Wizz Air & Ryanair lead Europe on liquidity for COVID-19

In a statement to the stock market on 16-Mar-2020 easyJet neatly summarised the current, unprecedented, challenge facing European Airlines:

"European aviation faces a precarious future and there is no guarantee that the European airlines, along with all the benefits it brings for people, the economy and business, will survive what could be a long-term travel freeze and the risks of a slow recovery. Whether it does or not will depend significantly on European airlines maintaining access to liquidity, including that enabled by governments across Europe."

A number of European governments have indicated that they are prepared to support the airline industry in the light of the COVID-19 pandemic and the consequent near total collapse of demand resulting from travel restrictions.

This report presents CAPA's analysis of the liquidity balances of leading European airline groups, with Wizz Air and Ryanair leading and Norwegian trailing.

It also gives a review of recent actions taken to cut capacity and expenditure by those groups. It comes with the caveat that, as with the spread of the virus, the situation is changing rapidly and its content may be quickly superseded.

Summary

- Flight restrictions have been imposed in many countries. The EU is considering a ban on travel to 31 countries by non-EU nationals.

- Wizz Air and Ryanair have the best liquidity among European airline groups, while Norwegian has the lowest.

- Leading European airline groups are cutting capacity by 75% to 90%. Austrian Airlines is suspending all flights.

- Some European governments, including those of France, Netherlands, Norway, Finland and Italy, have indicated they are willing to support airlines in the crisis. Late on 17-Mar-2020, the UK government said it would consider support to airlines.

Flight restrictions in many countries

Several European countries have now imposed flight restrictions, including total bans on international flights in Poland and Norway and a ban on non-nationals entering the Czech Republic.

In addition, the US has extended the ban on non-nationals from Europe's Schengen zone to include the UK and Ireland, and other nations outside Europe have imposed restrictions on inward travel, including Argentina, Chile, India and Peru.

On 16-Mar-2020 it emerged that the European Union is planning a temporary (30 day) ban on non-essential travel to 31 European countries by non-EU citizens and residents. UK citizens would not be covered by the ban, which needs approval from EU national leaders.

Furthermore, even where travel restrictions are not in place, social distancing measures (whether or not they are government-imposed) will further cut demand for air travel.

Wizz Air and Ryanair have the best liquidity; Norwegian the lowest

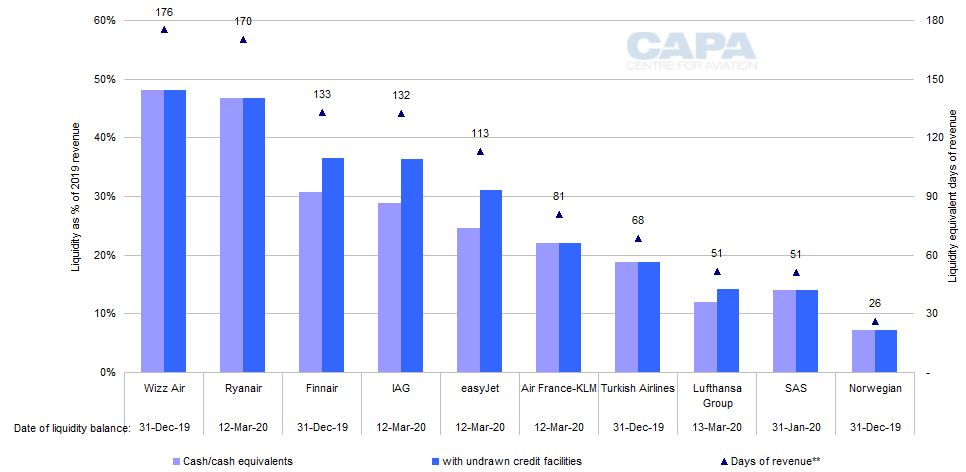

The chart below summarises CAPA's analysis of the reported liquidity balances of leading European airline groups, expressed as a percentage of 2019 revenue.

Liquidity is the gross level of cash and cash equivalents as reported in recent press releases, where available, or at the last reported balance sheet date (usually 31-Dec-2019 if no update has been given since).

Ranked by this metric, the ultra LCCs Wizz Air and Ryanair lead the way, with liquidity at 48% and 47% of revenue - equivalent to 176 days and 170 days of revenue respectively.

At the other end of the scale is Norwegian, with liquidity at 7% of revenue, or 26 days.

European airline groups: liquidity as a percentage of 2019 revenue*

Lufthansa Group capacity reduced by 80% to 90%; Austrian suspended entirely

On 13-Mar-2020 Lufthansa Group said that bookings were broadly 50% lower over the previous week compared with a year earlier. The group was considering a further 70% capacity cut in the coming weeks compared with its original plan.

On 16-Mar-2020 the group announced the temporary suspension of all Austrian Airlines flights from 19-Mar-2020 until 28-Mar-2020. On 17-Mar-2020 10% of originally planned long haul capacity, and 20% of short haul, will still be available.

Passengers will be rebooked on other airlines where possible.

Further cancellations and cuts by the Lufthansa Group will be published on 17-Mar-2020, with a sharp decline especially in the Middle East, Africa and Latin America. Overall, the group's long haul capacity will be cut by up to 90%.

European capacity will also be further reduced, with only approximately 20% of originally planned seat capacity still on offer from 17-Mar-2020.

The new schedules will be in place initially until 12-Apr-2020.

Lufthansa Cargo continues to operate its planned schedule, except for cancellations to mainland China.

Lufthansa Group liquidity can be increased through aircraft sales

Lufthansa Group is focusing on cost cuts, is planning to implement reduced working hours, and is negotiating the postponement of planned capex.

Lufthansa Group will suspend its dividend payment on its 2019 results as a cash preservation measure. The group has raised approximately EUR600 million in recent weeks, bringing its liquidity to EUR4.3 billion, according to a statement on 13-Mar-2020.

This is equivalent to 12% of its 2019 revenue. In addition, it has EUR800 million of unused credit lines, which, if drawn, would increase its liquidity to EUR5.1 billion, or 14% of revenue.

This is relatively low compared with other leading European airline groups. However, Lufthansa is raising additional funds - for example, through aircraft financing. It owns 86% of its fleet and almost 90% of the owned aircraft are unencumbered.

The group said that its unencumbered owned fleet has a book value of approximately EUR10 billion, so it can raise cash through sale and leasebacks, although it may not expect to receive good prices in current conditions.

IAG capacity cut by 75%

IAG reported on 16-Mar-2020 that, in addition to its suspension of flights to China and Italy and the reduction of capacity to Asia, the restriction on foreign nationals from the Schengen zone, UK and Ireland had added to the uncertainty.

IAG's 1Q2020 ASKs will now have been reduced by 7.5% year-on-year. In Apr-2020 and May-2020, ASKs will be cut by at least 75%.

The group is cutting costs and working to improve cash flow. It is grounding aircraft, reducing and deferring capex, cutting non-essential IT spend, freezing recruitment, offering voluntary leave options, temporarily suspending employment contracts, and cutting working hours.

IAG's liquidity as at 12-Mar-2020 stood at EUR7.35 billion, equivalent to 29% of 2019 revenue. With additional undrawn facilities of EUR1.9 billion, its total available liquidity is EUR9.3 billion, or 36% of 2019 revenue.

IAG has not called on governments for financial support to airlines.

Air France-KLM capacity cut 70% to 90%

Following the US ban on European nationals, Air France, KLM and Virgin Atlantic are continuing with services to US airports designated to receive US nationals, but with reduced frequencies, at least until 28-Mar-2020.

Air France-KLM group's US network accounts for 16.8% of ASKs and 15% of revenue for its network airlines, based on 2019.

The group said on 13-Mar-2020 that load factors and profitability on the continued US routes were "foreseen to be negatively impacted and remain uncertain". Air France-KLM, with its partners Delta and Virgin Atlantic, are working on a plan for US services beyond 28-Mar-2020.

On 16-Mar-2020 Air France-KLM said that flight activity would reduce "very significantly" over the next few days. ASKs will potentially decrease by 70% to 90% for two months, but the situation is being monitored daily and this could change.

Air France will ground its entire A380 fleet (nine aircraft, according to the CAPA Fleet Database).

KLM will ground its entire 747 fleet (seven aircraft, including five combis, according to the CAPA Fleet Database). This effectively brings forward the completion of the phase-out of the type by Apr-2020, rather than Apr-2021.

French and Dutch governments prepared to support Air France-KLM

The group has identified EUR200 million of additional cost savings in 2020 and is cutting planned capex this year by EUR350 million.

Air France-KLM's liquidity at 12-Mar-2020 amounted to more than EUR6 billion. A week earlier, both airlines had raised cash by drawing a total of almost EUR1.8 billion in revolving credit facilities. The group's liquidity is equivalent to 22% of 2019 revenue.

Both airlines plan a temporary short-time work scheme, subject to consultation with labour groups.

Meanwhile, the French government, which has a 14.0% equity stake in the Air France-KLM group, is reported to be preparing a recapitalisation plan. The Dutch government, which owns 14.3% of the group, has also said that it will support Air France-KLM.

Ryanair capacity cut by up to 80%; liquidity high

On 16-Mar-2020 Ryanair said that government restrictions were having a significant negative impact on the group's schedules. As a result, it expects the grounding of most of its fleet across Europe over the next seven to ten days.

For Apr-2020 and May-2020 Ryanair expects seat capacity to be cut by up to 80% and is not ruling out a total grounding of its fleet.

It is also taking the unprecedented step of waiving its flight change fee on bookings in Apr-2020.

All services to Poland are suspended, and it is "severely" reducing capacity to Spain in the period 15-Mar-2020 to 19-Mar-2020 as a result of Spanish quarantine measures.

As with other airlines, Ryanair is reducing its costs and focusing on improving cash flow. This includes deferring capex and share buybacks, freezing recruitment, bringing in voluntary leave, temporarily suspending employment contracts, and cutting working hours.

As at 12-Mar-2020, Ryanair Group has liquidity of EUR4 billion, equivalent to 47% of revenue (based on calendar 2019 revenue), the second highest proportion of any European airline group (after Wizz Air, which had 48% at 31-Dec-2019).

It expressed its confidence that it can and will survive through a prolonged period of reduced, or even zero, flight schedules.

EasyJet could ground the "majority of its fleet"

Easyjet announced on 16-Mar-2020 that it had undertaken "significant" cancellations. These would continue on a rolling basis and could result in the grounding of the "majority of its fleet".

It is focusing on cost cutting and stopping non-critical expenditure. Its cash balance is GBP1.6 billion, equivalent to 25% of FY2019 revenue, and it also has access to USD500 million (GBP460 million) in undrawn credit, bringing the total available liquidity to GBP2.2 billion - 31% of calendar 2019 revenue.

EasyJet CEO Johan Lundgren said that "coordinated government backing will be required to ensure that the [aviation] industry survives".

His call for liquidity to be enabled by governments is the first time a major European LCC has called for government support.

Turkish Airlines adds more countries to its flight suspensions

Turkish Airlines is suspending services to Austria, Belgium, Denmark, France, Germany, Netherlands, Norway, Spain and Sweden until 17-Apr-2020. This is in addition to previous suspensions to destinations in China, Italy, Iraq, South Korea and Iran.

According to its 2019 annual results, Turkish had liquidity of USD2.5 billion at 31-Dec-2019, equivalent to 19% of its revenue.

Norwegian Air capacity cut 85%; Norway government may support it

Following the US travel ban, Norwegian grounded 40% of its long haul fleet and cancelled up to 25% of its short haul flights until the end of May-2020.

On 13-Mar-2020 Norwegian said that the "turmoil in the capital markets has meant that in practice loans and credits are now closed, which means that it is not possible to finance businesses in a normal fashion".

Norwegian CEO Jacob Schramm has described the company's liquidity as being in a critical phase. He called on Norway's government to provide "powerful and extraordinary measures". The government's decision to remove aviation taxes is welcome, but not enough.

On 16-Mar-2020 Norwegian announced the cancellation of 85% of its flights and the temporary lay-off of 7,300 workers, which is 90% of staff.

From 21-Mar-2020 the airline will mainly fly a reduced domestic schedule and also between Nordic capitals, with "some" European flights. Its long haul network will be suspended, with the exception of flights between Scandinavia and Thailand, which will continue until the end of Mar-2020.

The reduced schedule will continue until at least 17-Apr-2020, but will be regularly reviewed.

Mr Schramm said: "We appreciate that the authorities of Norway have communicated that they will implement all necessary measures to protect aviation in Norway".

According to its 2019 annual results, Norwegian had liquidity of NOK3.1 billion (EUR270 million) at 31-Dec-2019, equivalent to just 7% of its revenue, but has some additional cash-raising potential from aircraft sales.

SAS suspends "most" of its capacity

SAS said that "the demand for international air travel is essentially non-existent". It is suspending "most" of its traffic from 16-Mar-2020 until the return of "conditions to conduct commercial aviation".

It is introducing temporary lay-offs of 10,000 people, or 90% of its workforce.

According to its 1Q2020 annual results, SAS had liquidity of SEK6.6 billion (EUR600 million) at 31-Jan-2020, equivalent to 14% of its revenue in the 12M to 31-Jan-2020.

Finnair capacity cut by 90%; government ready to support it

On 16-Mar-2020 Finnair announced that it would not pay a planned dividend for 2019. It also issued a second profit warning in less than a month, now expecting a substantial operating loss in 2020, rather than one that is merely lower than last year.

Finnair will cut capacity by approximately 90% year-on-year from Apr-2020 until "the situation improves". It is concentrating on cost reductions, while also taking steps to improve liquidity through credit lines, sale and leasebacks of aircraft and a "substantial" loan.

The government of Finland has said that it will support Finnair, although details have not been provided.

According to Finnair's 2019 annual results, it had liquidity of EUR953 million at 31-Dec-2019, equivalent to 31% of its revenue. With undrawn credit lines of EUR175 million, the total becomes EUR1.1 billion, or 36% of revenue.

Virgin Atlantic plans to ground 75% of its fleet and calls on UK government support

Virgin Atlantic has said that it is to ground 75% of its fleet until the end of Mar-2020 and 85% in Apr-2020. The airline's CEO Shai Weiss has called on the UK government to support the airline and the British aviation/travel industry.

Specifically, Mr Weiss would like to see government loans, a suggestion also backed by the pilot union BALPA. According to Virgin, the UK industry needs funding of up to GBP7.5 billion.

On 17-Mar-2020, the UK government announced a series of measures to support the economy and said would consider support to airlines, but gave no further details.

Alitalia could be taken over by Italian state

The government of Italy is reported to be finalising a takeover of Alitalia through a public vehicle. Almost three years into Alitalia's special administration, its administrators' repeatedly extended attempts to attract buyers may have finally been abandoned in the light of the COVID-19 outbreak.

Poland restricts all international air travel

Following a decision by the government of Poland to restrict international air travel, LOT Polish Airlines is to suspend all its services from Poland, in addition to its operation from Hungary, until 28-Mar-2020.

Other airlines, including Wizz Air and Ryanair (the other two major airlines in Poland) are also ceasing all flights to/from the country.

EU suspends '80-20' slot rules

In addition to the possibility that some individual European governments (not, so far, including the UK government) may provide support to airlines in their countries, the European Union has suspended slot use rules in the bloc.

Until Jun-2020, the so-called 80-20 'use it or lose it' rule, whereby airlines normally must use their slots for at least 80% of an IATA season in order to keep them, has been suspended. Clearly, with capacity down by 75% to 90% for most of Europe's leading airline groups, this rule is unworkable.

IATA welcomed the suspension of the rule, but called for the suspension to be extended to Oct-2020.

Governments must coordinate responses post-crisis

When announcing the suspension of Austrian Airlines flights on 16-Mar-2020, Carsten Spohr, Lufthansa Group CEO, also gave a reminder of the wider importance of aviation: "Now it is no longer about economic issues, but about the responsibility that airlines bear as part of the critical infrastructure in their home countries."

Nobody knows how long this unprecedented crisis will last, or exactly what the post crisis world will look like. However, it is certain it will look very different.

Governments must take steps coordinate their response and ensure that the post-virus aviation sector can serve the needs of the travelling public.

This does not only mean a coordinated response to the virus, but also a coordinated response to the governance and regulatory structure of European aviation once the crisis has passed.

CAPA MEMBERS - Stay up to date with the latest critical global developments affecting the industry with our customisable CAPA Alerts. Please contact our Sales Team for assistance.

MEDIA - If you are seeking further commentary on this topic, please contact our Marketing Team.