintained for several years, it seems a natural equilibrium level has been achieved.

Nevertheless, it is clear that aircraft leasing is set to remain hugely important to airlines.