CAPA World Aviation Yearbook 2013: Country, Airline data in a comprehensive 1,000 page report

CAPA has today issued a world first 1,000 page CAPA World Aviation Yearbook 2013. We are happy to provide the report, in 10 parts to allow easier management, for free download by industry leaders.

The 2013 Yearbook contains a global overview, with extensive summary data for the largest 50 aviation countries and detailed analysis of more than 70 leading airlines, covering all regions of the world.

Full data sets are included for each airline and region, covering fleets, orders, delivery dates, capacity by route/region and premium profiles, making the CAPA Yearbook an invaluable resource.

- The CAPA World Aviation Yearbook 2013 provides a comprehensive overview of the global aviation industry, including data on the largest 50 aviation countries and analysis of over 70 leading airlines.

- The aviation industry is facing uncertainty and volatility due to economic challenges in Europe and the US, leading to cautious and short-term reactive behavior among airlines.

- The report highlights the growth potential in Africa's aviation market, driven by the continent's abundant resources and emerging middle class.

- Europe's airline market is experiencing a divide between long-haul growth and limited growth on routes within the continent, with low-cost carriers gaining market share.

- Latin America's aviation market has seen rapid growth, consolidation, and improved profitability, with the LAN-TAM merger creating a dominant airline group in the region.

- The Middle East's aviation industry is reshaping the global competitive landscape, with carriers like Emirates, Qatar Airways, and Etihad Airways challenging traditional hubs and carriers.

Would you like to provide uniquely branded copies of the World Aviation Yearbook 2013 to your leading clients? This is a unique reference guide which will remain on bookshelves the year round.

We can fashion hard copy versions for you to distribute under your own corporate brand, or we can perform all functions on your behalf. Just deliver us your logo and cover wording, with appropriate advertising content - and leave the rest to CAPA!.

Ask for more details. Minimum order number: 50

Section 1: Global Overview

Pursuing certainty in an uncertain world: A compelling, but ultimately dangerous strategy

Uncertainty has become the new normal - and risk reduction takes on a high priority for many airlines as Europe's economy stutters and the US struggles for traction.

Over recent months, certain words frequently recur in airline reports to describe their outlook for the market: "challenging", "volatile", "uncertainty" are among the most popular. These are understandably in turn accompanied by corporate goals of enhancing the financial position and paying down debt, aligning capacity to demand, reducing costs and adopting more conservative fuel hedging positions, among others.

In these conditions, it is hard for a company to avoid adopting behaviour which is much more cautious and short-term reactive. Analysts and shareholders want restraint, in turn influencing share prices; executives, motivated by incentives issued by their boards, want to achieve share price targets; and in many ways the market simply leaves little option but to follow the herd.

Yet, aside from the lookalike profiles being created in this way, there are real dangers where all companies in an industry adopt the same approach….. (extracted from Section 1: Global Overview)

+ Global data sets

World's Top 50:

• Aviation countries

• Airports

• Airlines

Two-page data summaries for each of the world's top 50 countries:

• Aircraft fleets and orders

• Global alliance membership

• LCC market shares

Section 2: Regional Report: Africa

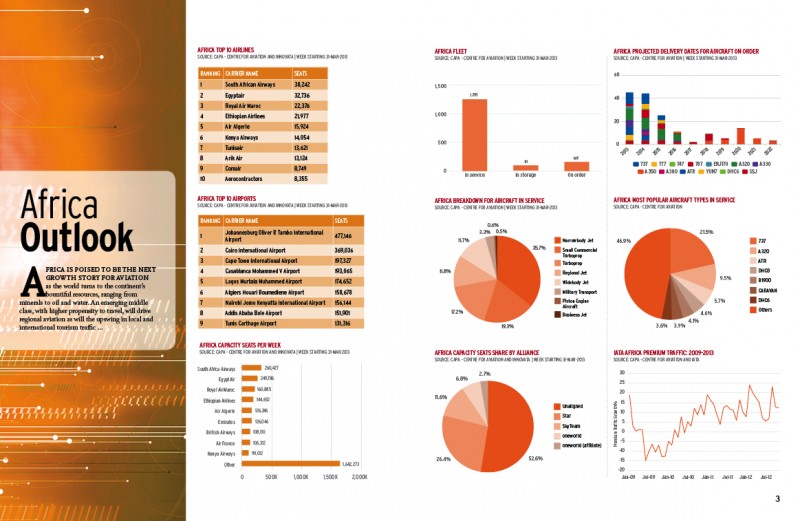

(Below: A sample of the data display from the Africa Regional Report)

Africa is poised to be the next growth story as the world turns to the continent's bountiful resources, ranging from minerals to oil and water. An emerging middle class, with higher propensity to travel, will drive regional aviation as will the upswing in local and international tourism traffic.

Aviation on the continent is however beset by a range of impediments to growth including strong state protectionism leading to a lack of desire to liberalise air services, high taxes and charges, a poor safety record stemming from ageing aircraft, weak finances and inadequate regulatory supervision, under-developed infrastructure across most of the continent and a lack of professional expertise and wide-spread corruption.

All of this makes it difficult for airlines to remain sustainable and for fares, which are well above the world average, to reduce, even via the entry of LCCs.

But the potential upside from economic growth, which includes having seven of the world's 10 fastest growing economies, is attracting a new breed of carrier like fastjet, Starbow and African World which are prepared to take the shorter term risk for big long-term gains……..

Africa: Selected airlines

South African Airways .............................................pp.10

"South African Airways' future hinges on a new strategic plan and CEO"

Egyptair........................................................................pp.20

"Egyptair looks to expand its way out of intensive care in 2013"

Kenya Airways.............................................................pp.31

"Kenya Airways boosts China services, with new Etihad codeshare, but has political and economic risks"

Arik Air.........................................................................pp.43

"Arik Air has the funding and opportunity to grow in 2013, but faces further government interference"

Royal Air Maroc.........................................................pp.52

"Royal Air Maroc shows promising growth for 2013 with route and fleet expansion - but needs a friend"

Fastjet..........................................................................pp.62

"fastjet pushes ahead with African expansion in 2013, but faces protectionist hurdles"

Ethiopian Airlines......................................................pp.67

"Ethiopian Airlines expands its global footprint to link the world's high growth regions"

To download the Yearbook and Region sections, please click here

Section 3: Europe

The European airline market has a number of dividing lines. There is little growth on routes within the continent, but steady growth on long-haul. Most of the growth within Europe goes to low-cost carriers, while the major legacy groups restructure their short/medium-haul activities. The big Western countries see little or negative traffic growth, while the East enjoys a growth spurt .

On the other hand, the big Western airline groups continue to lead consolidation, while many in the East struggle to survive. Many legacy flag carriers post losses, while LCC profits grow. Among the LCCs, the two larger established players make record profits with relatively slow traffic growth and the newer, smaller ones have less consistent profits but double-digit traffic growth. All these divides were clear in 2012 and will remain sharp in 2013.

IATA reported that European airlines saw passenger traffic (RPK) growth of 5.3% in 2012, driven by long-haul, while cargo traffic fell by 1.5%. Association of European Airlines (AEA) members' RPKs grew by 4.1%, although passenger numbers grew by only 2.2%. Members of the European Low Fares Airline Association (ELFAA) carried 7.2% more passenger than in 2011. In spite of this growth in passenger traffic, Eurocontrol reported that the number of flights in Europe fell by 2.4% in 2012. The apparent discrepancy is explained by a trend towards higher load factors, reflecting tight capacity control, and a higher average number of seats per aircraft. The latter point is explained by the superior growth of high seat density LCCs and of long-haul traffic.

Spain was the weakest major European market, with a 6.5% drop in the number of flights, and none of Europe's five biggest countries saw growth in flight numbers in 2012. By contrast, Turkey saw strong growth, followed by Norway, Poland and Ukraine. This pattern of a decline in flights in Western Europe, but positive growth in Turkey and Central/Eastern Europe, is forecast to continue in 2013, albeit at a lesser rate (Eurocontrol forecasts total movements will fall by 1.3%).

On the other hand, the big Western airline groups continue to lead consolidation, while many in the East struggle to survive. Many legacy flag carriers post losses, while LCC profits grow. Among the LCCs, the two larger established players make record profits with relatively slow traffic growth and the newer, smaller ones have less consistent profits but double-digit traffic growth. All these divides were clear in 2012 and will remain sharp in 2013.

IATA reported that European airlines saw passenger traffic (RPK) growth of 5.3% in 2012, driven by long-haul, while cargo traffic fell by 1.5%. Association of European Airlines (AEA) members' RPKs grew by 4.1%, although passenger numbers grew by only 2.2%. Members of the European Low Fares Airline Association (ELFAA) carried

The European airline market has a number of dividing lines. There is little growth on routes within the continent, but steady growth on long-haul. Most of the growth within Europe goes to low-cost carriers, while the major legacy groups restructure their short/medium-haul activities. The big Western countries see little or negative traffic growth, while the East enjoys a growth spurt .......

Europe: Selected airlines

Lufthansa Group .......................................................pp.23

"Lufthansa: why being the best of the Big three is not good enough"

Air France-KLM ...........................................................pp.41

"Air France-KLM: why it must transform, as medium haul and cargo operations hurt the bottom line"

IAG..................................................................................pp.58

"IAG slips into losses, targets immediate bounce-back. But further austerity will be needed all round"

Turkish Airlines.........................................................pp.72

"Turkish Airlines' 2012 operating profit almost triples; 2013 more doubtful, with 20% seat growth"

Easyjet..........................................................................pp.88

"easyjet SWOT analysis - is Sir Stelios strength, weakness, opportunity and threat all in one?"

Virgin Atlantic Airways............................................pp.99

"Virgin Atlantic, the flying enigma - a great brand in need of greater financial discipline"

Airberlin......................................................................pp.112

"airberlin: in need of a cap that fits after another underlying loss"

Alitalia .........................................................................pp.128

"Alitalia battles for survival in 2013, again, despite operational improvements"

SAS .................................................................................pp.143

"SAS SWOT: final call to establish a sustainable Scandinavian Airlines"

Norwegian Air Shuttle.............................................pp.158

"Norwegian Air Shuttle: at a critical turning point"

Air Astana....................................................................pp.173

"Air Astana plans more rapid regional growth as Kazakhstan emerges as world's fastest growing market"

Tajik Air........................................................................pp.189

"Tajik Air faces increasing pressure as Somon Air expands and new start-up enters the domestic market"

To download the Yearbook and Region sections, please click here

Section 4: Latin America

Latin America's market has been characterised over the Last decade by rapid growth, consolidation and significantly improved profitability. 2012 saw more healthy growth in every major market and a key milestone with the completion of the LAN-TAM merger, which puts about one- third of the region's capacity in the hands of one very powerful airline group.

The establishment of new LAN and TAM parent LATAM Airlines Group is the biggest component of a massive consolidation trend which has also included the mergers of Avianca and TACA, Gol and Webjet, and Azul and TRIP. In addition, consolidation has come in the form of casualties as several Latin American carriers of all sizes have suspended operations in recent years, with Uruguay flag carrier Pluna and Bolivia's largest carrier Aerosur joining

the list in 2012. The result of the consolidation has been the emergence of a healthier industry with the leading six airline groups accounting for about 75% of total capacity among Latin American carriers and having generally positive outlooks for 2013 and beyond.

The success of cross-border models has contributed to the consolidation and overall profitability of Latin America's aviation industry. Unlike in Asia, where the cross-border model has been used to accelerate low-cost carrier growth, in Latin America the model has been primarily used among full-service carriers.

LATAM and Avianca-TACA represent the world's best examples of successful cross- border models in the full-service carrier sector. LATAM now includes passenger airline subsidiaries in seven countries while Avianca- TACA has passenger airline subsidiaries in eight countries, plus a sister carrier in a ninth country. 2013 will see further integration at Avianca-TACA as all the carriers in the group take on the Avianca brand, representing a final step in a merger which was completed in early 2011. LATAM, meanwhile, will continue to pursue synergies made possible by the completion of their merger in mid-2012....

Latin America: Selected airlines

Aeromexico Group .....................................................pp.10

"Aeromexico plans more capacity growth in 2013 as delayed 787s are deployed to Europe and New York"

Avianca-TACA Group ................................................... pp.22

"Avianca-TACA primes for re-branding and intensifying competition with LATAM"

Copa Holdings.............................................................pp.31

"Panama's Copa on course for more industry-leading profits and double-digit growth in 2013"

Gol.................................................................................pp.42

"Gol pledges a financial turnaround as it records a second consecutive annual loss, of USD745 million"

LATAM Group ................................................................pp.52

"LATAM's 4Q2012 yields are damaged by aggressive competitive expansion in the uS-Brazil market"

Viva Group ...................................................................pp.61

"VivaAerobus and VivaColombia focus on domestic expansion as Irelandia ponders third Viva franchise"

Latin America: Selected countries

BRAZIL Overview .........................................................pp.73 "Brazil domestic growth slows in 2012 as Azul-Trip continues to take market share from Gol"

CHILE Overview............................................................pp.84 "Chile emerges as Latin America's fastest growing market despite domination from LAN"

COLOMBIA Overview ....................................................pp.99 "Colombia's aviation market poised for more rapid growth in 2013, led by VivaColombia, Avianca & LAN"

MEXICO Overview........................................................pp.107

"Mexico returns to double-digit domestic growth in 2012, boosting outlook for Aeromexico and LCCs"

Section 5: Middle East

Even for a region developing as fast as the Middle East, few years could match the changes wrought during 2012. The year saw the most influential carriers in the region engage with the rest of the airline industry in a way that has profound implications for global aviation. 2013 will be the year that this dramatic reshaping begins to make its effects felt on the global competitive landscape.

Outside of this competitive re-ordering, the region continues to produce outstanding levels of growth. During 2012, Middle Eastern airlines lead growth rates for international passenger and cargo traffic. With the global economy slowly warming up again, particularly in advanced economies, the rest of the world will catch up, although the region is still expected to lead growth in 2013.

The Big three: the super connectors take sides

A generation ago, travellers to Europe swapped aircraft in London, Paris, Frankfurt or Amsterdam. Travellers to Asia connected in Hong Kong, Singapore or Bangkok. They flew typically with Lufthansa, British Airways, Cathay Pacific and Singapore Airlines. Increasingly though, these traditional carriers and their hubs have been superseded by Dubai, Doha and Abu Dhabi and their home carriers: Emirates, Qatar Airways and Etihad Airways.

The rapidity of the shift has been breathtaking. In the past five years, London Heathrow, Paris Charles de Gaulle, Frankfurt and Amsterdam added a total of 11.7 million new passengers between them, growth of just 5%. In Asia-Pacific, Hong Kong, Singapore and Bangkok Suvarnabhumi have added 34.4 million passengers over the same period, an increase of 27%..........

Middle East: Selected airlines

Air Arabia ....................................................................pp.11

"air arabia reports another six months of profit and consistent growth"

Emirates Airline....................................................................... pp.19

"How Emirates and friends will soon reshape American aviation"

Etihad Airways............................................................pp.31

"Etihad jolts the status quo again - Jet airways and (wait for it) Air Canada are its newest partners"

Flydubai.......................................................................pp.39

"flydubai has bright outlook after recording first profit and emerging as close partner to Emirates"

Gulf Air........................................................................pp.51

"Gulf Air turn around plan offers a glimmer of hope for the beleaguered flag carrier"

Jazeera Airways.........................................................pp.60

"Could Jazeera Airways, a small and nimble carrier, come to the rescue of Kuwait Airways?"

Nasair ..........................................................................pp.69

"nasair plans ambitious expansion in 2013 ahead of further liberalisation in the Saudi Arabian market"

Qatar Airways .............................................................pp.77

"Qatar airways set to join oneworld by late 2013"

Saudia ...........................................................................pp.86

"Saudia faces new competitive threats in 2013 as Saudi Arabia loosens the regulatory reins"

Section 6: North America

North America is on the brink of reaching full maturity as the planned merger between American and US Airways and the previous tie- ups among the country's airlines will result in three large full-service network airlines, one major low-fare carrier, roughly three hybrid airlines and a couple of fringe airlines operating under the ultra low-cost carrier model. Canada is also moving into a new level of maturity as its two major airlines are in the midst of creating new businesses to enlarge their revenue, and one strong niche player adds some rationalisation to their duopoly.

But the full maturation of US markets does not mean challenges in achieving viable business models have been wiped out. While a high level of maturity deters some start-ups from introducing junk capacity into the market place, established airlines need to ensure they have a solid foundation to weather the wild cyclicality that remains the only predictable pattern in the airline business.

Once American and US Airways reach full integration about 18 months after closing on their merger during 3Q2013, three carriers will account for approximately 58% of the US domestic market based on current O&D data from trade group Airlines For America (A4A). Adding Southwest's roughly 25% share, four carriers (including regional feed for the majors) will represent roughly 83% of the US domestic market. The speedy pace of US consolidation during the last few years is a rapid change from 2005, when seven carriers accounted for about 90% of the market.....

North America: Selected airlines

United Airlines...........................................................pp.11

"United airlines pledges it is on the road to revenue recovery as yields improve"

Delta Airlines ............................................................pp.21

"Delta presses forward to build a competitive network in a consolidated and mature US market"

Southwest Airlines...................................................pp.41

"Southwest airlines, the US' fourth force, does not neatly fit the emerging US business models"

JetBlue Airways .........................................................pp.48

"JetBlue enjoys a cost "sweet spot" in the consolidating US market"

Hawaiian Airlines.......................................................pp.56

"Hawaiian Airlines endures short-term pain to secure, it hopes, successful longevity"

Spirit Airlines.............................................................pp.64

"Spirit exploits the new low-fare market niche in the US to achieve consistent profitability"

Alaska Air Group .......................................................pp.72

"Alaska continues to face challenges getting investors to acknowledge its solid financial performance"

Frontier Airlines.......................................................pp.80

"Frontier airlines straddles ultra low-cost and hybrid profiles (or falls between them)"

Air Canada ...................................................................pp.87

"Air Transat and westJet face heightened pressure as Air Canada applies rouge"

Porter Airlines ..........................................................pp.95

"Porter attempts to determine its place in Canadian aviation as rivals move into new endeavours"

Section 7: North Asia

North Asia is one of the few regions where most full service airlines are growing capacity. But the carriers are now looking to complement their expansion drive with definition. With the market having higher expectations and more travel options, airlines that could once relatively easily fill an aircraft now need greater differentiation and to deliver on it. It makes for a more complex region, but overall North Asia is still sleepy without much strategic growth like bilateral alliances and revenue innovation. And despite a burgeoning and promising LCC scene, many flag carriers are flat out ignoring this growth. Whatever definitions are established will surely change.

At the most macro level, driving change is the strong economy - relative to other regions, even if China's growth is slowing - and liberalisation. Japan remains the leading example of liberalisation in North Asia. Not only were open skies agreements reached with China, Taiwan and European nations, Japan even allowed greater air services, but no open skies, to the Middle East network carriers despite ANA and JAL not serving the region; Japan put national economic interests ahead of its airlines. Korea has a number of open skies agreements too, but is stubborn with countries (like Singapore) whose airlines pose too much threat.

Japan has also facilitated the entry of LCCs, three of which launched in 2012: Peach, Jetstar Japan and AirAsia Japan. Domestic routes are so far their staple but there have been short-term challenges: AirAsia Japan gained a new CEO as it became clear its performance lagged that of Jetstar Japan despite a similar network, while Jetstar Japan will reduce its Osaka Kansai base......

CHINA Outlook ............................................................pp.11

"Chinese airline outlook: slot shortages and yield pressures prompt the need for innovative solutions"

North Asia: Selected airlines

Cathay Pacific.............................................................pp.17

"Cathay Pacific, posting 84% drop in profits, seeks consistency but offers no brave new strategies"

Spring Airlines...........................................................pp.30

"Spring airlines, nearing 10 million pax p/a, looks to leverage agility and grow where permitted"

Jeju Air ........................................................................pp.41

"Korea's Jeju air signals it must change from hybrid to pure LCC model as it seeks partnerships"

Korean Air...................................................................pp.51

"Modest achiever korean air to increase North american strength, tap new markets & look for partners"

Hainan Airlines..........................................................pp.66

"Hainan Airlines to launch three new airlines as part of portfolio strategy"

Xiamen Airlines ..........................................................pp.79

"Xiamen airlines, china's fourth largest domestic airline, aims to surpass 20m pax in 2013"

Japan Airlines ............................................................pp.89

"Japan airlines' 17% margin may be envy of the industry, but JaL's outlook is less upbeat"

All Nippon Airways ....................................................pp.101

"ANA's capital-raising and international acquisition strategy raise questions for investors"

Japanese LCCS - AirAsia, Jetstar, Peach.................pp.113

"As new Japanese LCCs - AirAsia, Jetstar and Peach - settle in, strategy differences become apparent"

To download the Yearbook and Region sections, please click here

Section 8: South Asia

Indian aviation is seeing signs of revival after another difficult year marked by continuing losses, a 3% decline in traffic and the exit of Kingfisher, which up until less than two years ago was the largest single domestic airline in the country.

Many of the structural challenges in Indian aviation - such as the uncertain and unpredictable policy environment, intervention by the regulator on commercial matters, high sales taxation on fuel, and the low productivity of airports and airspace - remain unaddressed. However, two key developments in recent months have given rise to greater optimism.

Firstly, Kingfisher's exit in Oct-2012 has positively impacted market dynamics for the remaining carriers. The withdrawal of capacity, combined with pricing discipline, resulted in higher yields and improved financial performance in FY2013, at least up until 4Q when aggressive discounting returned.

And secondly, the historic decision by the government in Sep-2012 to allow foreign airlines to invest up to 49% in Indian carriers is a vital step in establishing a more professional and corporatised sector in India. It offers the promise not only of introducing strategic capital and expertise into the market, but also delivers a much needed confidence factor for other institutional funding.

CAPA estimates that India's carriers will report a combined loss of approximately USD1.6 billion in the 12 months ending 31-Mar-2013, with most of this accounted for by Air India and Kingfisher Airlines.....

South Asia: Selected airlines

Jet Airways............................................................pp.9

"Etihad's potential investment in Jet airways to be a game-changer for India"

AirAsia Group .............................................................pp.19

"AirAsia group completes first step in its bid to launch an LCC in India"

Air India........................................................................pp.31

"Air India: the time has come to stop procrastinating and act. the final scene is near"

Section 9: Southeast Asia

Southeast Asia continues to be a region of rapid growth driven by low cost carriers, including budget subsidiaries and affiliates of full-service carriers. For the first time LCCs accounted for over 50% of seat capacity within Southeast Asia in 2012. The region has seen a steady rise in LCC penetration rates since the turn of the century from a base of virtually zero

The four largest domestic markets in Southeast Asia - Indonesia, Philippines, Malaysia and Thailand - all now have LCC penetration rates exceeding 50%. The Philippines has the world's highest domestic LCC penetration rate among medium and large size countries - 80% in 2012, which is likely to increase to about 85% in 2013. But there is still room for more LCC growth in Southeast Asia as the size of the overall market, and in many cases LCC penetration rates, continue to increase.

2013 will again see more LCC capacity pouring into Southeast Asia. Based on CAPA data, the region's LCC fleet will grow by between 25% and 30% in 2013 to approximately 530 aircraft. This includes almost 300 aircraft from Asia's top two LCC groups - AirAsia and Lion -- and over 100 aircraft from affiliates or subsidiaries of Southeast Asian full-service carriers. Singapore Airlines, Thai Airways, Garuda Indonesia, Philippine Airlines and Vietnam Airlines are all now participating in the budget end of the market, allowing these groups to pursue growth while demand for long-haul and premium passenger services remains relatively flat and as demand in the cargo sector continues to be depressed.

There are now 25 LCCs operating in Southeast Asia, five of which have launched since the end of 2011. More new LCCs will enter the market in 2013, including Malaysia's Malindo, and most of the region's existing LCCs continue to expand rapidly........

Lion Air Group ............................................................pp.10

"indonesia's Lion Air Group has the growth opportunities to support the 600 aircraft on order"

Malindo Air .................................................................pp.18

"Lion's Malindo breaks AirAsia-MAS duopoly in Malaysian domestic market. Next stop: Delhi...and Asia"

AirAsia .......................................................................... pp.28

"AirAsia's 2013 outlook marred by intensifying competition and continued losses at new affiliates"

Malaysia Airlines.......................................................pp.43

"Malaysia airlines 2013 outlook clouded by increasing competition and launch of Malindo"

Cebu Pacific.................................................................pp.58

"Cebu Pacific sees bright outlook for 2013 as rationality returns to Philippines market"

Philippine Airlines ....................................................pp.69

"Philippine airlines group faces challenging future after exiting budget carrier sector"

Singapore Airlines....................................................pp.79

"Singapore Airlines looks to ride out the storm as profits continue to slide"

Tiger Airways .............................................................. pp.91

"Tiger returns to profitability but still faces challenges in Australia, Indonesia & the Philippines"

Thai Airways ................................................................pp.102

"thai airways faces challenging 2013 as competition within asia increases"

Vietjet Air...................................................................pp.114

"VietJet to pursue more rapid expansion in 2013; Jetstar Pacific needs to respond - fast"

Section 10: South Pacific

South Pacific carriers are emerging from a period of rebuilding their long-haul networks as they redirect their focus to Asia and Pacific Rim and away from the traditional markets in Europe for which they will rely on newly formed alliances.

The region's three biggest carriers, Qantas, Air New Zealand and Virgin Australia, have formed deep alliances with foreign carriers to create virtual long-haul networks, none bigger than the seismic partnership between Qantas and Emirates.

Virgin Australia has gathered the most comprehensive set of partners, including Etihad and Delta Air Lines for long-haul reach, and more locally Air New Zealand for trans-Tasman links.

As end of line carriers, more such relationships will need to be established by these three over the coming year as a means of overcoming the tyranny of distance using their own metal.

Australia became the centre of attention when national carrier Qantas announced a global alliance with Gulf heavyweight Emirates as the key plank of a strategy to turn around its loss making international business.

While the alliance was timed to take effect on 31-Mar-2013 to allow time for regulatory approvals, route and schedule changes - including a decision by Qantas to move all its European flying from transiting through Singapore to Emirates' Dubai hub - it also helped Qantas to return an AUD111 million (USD113.6 million) after tax profit in the first half of FY2013. Qantas international, while still posting a loss, was vastly improved and on track to meet its target to breakeven in FY2015.

Having cemented its alliance with Emirates, Qantas has turned its attention to Asia where the future of the mainline brand lies. Extensive schedule changes will take effect over the fourth quarter of FY2013 to create more favourable Asian connections and fill the effective 40% increase in capacity between Australia and Singapore, which previously accommodated passengers bound for Europe.......

South Pacific: Selected airlines

Virgin Australia.........................................................pp.9

"Virgin Australia gains tiger Australia to complete the domestic set"

Air New Zealand.........................................................pp.18

"Air New Zealand poised to deliver on "go beyond" strategy, still facing stiff competition"

Air Pacific ....................................................................pp.30

"Air Pacific charts its future course as a rebranded Fiji Airways when MD Dave Pflieger departs"

Air Niugini....................................................................pp.39

"Air Niugini expands in growing economy despite service challenges and weak balance sheet"

Skywest ........................................................................pp.50

"Skywest leads Virgin Australia regional expansion and into lucrative mining charter operations"

To download the Yearbook and Region sections, please click here

Would you like to provide uniquely branded copies of the World Aviation Yearbook 2013 to your leading clients? This is a unique reference guide which will remain on bookshelves the year round.

We can fashion hard copy versions for you to distribute under your own corporate brand, or we can perform all functions on your behalf. Just deliver us your logo and cover wording, with appropriate advertising content - and leave the rest to CAPA!.

Ask for more details. Minimum order number: 50