CEO Daldrup completes his job at Berlin’s airport. Future roles...

The story of Berlin Brandenburg Airport is like one of those nightmare movies that never ends. From the day the plans for it were first hatched until the ceremonial cutting of the tape last October, it took the best part of two decades.

On numerous occasions politicians wondered openly about whether or not to axe the project altogether, as what started off as an apparently minor problem related to electrical wiring of the fire alarm and sprinkler systems mushroomed into a decade long debacle never before witnessed in the industry, with many thousands of faults discovered.

'Vorsprung durch Technik' (Progress through Technology). Not in this case.

Then Engelbert Daldrup was appointed as CEO, a plan was put into place, and the airport was finally completed, an airport that should hopefully serve Germany's capital well for decades to come.

Mr Daldrup has now announced that he intends to step down as he feels he has done the job he was asked to do...

Summary

- Berlin Brandenburg Airport's CEO Engelbert Daldrup has asked to step down later in 2021.

- He can be credited with saving the airport, which took a decade to build and on several occasions came close to being scrapped altogether.

- By and large, Mr Daldrup's job is done, although questions still remain about ongoing funding.

- He may now wish to retire, but if he does not, there is a multitude of organisations and projects that require a fix across all continents.

Berlin's airport is up and running at last, and the person responsible is moving on

Berlin Brandenburg Airport's (BER) CEO Engelbert Lütke Daldrup requested that the supervisory board of Flughafen Berlin Brandenburg (FBB) terminate his employment effective Sep-2021.

Mr Daldrup pointed out that he had fulfilled his purpose with the completion and commissioning of the airport and the submission of the new 2021 business plan.

Chairman of the supervisory board Rainer Bretschneider stated: "Engelbert Lütke Daldrup took on great responsibility at a very difficult time for FBB and has lived up to the hopes and expectations placed in him. The fact that BER went into operation was largely because of his work. We owe him a great debt of gratitude." In Mr Daldrup's case BER is at least up and running, something that many people had begun to believe would never happen.

The job is complete

So is Mr Daldrup's job done? In the sense that the airport exists, and has traffic, and there is a business plan in place - yes, that would be the impression.

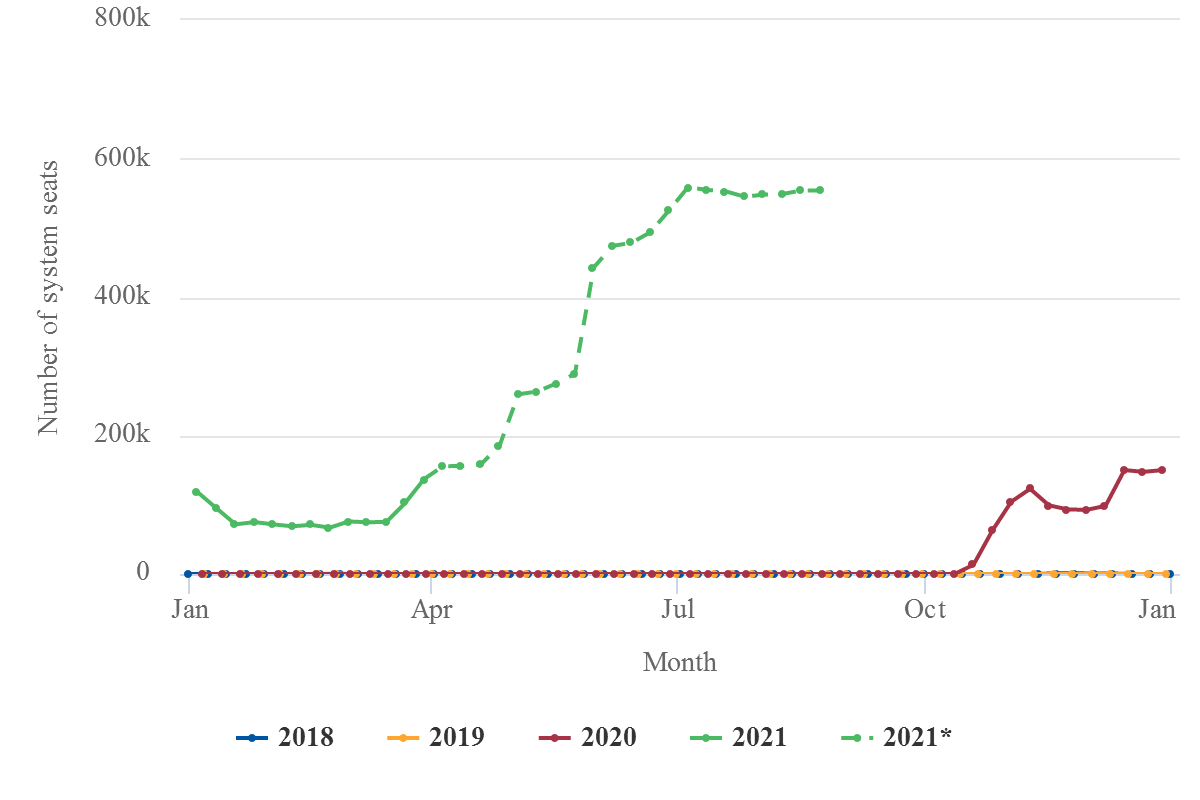

In the first two months of 2021 there were 355,000 passengers. Seat capacity is rising each week, and from the beginning of Apr-2021 it will be at its highest level since BER opened on 31-Oct-2020.

Over 10 million seats have been committed to BER already this year, despite the arrival of a third coronavirus infection wave in Germany and slow vaccination processes.

Berlin Brandenburg Airport: weekly total system seat capacity, 2018-2021*

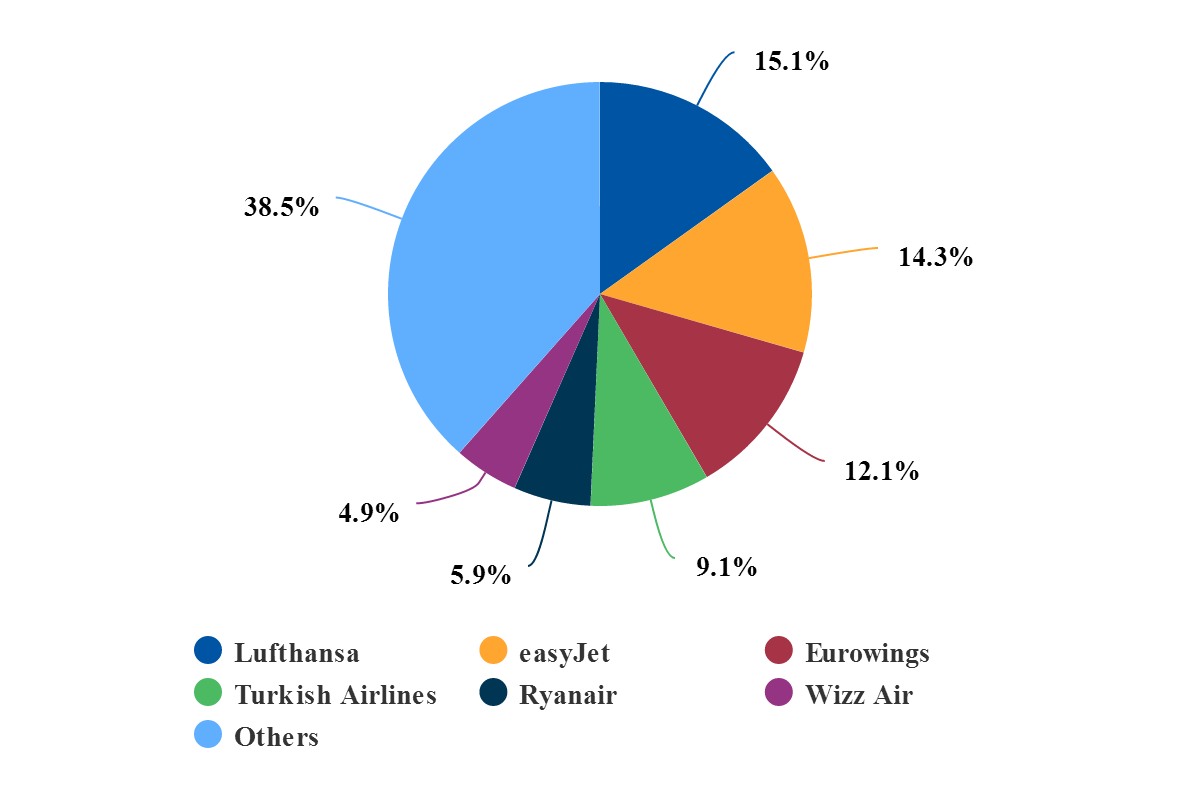

There is a satisfactory, in fact almost ideal, split between full service, low cost, regional/commuter and charter capacity (the airport is the amalgamation of what were separate full service and low cost oriented predecessors), and with all three alliances well represented.

And possibly for the first time in decades, the national flag carrier Lufthansa has established itself as the most significant airline in Berlin, the capital of Germany; at least in terms of seat capacity, if not in movements (where it ranks second to its subsidiary, Eurowings).

Berlin Brandenburg Airport: system seats for all business models, week commencing 22-Mar-2021

One of the airport's terminals is closed (the low cost designated one, which used to be Schoenefeld Airport's terminal), but that is the same at many other airports and some are at risk of closing altogether, which BER is not (of course).

Technically speaking, Mr Daldrup's job is done. Since there are still financing issues in play (FBB's CFO said in Feb-2021 that reaching profitability by the mid 2020s, the target date, can only be achieved with further public aid), there is an argument that Mr Daldrup could try to tackle that, perhaps by way of partial privatisation, but that is the only reason for keeping him on if he believes he has reached the end of the line.

There are many other challenges that require determination and application...

So what challenge could Mr Daldrup take on next, were he to be up for a new one?

Here are some suitable challenges; there are many others. (The industry has them in abundance.)

1. Mexico City's multitude of airports

Mr Daldrup could look to Mexico.

Mexico having waited decades for a new airport to be built in the capital city there, one that has the busiest airport in Latin America, it was summarily axed by the incoming President on the strength of a dubious referendum in which hardly anyone participated.

President Obrador, or AMLO as he is often called, after his initials (Andrés Manuel López Obrador), opted instead for expanding the already creaking Juarez International Airport, a smaller privately owned airport in the far suburbs, and the conversion of a military base, with overlapping approach and departure paths.

So Mexico City will go from one to three airports, each with an indeterminate traffic mix and not easily connected by surface transport.

What is more, the cost of all this revision looks set to exceed considerably the cost of the new airport.

See: Abandoning the new Mexico City airport costs more than to build it (Feb-2021)

It is probably too late now for that decision to be reversed again, but a week is a long time in politics. Should it ever come back on the radar, Mr Daldrup is the man who would know how to get it built.

2. Spain/AENA

In another recent report, 'Spain and airport operator AENA prepare for a recovery - will it come?', it was revealed that the main airport operator, AENA, the world's biggest by passenger numbers in normal times, has just announced its first loss since 2012, and accordingly, since it was partially privatised in 2015.

See: Spain and airport operator AENA prepare for a recovery - will it come?

(Mar-2021)

Spain is one of several European countries which depend on tourism to such a degree (up to 15% of GDP in some regions) that the pandemic has hit them hard. The stop-start nature of restrictions - local, national and international, and within the airline business itself - has crippled that industry in Spain, and many Spanish coastal resorts have become ghost towns.

Now, with the first signs of a possible recovery (bars and restaurants are starting to reopen on the Costa Blanca and in the Balearic islands), and despite a new wave of infection across Europe, AENA and the tourism business it supports must hope that the much sought-after coordination between governments will actually come to pass, and that the beaches will soon be full again.

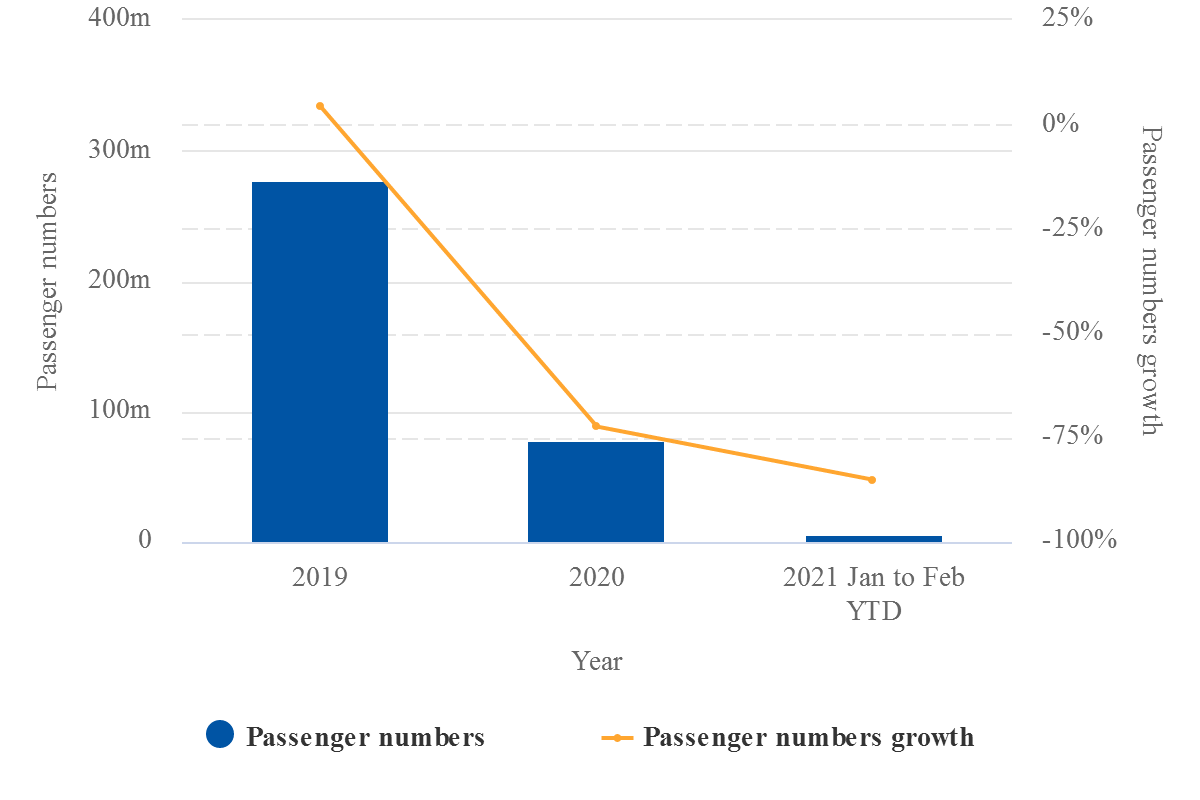

AENA's difficulties would be a challenge and a half, even for Mr Daldrup. Passenger traffic data for the first two months of 2021 for Spain show that the decrease is running 13 percentage points higher, at -85.1%, than it was for 2020 as a whole.

AENA Aeropuertos S.A.: passenger numbers, 2019-2021 Jan to Feb YTD

3. The entire low cost and regional airport sector in Europe is in need of treatment

Low cost airlines in Europe have organisations that shout loudly in their support - but not the regional, and specifically low cost, airports (LCAs) that support them.

If one were to be inaugurated and Mr Daldrup persuaded to head it up it could be a much-needed boost for an industry segment that has taken a hammering from the pandemic. LCAs rely mainly on what little income they can derive from the LCCs that use them, which often doesn't amount to much.

With obscure, infrequent scheduling LCAs often cannot justify a large range of concession outlets, and in any case - most budget airline passengers only want to buy a cup(s) of coffee while they are waiting for their delayed flight, not a five-course gourmet meal, a diamond necklace or a Persian carpet. Nor do they want to pay for valet parking in a heated garage or luxuriate in a private lounge or terminal.

In many cases those airports are out of the way, off the beaten track and not attached to major conurbations, and so, there is little opportunity to lease out their land, either.

The position is so serious that some are thinking of calling it a day altogether, not just suspending operations.

Early in Mar-2021 the CEO of Stockholm Skavsta Airport, Cédric Fechter, stated that the airport could face bankruptcy if no governmental support was provided over the next few weeks.

The airport, the 13th busiest in the five Nordic countries in 2019, is negotiating a bank loan guarantee with the government of Nyköping, the local municipality, which is a 10% shareholder. The other 90% is held by VINCI Airports, one of the biggest private sector airport operators in the world.

Comparisons between primary and secondary/regional/LCAs vary from country to country. In some, for example in France and Italy, the pandemic has hit major cities worse than the regions, so traffic declined equally.

In the UK that was not so much the case. London Heathrow lost 72.7% of its passengers in 2020 compared to -83.9% at Doncaster Sheffield - what is now a 100% LCA in the north of England.

In Spain, Madrid Barajas experienced a 72.3% reduction in passengers, while at Girona Costa Blanca airport, an alternative for the Barcelona region, it was -91.1%.

The point is that with traffic decline at any even higher level in early 2021, primary gateway and hub airports have the opportunity to alter their business model to take in LCCs for a few years if they want to, and they are usually very well placed geographically for that to be an attractive proposition for passengers.

In the UK the problem is acute.

Potentially even major regional airports such as Manchester, Birmingham and Edinburgh could lose out to Heathrow. All of them are struggling to attract old routes back and to find new ones (although Manchester will have a new Aer Lingus long haul base later in 2021), whereas comparatively, Heathrow prospers. There is a similar pattern in other European countries.

Comparative table of scheduled departures, five UK airports, in seven days from 25-Mar-2021

|

Airport |

Number of scheduled departures |

Main destination and number of flights |

Percentage of flights |

|

937 |

New York JFK (36) |

77.6% |

|

|

166 |

Doha (18) |

13.2% |

|

|

43 |

Frankfurt (8) |

3.6% |

|

|

60 |

London Heathrow (16) |

5.0% |

|

|

2 |

Belfast City (2) |

0.16% |

In short, the entire regional/LCA segment needs a plan.

4. The City of New York and its airports

In New York the state governor is facing the sack for, inter alia, sending COVID patients back to nursing homes where they could happily infect everyone else, and for assorted allegations of sexual impropriety.

At the same time the Mayor, Bill de Blasio, has just announced that he will sign an emergency executive order (a weapon of the state which is being vigorously deployed in the U.S. right now) to extend the Port Authority of New York and New Jersey (PANYNJ)'s lease at New York John F Kennedy International Airport from 2050 to 2060.

The extension includes assurances that the airport's new construction project will abide by a community benefits package, which requires the following criteria:

• At least 30% workers of colour;

• At least 30% of contractors are from minority and women owned businesses;

• Establishes new apprenticeship and scholarship programmes for the surrounding community;

• Requires the new building meets strict environmental standards.

No one would deny that these are measures which in normal times would merit consideration at least.

But tinkering with a lease for another 40 years on this basis alone? When New York had one of the worst airports in the U.S. (LaGuardia?). To be fair, that airport has been improved beyond all recognition by way of two public-private partnership (PPP) deals, while similar works are under way at JFK and Newark airports.

But should that not in itself be a spur now to more private sector participation and greater competition, rather than lengthening the public sector organisation lease as a quid pro quo for extending a 'community benefits package'?

The region's airports, which are owned individually by the cities of New York and Newark, have been proposed for privatisation before now, but that looks highly unlikely under the new national administration, which appears to place aviation lower down in the pecking order than rail travel.

At the same time New York - both the city and the state - is struggling, with several million people having left it in the past few years. That means the remaining ones have to pay more tax, which prompts even more to leave.

To do with the New York airports what the British government did with the British Airports Authority, to split it up so that there is a different owner for each of the six main London airports, would at least provide the competition that would help the city kick-start its aviation sector again, in an environment which would be far more competitive than it was previously.

Which leads naturally on to:

5. The U.S. Federal Aviation Authority and the airport privatisation programme

Mr Daldrup could perhaps put some bite into the flagging airport privatisation momentum, which, like New York, is on its last legs, despite the original 1996 programme having been revamped a few years ago with more scope for leasing and easier entry to the scheme.

During Mar-2021 ACI-North America estimated that U.S. airports would need USD115.4 billion for necessary infrastructure projects over the next five years, adding that airports had been unable to fund necessary projects because Congress "has not modernised one of the main funding mechanisms for airports in over 20 years - the Passenger Facility Charge".

The PFC apart (for which some modification has been mooted), the question is, where is the infrastructure funding coming from? The private sector is better placed now, with at least 10 PPP schemes completed or in progress to contribute, but it needs a champion in the U.S. like never before, and not necessarily one who is a politician.

A recent CAPA report drew attention to the need for more PPPs in the U.S. airport sector.

See: U.S. airports' funding crunch - are P3s the answer? (Feb-2021)

Meanwhile, there is zero activity in the FAA's revamped Airport Investment Partnership Programme, (formerly the Airport Privatisation Pilot Programme), as this FAA table of deals since the last successful one (and arguably, only one) in 2013 shows.

FAA Airport Investment Partnership Programme: airport deals, as at 25-Mar-2021

6. Infraero - clarifying its role and bringing more certainty to its future

AENA was mentioned previously as one of the largest airport operators in the world.

Another one with similar status is the state-owned Infraero in Brazil, but it is a shadow of its former self, with the majority of its profitable assets either partially privatised or about to be.

It tried desperately to hang on to the remaining ones, the Congonhas airport in São Paulo and Santo Dumont in Rio de Janeiro, but they will be gobbled up in a forthcoming concession tranche.

Active airports for Infraero, as at 25-Mar-2021

In mid-2017 the Brazilian Transport Minister said the government was considering a potential IPO for Infraero itself, and that a share issue, if conducted, could result in the state relinquishing control of the company.

But that never happened.

Alternatively, Infraero could either be downsized or terminated by privatising its stakes in 56 airports. The former has certainly been the case; the potential for the latter remains.

But privatisation by way of selling or leasing Infraero has been consistently ruled out, as was a scheme by which it would start to invest in foreign airports, as AENA Internacional does in Spain. The Portuguese airports under ANA might have been a target but they are long gone - to VINCI.

To add insult to injury, the government then started to look at ways to dispose of Infraero's shares in some of the larger airports that have already been concessioned (and supported in some cases by the private sector concessionaires), such as Belo Horizonte Tancredo Neves, Brasília International, Rio de Janeiro Galeão, São Paulo Guarulhos and Campinas Viracopos.

Its main role now, apart from the declining number of airports it operates uniquely, appears to be to take on tertiary level regional airports, dust them down, and prepare them for a hopeful privatisation. But investor interest, other than from local firms and assorted chancers in Brazil with little or no sector experience, is rapidly running out in these bundled privatisations of airports handling a few thousand passengers a year.

But that is a waste of expertise built up over decades, and Infraero is desperately in need of a new challenge, perhaps in the foreign arena.

7. ACSA: finding the right foreign investments

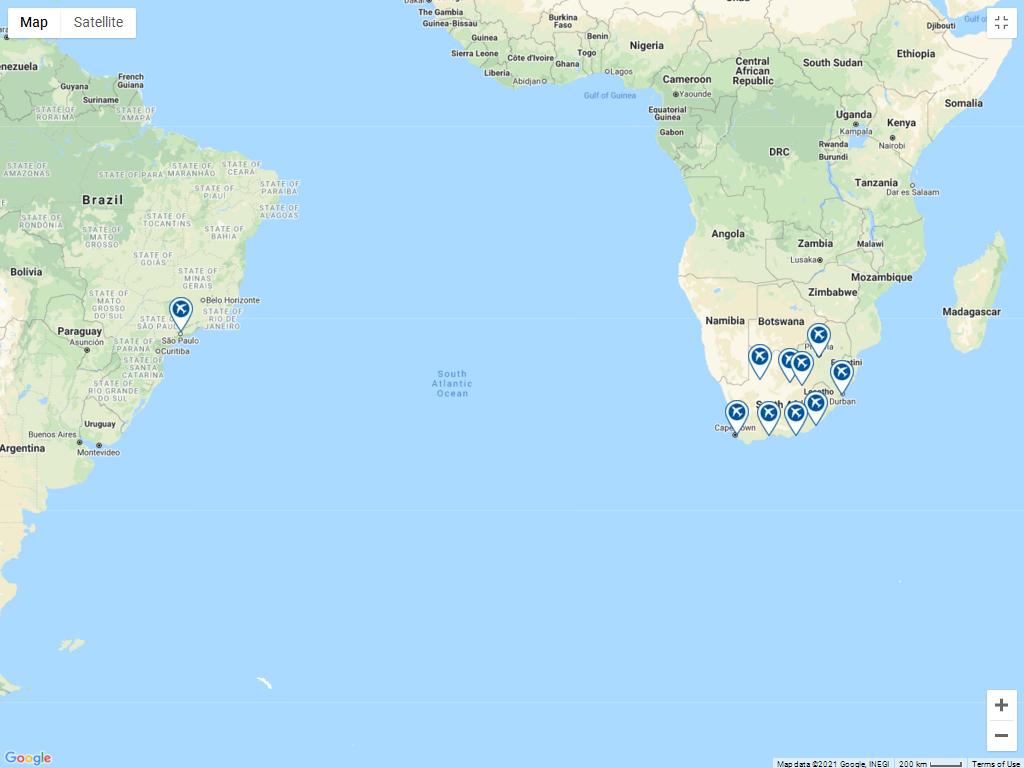

Another big airport operator that has lost its way is South Africa's state-owned Airports Company South Africa (ACSA).

South Africa has been hit hard by the pandemic. The first wave was not so bad but the second one, which includes the mutant strain which originated there, has been devastating, with more than 1.5 million cases now and still rising.

South African Airways, rarely in the best of health itself, entered business rescue proceedings in Dec-2019 and suspended operations in Sep-2020. It may exit business rescue at the end of Mar-2021.

Meanwhile, traffic at the country's leading gateway, the Oliver Tambo airport in Johannesburg, fell by 64% in 2020 and by 72.6% in the first two months of 2021. There is a similar story at Cape Town and other airports.

It was partly because of its exposure to a domestic economy, and currency that is habitually up and down like a yo-yo, that ACSA started to take stakes in foreign airports such as Mumbai in India and São Paulo Guarulhos International Airport in Brazil. But the former has already gone, to India's aggressive Adani Group, and it looks like an offer is being considered for the latter.

Active airports for Airports Company South Africa (ACSA)

This is a bad move for ACSA.

It is the leading airport operator on the continent, where there is a great deal of expertise and human capital, and if Africa is to capitalise on its promise (it was tipped as the growth region in years to come before the pandemic), it needs to be at the forefront of airport operation across that continent. That means investing specifically in Africa, as well as operating and not leaving that to, for example, Qatar Airways (see later) in Rwanda.

Otherwise, it risks losing its pre-eminence countries like Ethiopia, along with a shift in the balance of political power from the south of the continent to the east.

Another job for the trouble shooter?

For further information on ACSA and its disposal of its foreign interests, see: ACSA's parlous state; prepared to lose airport investments (Oct-2020)

And that also leads on to another massive challenge, one of uniting African aviation.

8. Bringing the continent of Africa together

A 'Top Gun' is needed to force the national leaders of all its countries to commit unequivocally to the Yamoussoukro Decision (a treaty that allowed for open skies among most African countries), which has "come of age", being 21 years old now, but which has never been anything like fully implemented.

There has been some progress since in the past three years, with the Single African Air Transport Market (SAATM) being launched in 2018, but it has been slow as ever, and the prospect of finalising the Decision and the Agreement which followed it in 2021 seems as remote as ever.

The SAATM is intended to liberalise African aviation by way of open skies and the adoption of universal fifth freedom rights, but entrenched interests remain in most countries.

COVID-19 has illustrated pointedly that Africa can no longer rely on international markets for tourism and trade and needs to start to look regionally for opportunities.

There are also calls for the African Continental Free Trade Area, Univisa for Africa (multiple entry to African countries), and SAATM all to be implemented simultaneously.

A huge task; requiring someone with huge ambitions.

9. Airports Authority of India - another new role to be determined?

Airports Authority of India (AAI) may not be losing control like Infraero but its influence is waning.

In Mar-2021 AAI was reported to be considering plans to sell its stake in Mumbai Chhatrapati Shivaji Maharaj International Airport, Delhi Indira Gandhi International Airport, Bangalore Kempegowda International Airport, and Hyderabad Rajiv Gandhi International Airport. The AAI owns a 26% stake in each of Mumbai and Delhi, and a 13% stake in each of Bangalore and Hyderabad and these were the airports first privatised by way of concession in India.

India's Minister of State for Civil Aviation, Hardeep Singh Puri, said, "Mumbai airport shares 39% and Delhi shares 46% of their gross revenue with the AAI", adding, "even after the stake sale, AAI will continue to receive this share[,] which will be used to develop aviation infrastructure".

He further noted: "Privatisation is a means of raising resources to fulfil the aspirations of our citizens without imposing new taxes".

Well if that is the case, why not just privatise the whole of the AAI and have done with it?

By way of groups like GMR, GVK, Adani Group, TATA and many others, India has enough private sector companies to take on the challenge, and foreign investors will be tempted by some of the bigger fish - and even some of the minnows - in reasonable bundles, even if they were put off by the mismanagement of the first privatisations (Delhi, Mumbai etc.) in 2006.

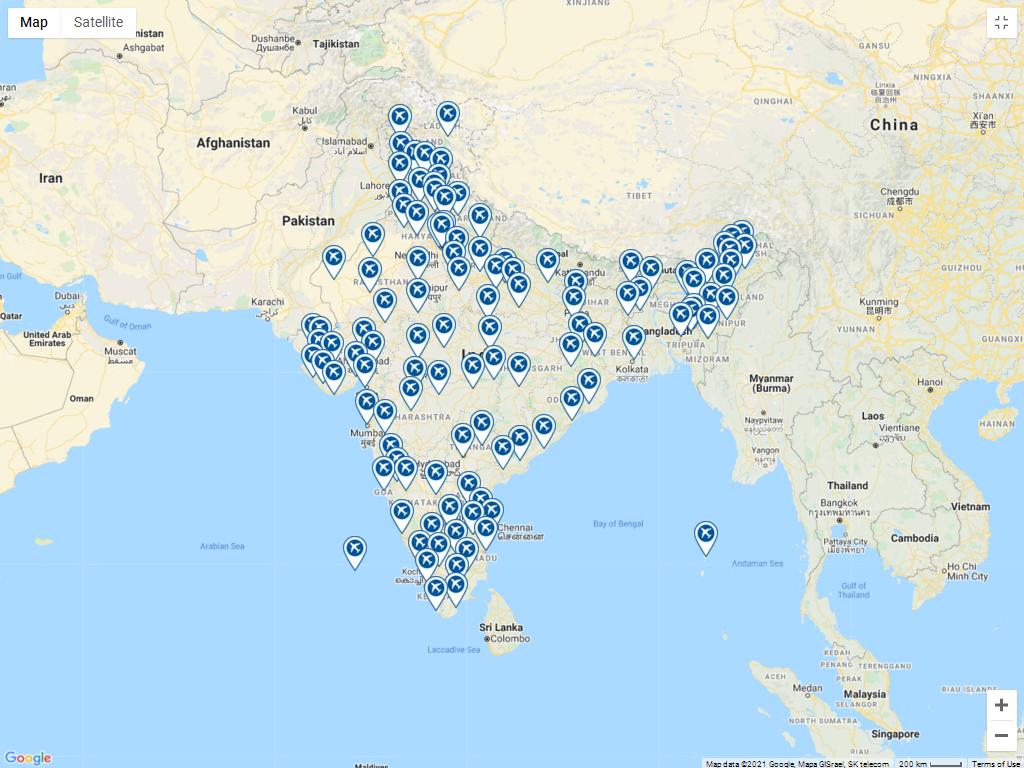

Active airports for Airports Authority of India

India's Government is actually already considering plans to privatise 13 airports by 2022, operated by AAI under the operation, management and development agreement (OMDA) model, and it may offer contracts to operate privately the 13 airports in six packages, which will bundle together profitable and unprofitable airports into one package in order to attract bidders. That has worked in Mexico and, to a degree, in Brazil.

But if AAI's airports are to be sold off, the organisation, like Infraero, needs a new role. One of them could be developing a seaplane/waterdrome network.

See: India and Indonesia explore seaplane/waterdrome developments

(Nov-2020)

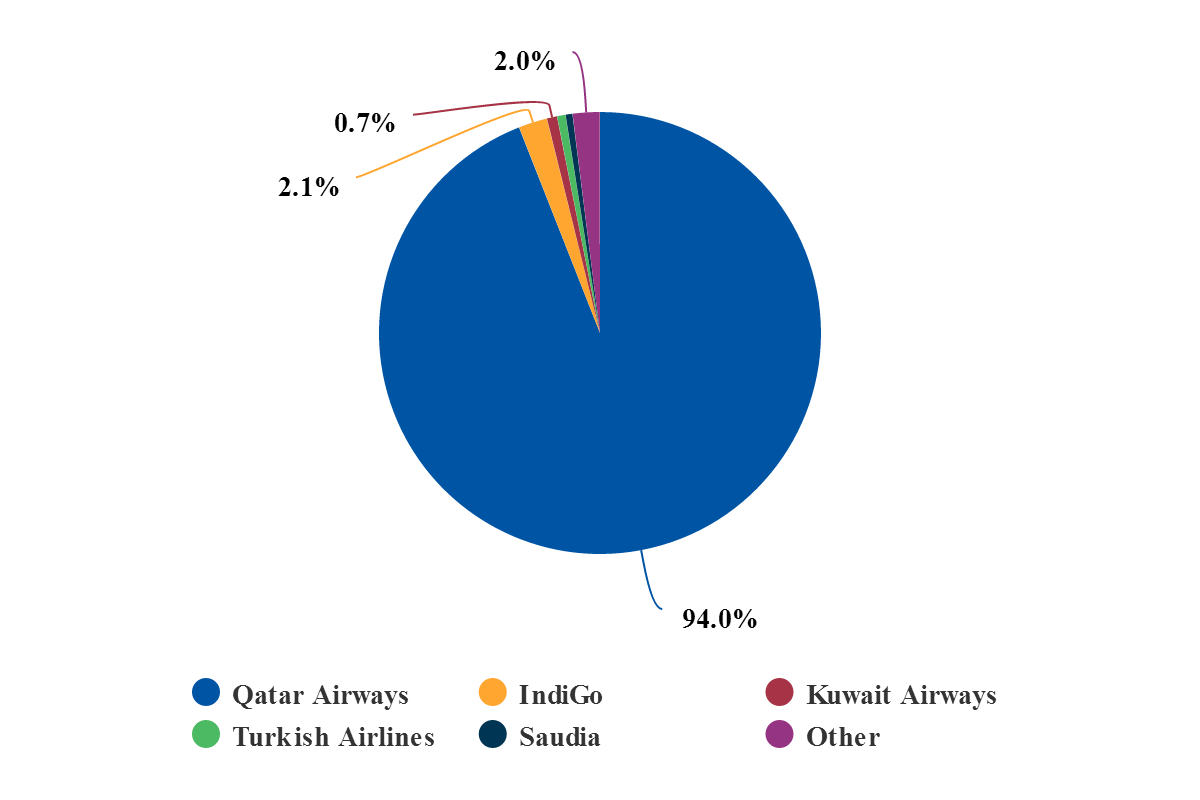

10. Doha Hamad Airport /Qatar Airways braces for the World Cup

Qatar is likely to be the venue to host the first major fully-attended sporting event since the pandemic began (the FIFA World Cup in Nov-2022 and Dec-2022).

The event will be a major logistical challenge: demand could be huge, including from many fans who would attend the event without tickets for matches.

Qatar Airways will need to convert its passenger-to-cargo aircraft back to passenger ones, as soon as possible.

See: Cargo demand & supply: Qatar Airways reinforces global #1 position (Jan-2021)

The real challenge will be to the airport, a relatively new one. But that was the case with the new King Shaka airport at Durban, South Africa, which opened just before the 2010 World Cup.

In Qatar there is no real alternative to Hamad; just the old Doha International Airport, which is being refurbished to handle overspill. But that overspill could now be much bigger than previously anticipated, and Qatar's image depends on how well the competition is handled, following much criticism of the venue selection process.

At least Doha Hamad International Airport is rising to the challenge, reporting it is on schedule to facilitate handling 58 million passengers per year by 2022. But a final phase of expansion is planned after the World Cup to increase capacity to nearly 70 million passengers per year. Perhaps that could be brought forward as far as it is possible to do so.

Coming out of the COVID-19 mist, predicting what system adaptation will be needed is an uncertain task.

Doha Hamad International Airport: system movements (peak), week commencing 22-Mar-2021

11. Philippines DoT needs a shake-up

The need here is to establish a new base for organisation The Philippines' Department of Transportation is permitting the creation of four large competing airports in and around Manila, where only one is needed.

One of the four, the new airport at Sangley Point, has been put on the back burner while a new tender is issued, seemingly for political reasons.

But the others, including a new airport at Bulacan - under the auspices of the San Miguel Corporation and the Clark International Airport, where a new terminal has just been added - continue, along with a USD2 billion expansion of the existing Ninoy Aquino International Airport (NAIA).

Collectively, these projects are costing upwards of USD30 billion while traffic at NAIA is not expanding at a particularly high rate.

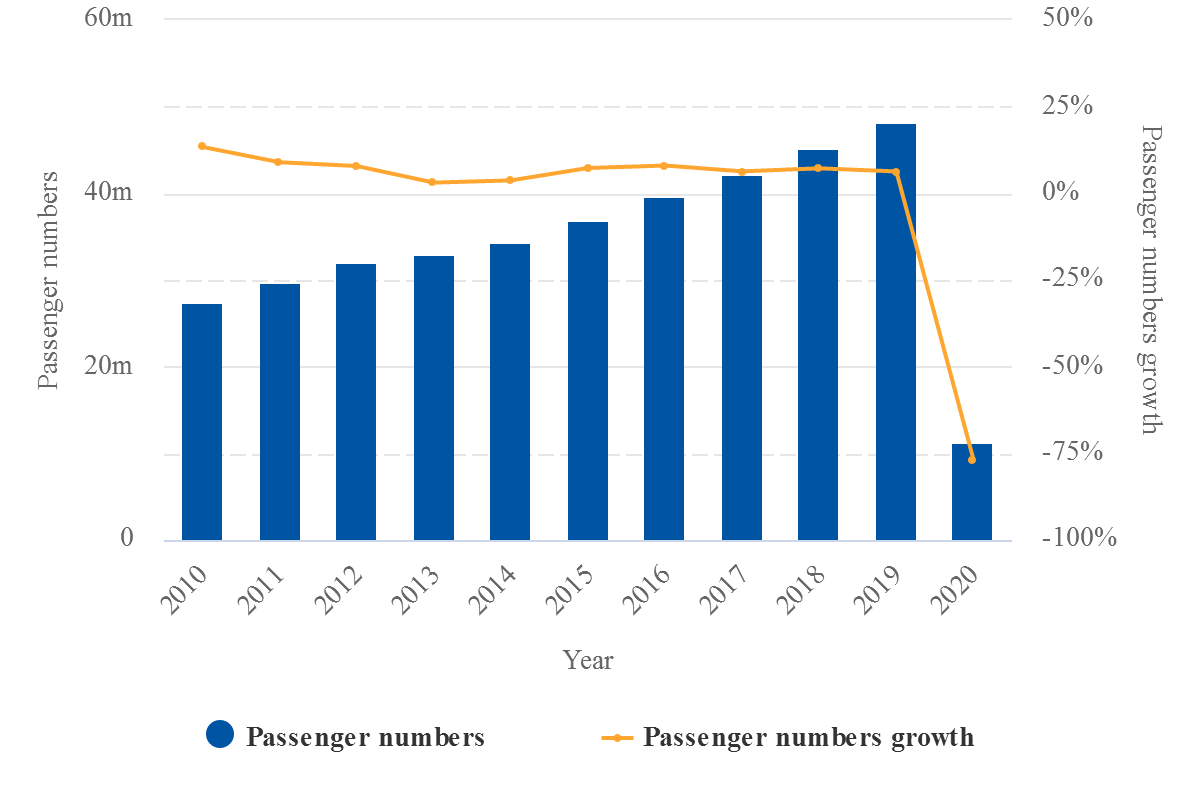

Manila Ninoy Aquino International Airport: annual passenger numbers and growth, 2010-2020

Mr Daldrup's experience of cost-cutting, where it is justified and where it is not, could certainly come in handy here.

For more information see:

Philippines' USD10bn airport project scrapped: politics? (Feb-2021)

12. The European Union

The EU has suffered from slow administration of its vaccination programme, with all the ramifications that would have for air travel and tourism.

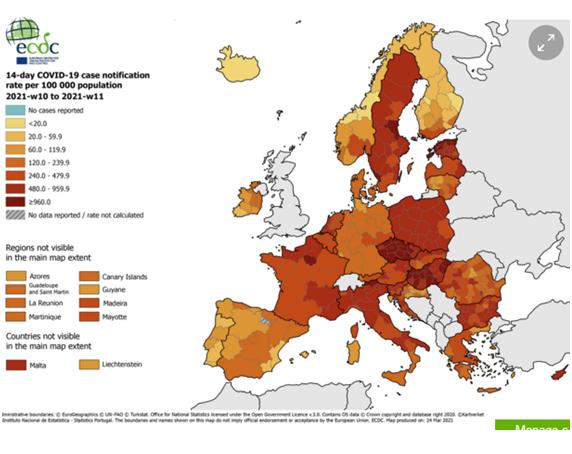

The map below shows the continuing extent of COVID infection in Europe in week 10 and 11 of 2021. Most of the continent is on fire, with only the northern part of the Nordic countries and parts of Portugal and Spain escaping the ravages of the virus.

COVID-19 infection in Europe, weeks 10 and 11 of 2021

Where the EU specifically needs help is in the organisation of the Digital Green Certificate, the proposal for which has been described as "very, very ambitious", given the pace of progress with other similar projects from air travel stakeholders and other companies.

The system would require EU states to issue common, interoperable and mutually recognised certificates for COVID-19 vaccination, testing and recovery status for travel within the bloc. The European Commission has set a target of implementing the solution by Jun-2021, in time for a peak summer travel period, which (at this stage) looks as if it might not happen.

Quite different from opening an airport, but a challenge all the same.

13. ICAO

The world's leading responsible authority on aviation has hardly shown a lead during the pandemic. Only recently has Airports Council International (ACI) World welcomed (12-Mar-2021) the publishing of an updated industry guidance by ICAO, which ACI World expects will support a harmonised and consistent global recovery from the COVID-19 pandemic.

ACI World has stated that it believes the new Phase III updates issued by the Council Aviation Recovery Task Force and adopted by the ICAO Council will help bring coordination between participants in the global aviation ecosystem. The updates include renewed policy recommendations to states, the Take-Off Guidance Document, and the Manual on Cross Border Testing and Risk Management.

The response from ICAO has hitherto been cumbersome and slow. Worst of all, there appears to have been limited co-operation between it and the World Health Organisation (WHO), also a UN agency. Such co-ordination would be expected to bring together developments in the many testing techniques for the coronavirus and in vaccination programmes into a cohesive whole, so that the world, not individual countries or regions, could be presented with a target date(s) for the resumption of air services.

There is much to be learned from the way this pandemic was handled, and procedures will need to be instigated rapidly in preparation for another such incident - and it is likely there will be one. After all, there have been several already, and even now there is an Ebola virus outbreak in Africa running concurrent with the second and third (and fourth) COVID-19 waves.

This subject was covered a CAPA the report.

See: Davos conference avoids critical questions on COVID and aviation (Feb-2021)

Realistically, Mr Daldrup would probably not wish to take on any of these challenges, and nobody could blame him for that.

But equally realistically, the fact is that there are many places in the aviation sector where a Mr Daldrup would find a role.