Africa's potential remains massive: Qatar Airways expands African reach with Airlink investment

On 20-Aug-2024, Qatar Airways announced it had acquired a 25% stake in the privately-owned Airlink (South Africa).

CEO Badr Mohammed Al Meer stated the investment "further demonstrates how integral we see Africa being to our business' future".

Southern Africa was 'a gap' in the Qatar Airways network

In May-2024, while the carrier was in the final stages of the investment, Mr Al Meer said Southern Africa was "a gap" in Qatar Airways' African network.

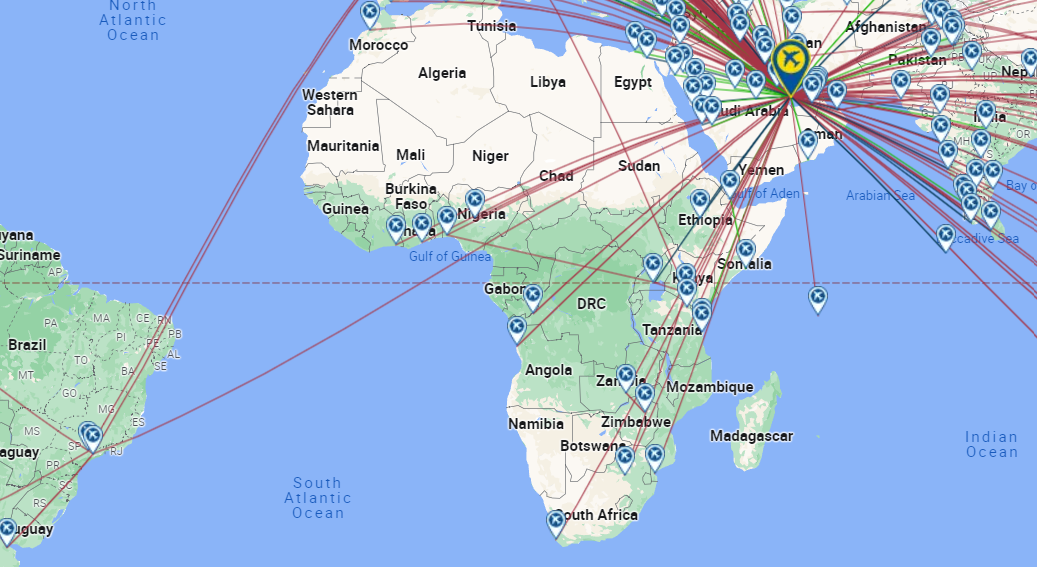

Qatar Airways currently operates 52 weekly frequencies to 25 destinations across Africa, including 24 weekly frequencies to South Africa and 14 weekly frequencies to Angola.

Qatar Airways African network map for the week commencing 19-Aug-2024

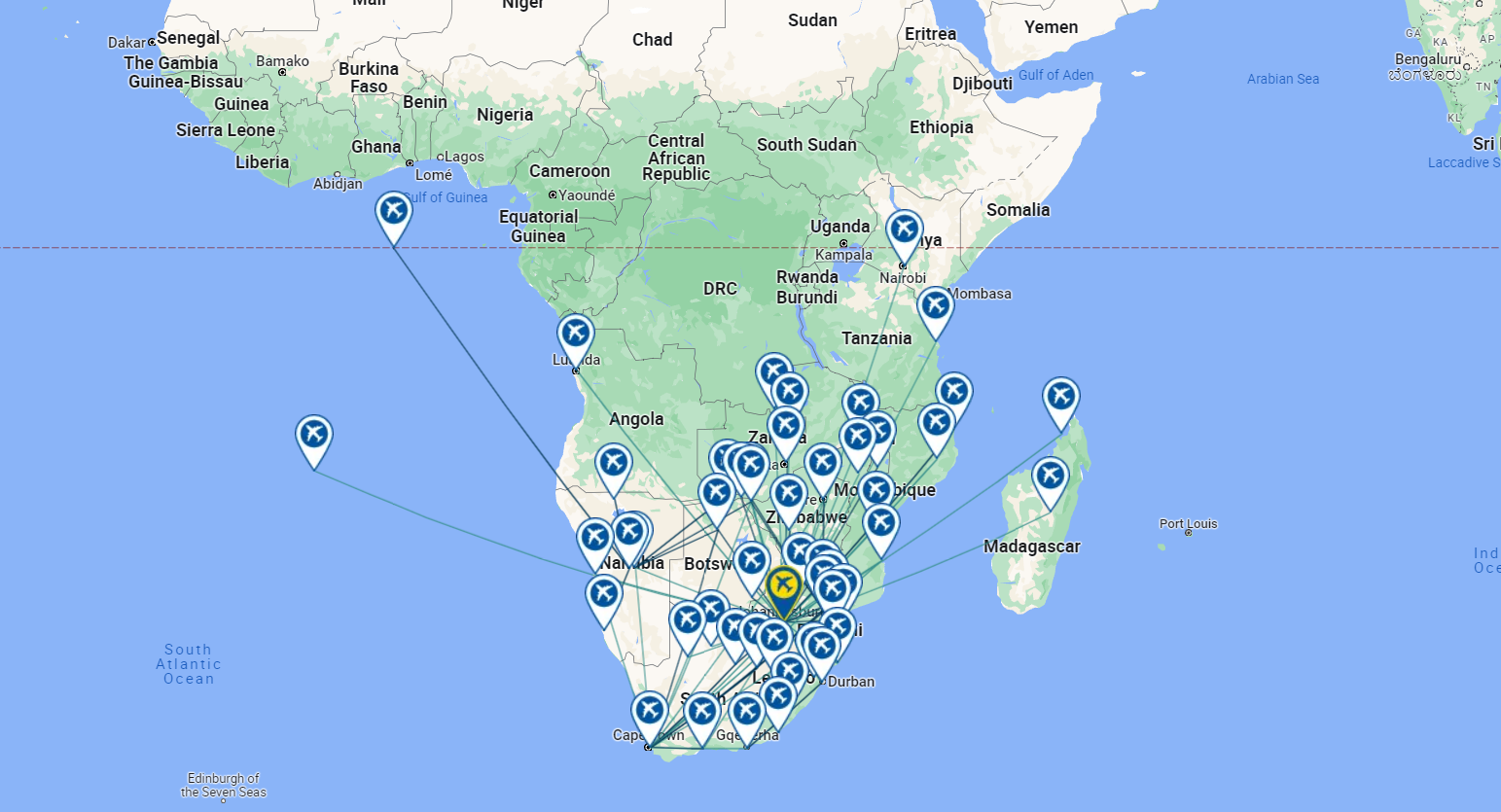

Airlink currently serves 50 destinations across 15 African countries. Notably, Airlink offers service to the following cities currently unserved by Qatar Airways:

- Antananarivo (Madagascar);

- Blantyre (Mozambique);

- Durban (South Africa);

- Gaborone (Botswana);

- Maseru (Lesotho);

- Sikhuphe (eSwatini);

- Windhoek (Namibia).

Airlink (South Africa) network map for the week commencing 19-Aug-2024

Growing roots in Africa

A stake in Airlink will open the door for Qatar Airways to launch new routes across Southern and Eastern Africa, creating new O&D pairs to cater to increased tourism demand and facilitate freight transportation via Qatar Airways Cargo.

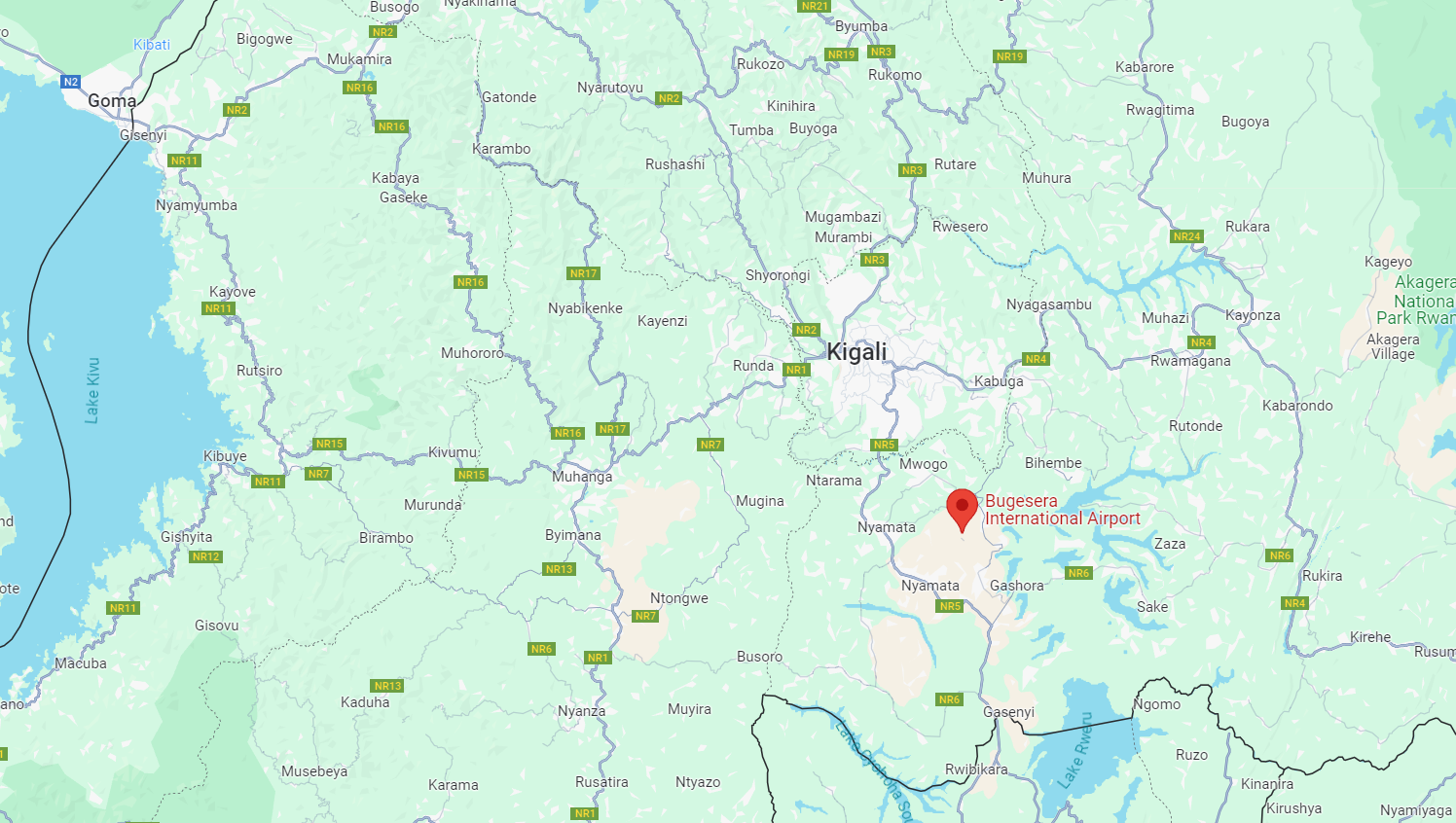

The investment complements the carrier's proposed acquisition of a 49% stake in Rwandair and its confirmed 60% stake in the new Kigali Bugesera International Airport, which is scheduled to commence operations in 2028.

Bugeresa International Airport location

The airport will be designed to handle up to seven million passengers p/a.

Rwanda's central location in the heart of Africa will support Qatar Airways' ambitions to expand operations across the continent, enabling access to new destinations and partnership opportunities.

The sky is the limit as African market reaches new heights

Qatar Airways is taking full advantage of the developing tourism market in Africa.

In addition to its investments in South Africa and Rwanda, the carrier has codeshare partnerships with Air Botswana and Rwandair.

A Nov-2023 report by the World Trade Tourism Council (WTTC) found that the African travel and tourism market is on track to grow by 6.5% annually throughout the next decade, contributing more than USD350 billion to the economy.

In its 2024 Commercial Market Outlook, Boeing forecasted passenger traffic in Africa to increase 6.4% p/a through 2043, exceeding the global average of 4.7%.

By establishing strongholds in South Africa and Rwanda, Qatar Airways is placing itself directly at the forefront of one of the world's fastest-growing regions in aviation.

Out of Africa - will things ever change though?

In a CAPA - Centre for Aviation Analyst Perspective last year, Richard Maslen, Head of Analysis at CAPA - Centre for Aviation noted there are only so many times it is possible to highlight the prospects for growth in aviation across the African continent while still maintaining enthusiasm that the huge potential can be realised.

Africa certainly represents the last frontier for aviation development, but impotent government transport strategies and ongoing protectionism practices continue to limit its success.

There is a mild hope of regulatory progress, while perhaps the greatest optimism attaches to some very persistent attempts to expand LCC operations in the region.

To recite the decades-old painful cliché: Africa's potential remains massive

Until governments recognise the wider benefits that an efficient aviation system can bring, with its impact on economic development, that persistent situation will continue.

Africa remains a market of huge potential but even larger challenges. The outlook for the future appears for mostly more of the same, but this Qatar Airways deal highlights there are some glimmers of hope.