European aviation. Seats and fleets point to 2Q2021 recovery

According to the CAPA Feet Database, Europe's passenger jet fleet in service increased by 1.8% month-on-month in Feb-2021, to 3,400.

This is almost three times the Apr-2020 trough level, but 16% below the Aug-2020 peak recovery level. Moreover, it has changed little since Nov-2020 and represents only 56% of the total passenger jet fleet, compared with the world average of 65%.

Seat capacity in Europe also continues to lag the rest of the world, falling by 74.5% relative to 2019 in the week of 1-Mar-2021, according to OAG schedules and CAPA seat configurations. Middle East is down by 55.8%, Africa is down by 53.6%, North America by 45.1%, Latin America by 43.4%, and Asia Pacific by 33.9%.

Nevertheless, a combination of seat capacity and fleet in service data supports the conclusion that 1Q2021 will be the low point in this phase of the pandemic. European aviation can expect the recovery to start in 2Q2021.

Summary

- Europe has 7.2 million seats vs 28.3 million in the same week of 2019, down 75%. It has fallen more deeply than all other regions for 19 successive weeks.

- Europe's passenger jet fleet in service rose 1.8% in Feb-2021, but has changed little since Nov-2020 and is below the world average as a percentage of the total.

- Europe's LCCs have a higher percentage of passenger jets in service than legacy airlines.

Europe has 7.2 million seats vs 28.3 million in 2019 - down 75%

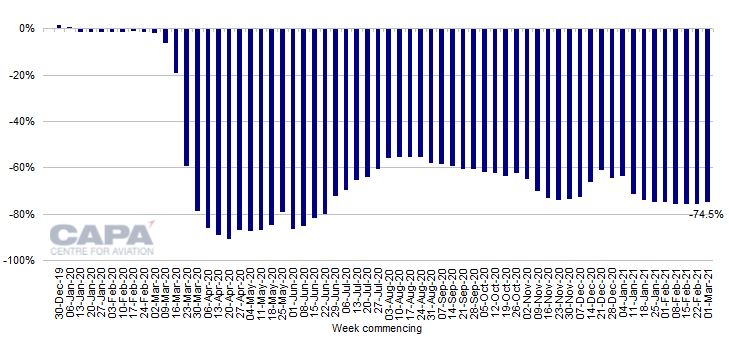

In the week commencing 1-Mar-2021, total European seat capacity is scheduled to be 7.2 million.

This is 74.5% below the 28.3 million seats of the equivalent week of 2019 and almost the seventh consecutive week of a similar rate of decline. It is the 50th week of very heavy double digit percentage (more than 50%) declines in seats versus 2019.

This week's total seat capacity for Europe is split between 3.3 million domestic seats, versus 7.4 million in the equivalent week of 2019; and 3.9 million international seats, versus 21.0 million in the same equivalent period.

Europe's domestic seats are down by 55.0% versus 2019, compared with last week's -56.2%.

International seat capacity is down by 81.4% versus 2019, compared with last week's -82.2%.

Europe: percentage change in weekly airline seat capacity vs equivalent week of 2019

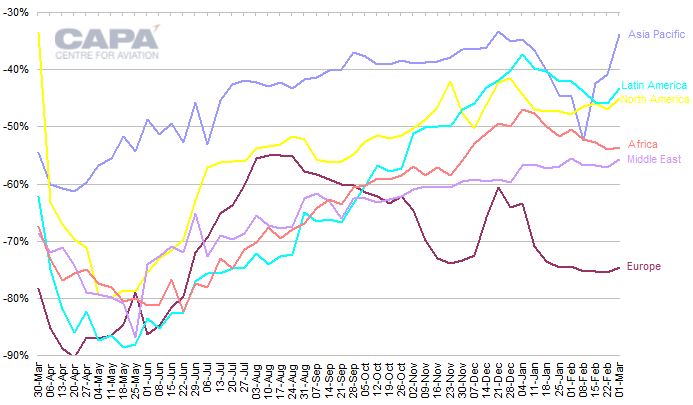

Europe has been the worst performing region for four months

Since mid Oct-2020 Europe has been at the bottom of the regional league table ranked by the percentage decline in capacity versus 2019.

Europe's 74.5% cut in seat numbers is 18.8ppts adrift of the next deepest, the Middle East, which is down by 55.8% this week.

Africa's seat count is down by 53.6%, North America's by 45.1%, Latin America's by 43.4% and Asia Pacific's by 33.9%.

All regions enjoyed an improvement in the trend of seats versus 2019 levels this week (albeit only a modest improvement for Europe).

Percentage change in passenger seat capacity vs 2019 by region, week of 30-Mar-2020 to week of 1-Mar-2021

2Q2021 schedules are falling

Capacity derived from current schedules for Mar-2021 is now projected to be down by 71% from 2019 levels, compared with -69% projected a week ago. This follows a 75% fall in Feb-2021 and a 71% drop in Jan-2021.

Looking to the first months of the summer 2021 schedule, airlines have reduced planned 2Q2021 capacity in Europe by 10% since last week. Nevertheless, 2Q2021 is projected to be at 66% of 2019 seat capacity, which is a big increase on the 28% planned for 1Q2021.

Apr-2021 capacity has been cut by 16% since last week, but is still projected at 51% of 2019 capacity. May-2021 is projected at 71%, and Jun-2021 at 77% of 2019 capacity.

Europe's passenger jet fleet in service increased slightly in Feb-2021…

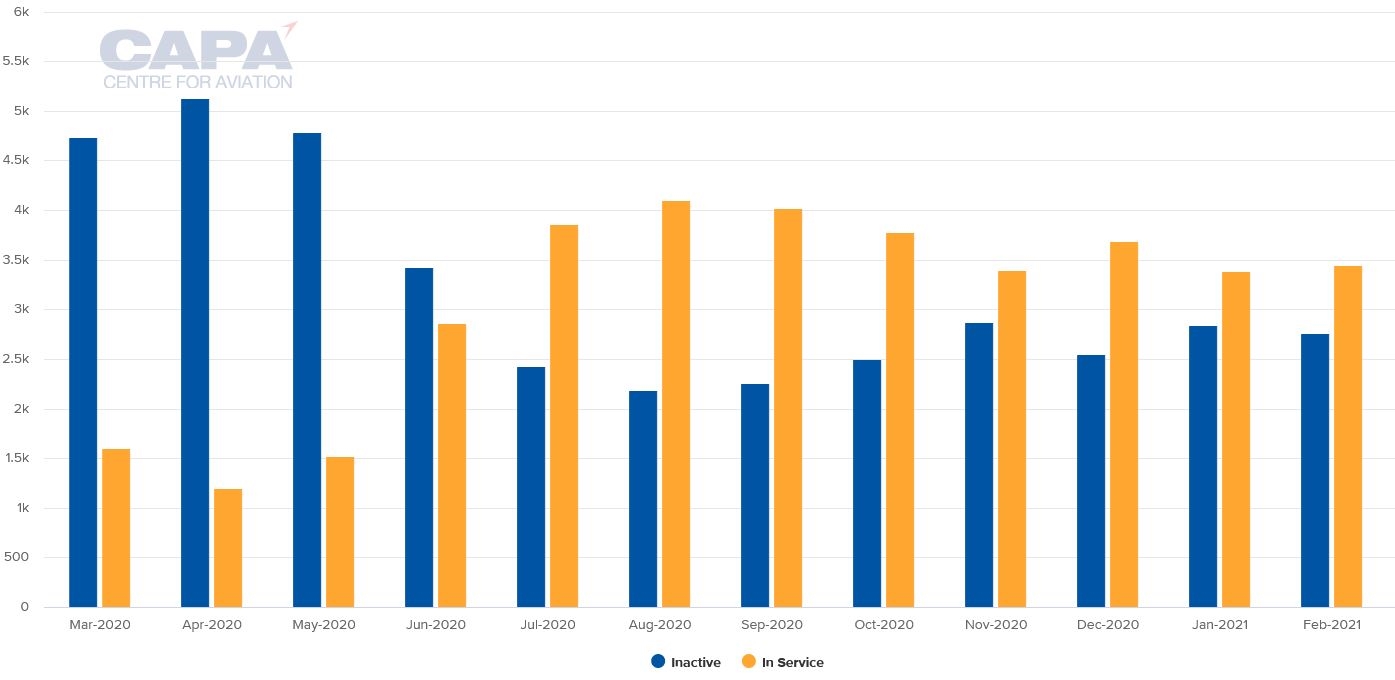

According to the CAPA Fleet Database, the number of passenger jets in service with European airlines rose by 1.8% month-on-month, to 3,432, at the end of Feb-2021.

This was a 39% reduction compared with a year earlier, and still 16% below the peak recovery total of 4,093 at the end of Aug-2020.

…but has not changed much since Nov-2020

The number of passenger jets in service rose above 3,500 in Dec-2020, but has otherwise hovered around the 3,400 level since Nov-2020.

The number of inactive passenger jets (parked or stored) fell by 2.8% in Feb-2021, to 2,749, but this was 26% more than at the end of Aug-2020.

Europe: number of passenger jets* in service and inactive at month end, Jan-2020 to Feb-2021

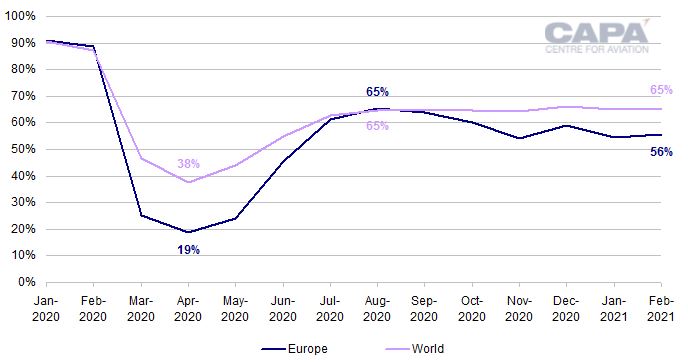

Europe's fleet in service is below the world average as a percentage of total fleet

The percentage of the total number of passenger jets that are in service in Europe continues to underperform against the world average.

At the end of Feb-2021, 56% were in service in Europe. This was a slight increase from 54% at the end of Jan-2021, but some 9ppts below the global average of 65%.

Moreover, Europe's figure has fallen from its end Aug-2020 peak of 65%, whereas the world average has been broadly stable since then.

Percentage of passenger jets* in service at month end, Jan-2020 to Feb-2021

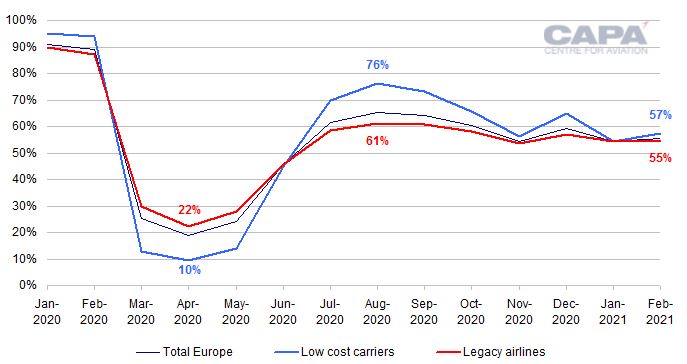

Europe's LCCs have a higher percentage of passenger jets in service than legacy airlines

European LCCs have 57% of their jets in service at 26-Jan-2021, compared with legacy airlines' 55%. At the end of Jan-2021, both were at 54%.

Europe: percentage of passenger jets* in service at month end, Jan-2020 to Feb-2021

European aviation can expect the recovery to start in 2Q2021

The fall in the number of aircraft in service during the pandemic has been less severe than the fall in seat capacity, indicating a significant drop in aircraft utilisation. This reflects a desire by airlines, particularly LCCs, to rotate the use of their fleets in order to maintain flexibility and to avoid the costs of decommissioning and recommissioning aircraft.

The month-on-month increase in the number of passenger jets in service in Feb-2021 is small, and has not taken the percentage of active aircraft out of its range of recent months.

Moreover, capacity scheduled for the early summer months still looks too high (particularly given that the UK, for example, expects to allow international travel to return no earlier than 17-May-2021).

Nevertheless, the combination of seat and fleet data point to 1Q2021 being a capacity trough. New variants of the COVID-19 virus remain a source of uncertainty, but vaccination programmes across Europe are building momentum.

The recovery should start in 2Q2021 and could gain significant additional momentum in 3Q2021.