Urumqi Airport: fast growing Central Asian hub, but no BRI benefit yet

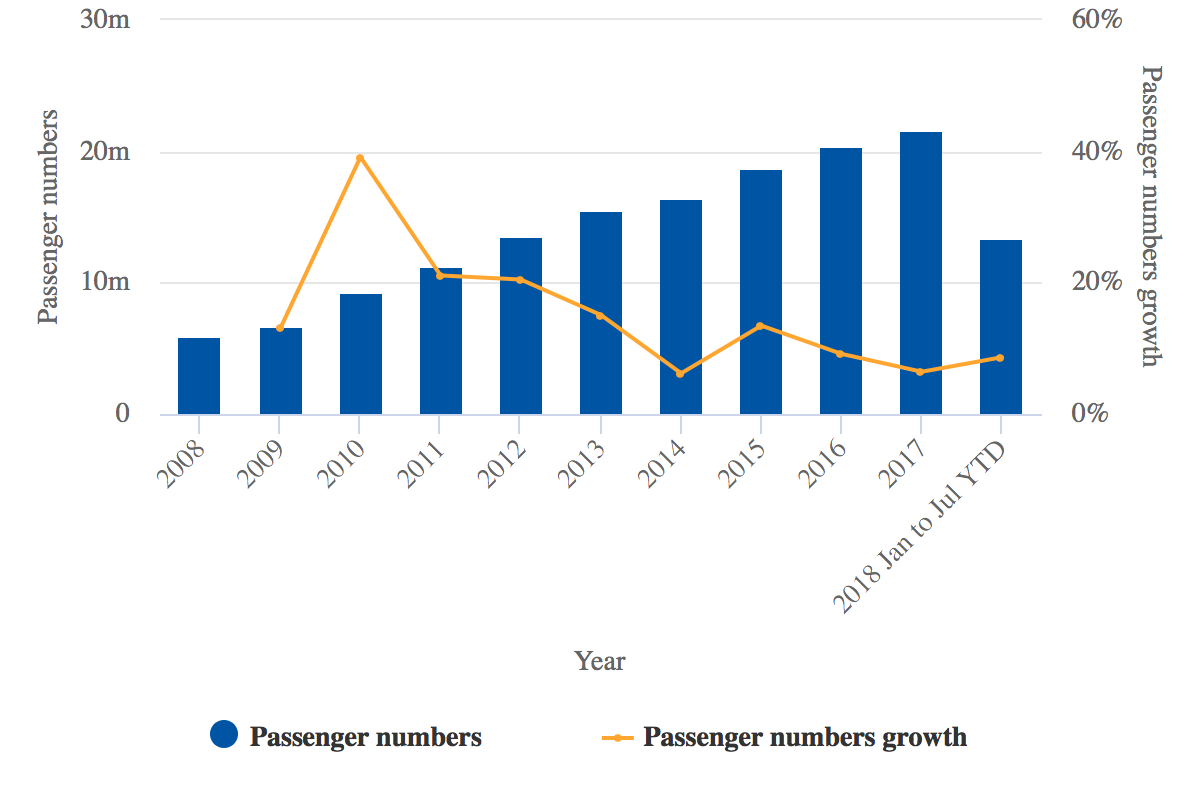

Urumqi has emerged as one of China's fastest growing airports. Passenger traffic has nearly quadrupled over the past decade, from only 5.8 million in 2018 to 21.5 million in 2017. Traffic increased by 6% in 2017 and was up another 9% in the first seven months of 2018.

However, Urumqi is still relatively underserved from an international perspective, despite its strategic location on the Silk Road and only 300km from Kazakhstan. Urumqi is closer to Central Asia than eastern China and is within narrowbody range of several markets benefitting from China's 'Belt and Road Initiative' (BRI). Urumqi also has a large Central Asian ethnic population and has become a hub for international companies seeking to increase their presence in Central Asia or the Silk Road Economic Belt.

China Southern has operated a hub at Urumqi for several years and currently links Urumqi with 15 international destinations - all of which are along the Silk Road. However, the China Southern hub consists predominantly of domestic services and 96% of Urumqi's total seat capacity is in the domestic market. International traffic has declined over the past three years, whereas domestic traffic has grown rapidly.

Summary

- Urumqi, located in northwestern China, has experienced rapid domestic growth over the past several years and now has more than 50 domestic destinations.

- Urumqi is also a gateway to Central Asia and other Silk Road countries, a region which accounts for nearly all of its 20 international destinations.

- However, Urumqi's international capacity has declined in the past three years and China Southern's Urumqi hub has been focusing on domestic expansion.

- China's Belt and Road Initiative could lead to increased demand for air travel between China and several of Urumqi's existing international destinations.

The Belt and Road Initiative (BRI) and potential implications for aviation will be the topic of a panel at the CAPA Asia Aviation Summit in Singapore on 8-Nov-2018. For more information about the summit, including the agenda, click here.

Urumqi is well connected with Central Asia

Urumqi is connected with all five Central Asian countries - Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan. There are currently 34 weekly services from Urumqi to seven Central Asian destinations, generating approximately 5,000 weekly one-way seats.

China Southern's Urumqi hub serves all seven destinations: Astana and Almaty in Kazakhstan; Bishkek in Kyrgyzstan; Dushanbe and Khudzhand in Tajikistan; Ashgabat in Turkmenistan; and Tashkent in Uzbekistan.

Urumqi is also served by three Central Asian airlines - Air Astana, Tajikistan's Somon Air and Uzbekistan Airways. Air Astana operates from both Almaty and Astana, Somon Air operates from Dushanbe, and Uzbekistan Airways from Tashkent.

Urumqi currently accounts for 51% of total China-Central Asia capacity. Beijing accounts for another 47% and Xian the remaining 2%, according to CAPA and OAG data. Beijing caters to point-to-point traffic and Urumqi is the natural hub for traffic from anywhere else in China. Urumqi is ideally located for Central Asian traffic and has the domestic network (more than 50 destinations) to feed international services.

Surprisingly, Urumqi's Central Asia capacity has declined in recent years

However, Urumqi-Central Asia capacity has declined in recent years, along with overall China-Central Asia capacity. The lack of growth in the China-Central Asia market in the five years since China launched BRI indicates the initiative (which has led to several major motorway, railway, shipping and gas/oil pipeline projects in Central Asia and beyond) has not yet impacted aviation.

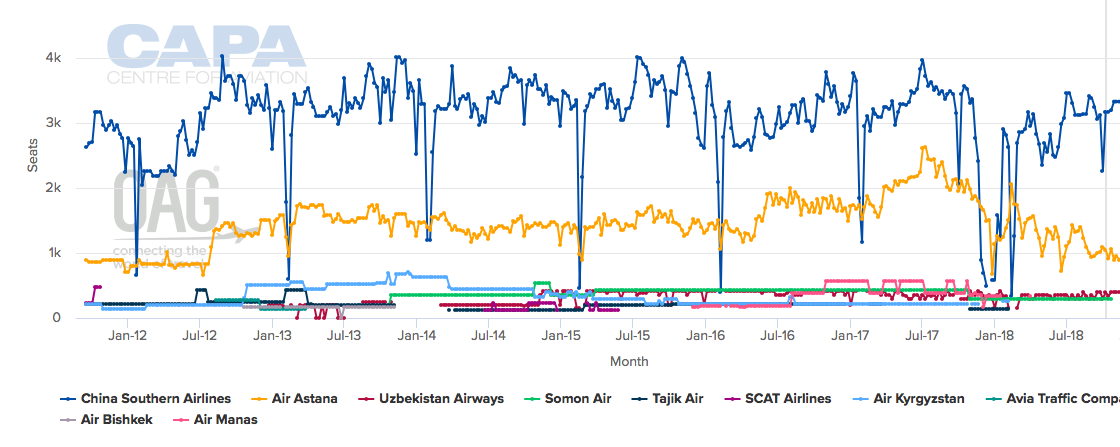

China Southern increased Central Asia capacity significantly in 2012 but its capacity in the five following years (from late 2012 to late 2017) was flat. Over the past year, China Southern's Central Asia capacity has even declined slightly, primarily a result of frequency reductions to Kazakhstan and Turkmenistan.

Air Astana and Somon Air have also reduced capacity to Urumqi over the past year, while Air Kyrgyzstan and Air Manas have suspended services entirely. Air Kyrgyzstan and Air Manas, which was the only LCC operating from Urumqi to Central Asia, each had two weekly services on the Bishkek-Urumqi route until early 2018.

Urumqi-Central Asia one-way weekly seat capacity by airline: Sep-2011 to Nov-2018

China Southern has filled some of the void in the Urumqi-Bishkek market by adding capacity. China Southern added a sixth weekly service to Bishkek in Jul-2018 and is further upgrading the route in late Oct-2018 with a seventh frequency, as well as upgauging all flights to the 737 MAX 8.

China Southern dominates the Urumqi-Central Asia market

China Southern is also increasing capacity to Ashgabat, Dushanbe, Khudzhand and Tashkent at the end of Oct-2018 by upgauging all four Central Asia routes from 737-800s to 737 MAX 8s.

China Southern is also increasing capacity to Ashgabat, Dushanbe, Khudzhand and Tashkent at the end of Oct-2018 by upgauging all four Central Asia routes from 737-800s to 737 MAX 8s.

However, China Southern's Urumqi-Central Asia capacity will still be reduced slightly on a year-over-year basis. Although Almaty and (soon) Bishek are served daily, Ashgabat and Khudzhand are only served once weekly, while Dushanbe and Tashkent are only served twice weekly and Astana thrice weekly.

The withdrawal of Air Kyrgyzstan and Air Manas highlights the challenges Central Asian airlines confront in competing with China Southern in the Urumqi market. Urumqi has significant local traffic to Central Asia as the city has a large Central Asian ethnic population and has close business ties with Central Asia (a legacy of the historical Silk Road trading route).

However, China Southern has a huge competitive advantage over Central Asian airlines because it is able to feed its Urumqi-Central Asia services with its huge domestic network. China Southern currently serves 37 domestic destinations in China from Urumqi.

China Southern also attracts some international connecting traffic on its Urumqi-Central Asian services. China Southern does not currently have any services from Urumqi to East Asia but is able to attract two-stop traffic from East Asia and North America via Guangzhou and Urumqi.

China Southern even attracts some traffic heading between Central Asian countries (as well from Central Asia to neighbouring countries such as Afghanistan, Azerbaijan and Pakistan), despite the backtracking, because of the lack of direct connections within the region.

China Southern's Urumqi network to reach 16 year-round international destinations

China Southern is launching services from Urumqi to Bangkok on 28-Oct-2018. Bangkok will initially be served with three weekly 737 MAX 8 services and should generate more sixth freedom traffic for the Urumqi hub, since Bangkok is a popular destination for Central Asian residents.

Bangkok will be China Southern's 16th year-round international destination from Urumqi. In addition to its operation to the seven previously mentioned Central Asian cities, China Southern currently operates from Urumqi to Dubai in the UAE; Moscow and Novosibirsk in Russia; Islamabad and Lahore in Pakistan; Baku in Azerbaijan; Tbilisi in Georgia and Tehran in Iran. These are also all Silk Road countries and most of them border Central Asia. (The 16 international destinations exclude Saint Petersburg in Russia and Taipei in Taiwan as these routes are only served on a seasonal basis.)

China Southern uses Urumqi as its gateway for Central Asia, the CIS and the Middle East. Of the current 15 year-round destinations served from Urumqi, only three (Dubai, Moscow and Lahore) are also served from China Southern's largest hub, Guangzhou. Dubai and Moscow are also served from Wuhan; Moscow is also served from Shenzhen.

Urumqi's economic links, cultural ties and proximity to Central Asia make it a logical hub for the region. Narrowbody aircraft can be used for all the markets in Central Asia and the CIS, which is ideal, given that they are generally thin low frequency markets. Of the 15 international destinations China Southern currently serves from Urumqi, only Almaty (and soon Bishkek) are served daily.

All of China Southern's international routes from Urumqi are currently operated with 737s. Its only widebody route from Urumqi is Beijing, which is operated with a mix of 737s, A320s, A321s and 787s. The service to Beijing is a four-hour flight from Urumqi, making it longer than most of the international routes. Dubai and Moscow are the longest international routes from Urumqi; both are five to six hours.

China Southern is the market leader in Urumqi

China Southern is by far the largest airline at Urumqi, accounting for more than 40% of total seat capacity. Hainan Airlines is the second largest airline, with a 10% share, followed by Tianjin Airlines with 8% and Urumqi Air with 6%.

Tianjin and Urumqi are both part of the Hainan Airlines Group. Urumqi is the third largest base (after Tianjin and Xian) for Tianjin Airlines, which follows a full-service airline model. Urumqi Air is a small Urumqi-based LCC, operating a fleet of only 16 aircraft.

Urumqi Air currently has 32 domestic routes in total, including 15 from Urumqi. Tianjin Airlines has 17 domestic routes from Urumqi and Hainan Airlines has 16 domestic routes from Urumqi. China Southern is the only Chinese airline currently operating international services from Urumqi although Urumqi Air operated a seasonal twice weekly service this summer (late June to late August) to Irkutsk in Russia, which was the airline's first international service since commencing operations in 2014.

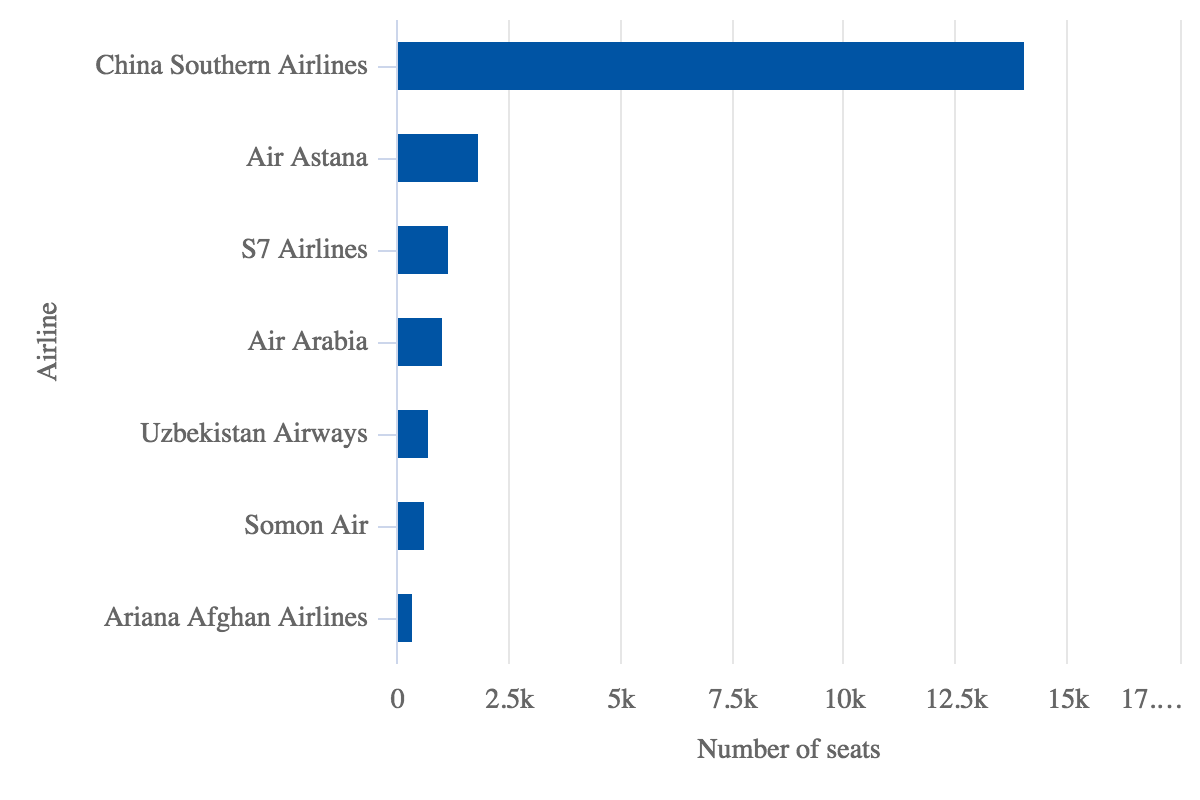

China Southern dominates Urumqi's international market, accounting for more than 70% of international seat capacity. Air Astana is by far the largest foreign airline in Urumqi and is the only foreign airline with at least seven weekly frequencies. Air Astana currently has five weekly services from Kazakhstan's largest city Almaty and three weekly services from the capital Astana. During peak periods, Air Astana has a daily service from Almaty and up to six weekly frequencies from Astana.

In addition to Somon Air and Uzbekistan Airways (previously mentioned), Urumqi is served year-round by S7 Airlines, Air Arabia and Ariana Afghan Airlines. China Airlines also has seasonal service from Taipei and Korean Air has seasonal service from Seoul. (China Southern also has seasonal service to Taipei and had a seasonal service to Seoul until 2016. China Southern also had a year-round service from Urumqi to Istanbul until 2016.)

Urumqi international weekly seat capacity by airline: w/c 15-Oct-2018

Somon Air competes against China Southern on the Urumqi-Dushanbe route but has only two weekly services. Uzbekistan Airways competes on the Urumqi-Tashkent route but also has only two weekly services.

S7 competes against China Southern in the Urumqi to Moscow and Novosibirsk markets. S7 currently has three frequencies to Moscow and two to Novosibirsk, which is located in Siberia less than 1000km from Urumqi. Air Arabia has three weekly services to Sharjah; it is the only airline serving the route but China Southern serves nearby Dubai.

Silk Road projects should start to drive faster international growth for Urumqi

Ariana has just one weekly service to Urumqi. However, it is the only airline linking Urumqi with Kabul - or anywhere in Afghanistan, another Silk Road country and a member of the Central Asia Regional Economic Cooperation (CAREC).

China is also part of CAREC and Urumqi has links to 10 of the 11 other CAREC countries. (The exception is Mongolia, which could be linked to Urumqi in future, given that Urumqi is only 300km from the China-Mongolia border.)

As economic ties within CAREC and the Silk Road Economic Belt increase, driven by BRI, there should be opportunities to increase the number of international services at Urumqi.

Urumqi is already a hub for traffic to, from and within the region. However, all of the airport's recent growth has been in the domestic market.

Urumqi Airport annual passenger traffic and year-over-year growth: 2008 to 7M2018

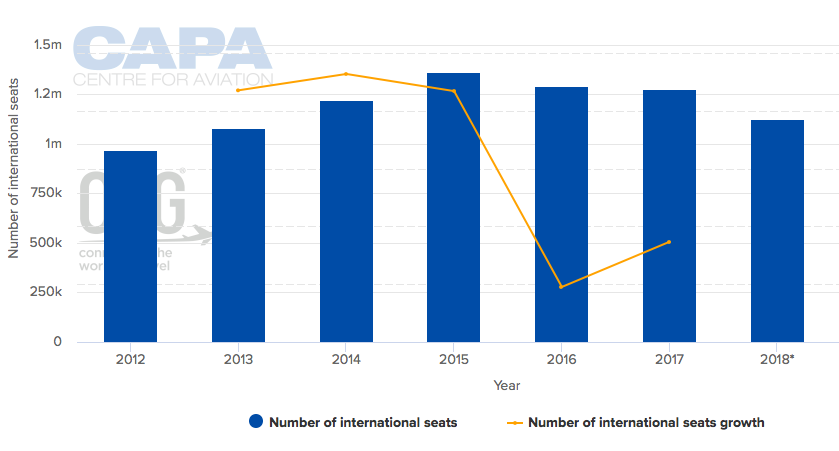

Although Urumqi's domestic capacity has increased by more than 70% in the past six years (2012 to 2018), the airport's international capacity has increased by less than 20% over the same period. Over the past three years (2015 to 2018) international capacity has declined by more than 20%, whereas domestic capacity has increased by nearly 30%.

Urumqi international annual seat capacity and year-over-year growth: 2012 to 2018

Only 4% of Urumqi's seat capacity is currently in the international market. In comparison, international operations now account for 22% of total seat capacity in China. Urumqi is the 14th largest domestic airport in China (based on current seat capacity) but is only the 28th largest international airport.

Urumqi should have a much larger international operation, considering its location along the Silk Road and at the door stop of Central Asia. If BRI starts to drive increased demand for air travel between China and Silk Road countries, Urumqi will obviously benefit.