CAPA Australia New Zealand Aviation Perspective: 20 May 2016

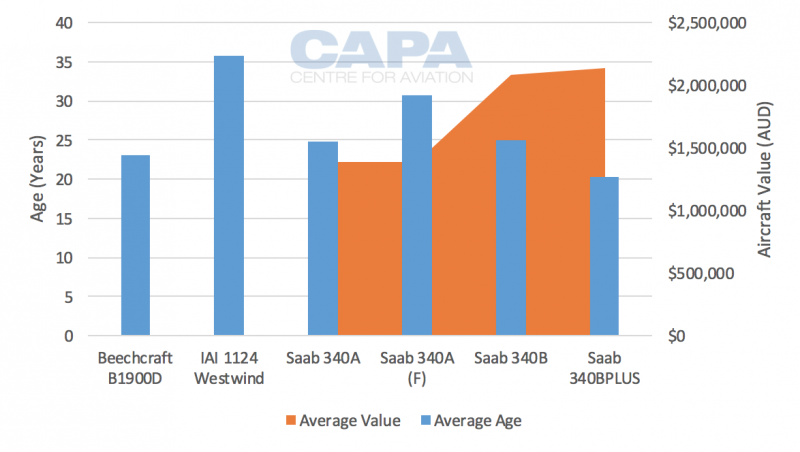

Fleet renewal is the question Rex wishes it didn't have to answer. As Australia's largest independent regional airline, Rex operates to 58 ports - primarily in the east, though with a small operation in Western Australia - and holds a monopoly on around 75% of its routes. Rex's average fleet age stands at 22.2 years, although the airline itself is just 15. Rex maintains it can operate a Saab 340 fleet to around 2035, or until each frame is about 40 to 45. Indeed, it may be able to. It has a huge spares inventory from operators who have dropped their Saab fleets, but maintenance costs will eventually make the aircraft uneconomic to operate. Worldwide, no Saab older than 32 is still in service.

- Rex, Australia's largest independent regional airline, operates to 58 ports and holds a monopoly on around 75% of its routes.

- The average fleet age of Rex is 22.2 years, with a fleet of 50 Saab aircraft valued at AUD114 million (USD82.4 million).

- Rex can potentially operate its Saab 340 fleet until 2035, but maintenance costs will eventually make them uneconomic.

- The ATR 42 is the only possible replacement for Rex's Saab fleet, but a like-for-like renewal would increase seat capacity by 41%.

- Rex has been making frequent cuts to counter falling passenger numbers, with ASKs at an all-time low and no positive passenger growth since 2008.

- The lack of a suitable replacement and the financial challenge of a fleet renewal, estimated to cost between AUD400 million (USD289.2 million) and AUD665 million (USD480.8 million), pose significant challenges for Rex.

Regional Express (Rex) Average Fleet Age and Average Value

Rex values its 50-strong fleet of Saab's at AUD114 million (USD82.4 million), though CAPA partners, Oriel, estimates a slightly more conservative value of AUD104.3 million (USD75.4 million) or AUD2 million (USD1.4 million) each. The ATR 42 is the only possible replacement, but a like-for-like renewal would increase seat capacity by 41%. Rex could settle for 35 aircraft to keep seats steady, but Rex is making frequent cuts to arrest falling passenger numbers - ASKs are at an all-time low despite an expanding number of destinations. Positive passenger growth has not been recorded since 2008 and it recorded its first loss in 1HFY2016.

The absence of a suitable 34-seat turboprop replacement and lack of capital to undertake a 50-aircraft fleet renewal may be Rex's biggest challenge yet. For an airline with single-digit profits and market cap around AUD84.8 million (USD61.3 million), an investment of AUD400 million (USD289.2 million) at the low end, or as high as AUD665 million (USD480.8 million), may be beyond its reach.