Republic's unusual quarterly loss was partially “self-inflicted”, but sees “strengthening trends”

For Republic Airways Holdings' CEO Bryan Bedford it was an uncomfortable and unusual duty: reporting a net loss of USD36.5 million for the first quarter of 2010. This was the first quarterly loss for the company since 9/11; that was then followed by 32 consecutive quarters of profitability, which, Mr Bedford claimed, "is among the best track records in the industry." Even so, it was the branded operations that dragged down the Republic results but with the merger announcement between United and Continental, the CEO said it remains clear that the rationale for purchasing both Midwest and Frontier is justified. The company is now modestly bullish on the outlook.

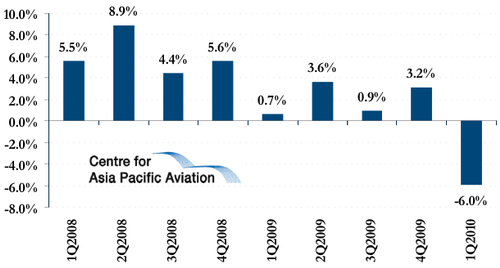

Republic Airways Holdings net profit margin: 1Q2008-1Q2010

Even though it was clear that our branded operations would lose money in the first quarter, frankly, none of that makes the results any easier to accept," he told analysts on yesterday's first quarter conference call. "We, support consolidation and hub rationalization, even though both of those processes could result in lower overall demand for our core fixed-fee flying. However, as our partners, who have struggled to maintain profitability in the last cycle, return to sustained profitability, the counter-party risk on our CPA contracts also decreases and since we have very long CPA contracts in place, that reduced risk is welcome." Republic's United contracts start expiring in 2015 and go out through 2019.

Consolidation will not undermine CPA contracts

In response to questions, Mr Bedford said concerns about CPA contracts after the United-Continental announcement were unfounded, pointing to the fact that the contracts had survived the Delta-Northwest merger. Indeed, he sees no change in either United or Continental operations for some time. However, he did provide a glimpse of what could be.

Raymond James' Jim Parker wondered whether the consolidation might result in a need for the 70-seat jets in the fixed-fee operation, but Bedford reminded him that there are only two legacies that have the scope available for 70-seaters: United and US Airways, which can go up to 90 seats. "We don't expect that either United or Continental will be making changes on the regional side in the near term," he said. "For the merged carrier we will have to see which collective bargaining agreement survives. If United's does survive then the former Continental Express routes may have a real demand for 70-seat jets."

Consolidation will benefit "all airlines…including Frontier"

Mr Bedford then turned to consolidation's impact on its branded service. "If consolidation does lead to a 4-5% reduction in domestic capacity then all airlines will benefit, including Frontier," he said. "But we can't assume anything. In fact, we have to assume competition will be every bit as challenging as it has (been) in the past years. So we have to work hard to position Frontier to return to sustain profitability in the harshest of environments. We are fully committed to restoring the company to profitability and expect to begin a new track record of consistently quarterly profits n the second quarter. We also expect our Frontier operation to contribute to both profitability and cash flows in the second half of 2010."

Changes in the revenue and expense pictures explain the loss

CEO Bedford told analysts he had promised a lot of noise in the quarterly results and much of it came from parsing Republic's statistics. The bottom line first quarter net loss of USD36.459 million for the Republic Airways Holdings consolidated business compares to a net profit of USD2.1 million in the first quarter of 2009.

Changes in the revenue and expense pictures tell the tale. Revenues for the quarter rose 87.1% to USD608.7 million while costs rose a whopping 124.1%, to USD628.7 million.

CPA results - "we have work to do in reducing fixed-fee costs."

However, Mr Bedford preferred to explain it a different way - by breaking out fixed fee and branded operations separately but only on pre-tax numbers.

He said, "Pre-tax income for the fixed-fee service was USD14.3 million in the first quarter, which was a pre-tax margin of 5.7%,", adding the operations incurred a USD2 million hit from the February storms as well as a USD2 million cost on the return of its final CRJ-200 aircraft to lessors, resulting from the downsizing of its Continental Express operations. "Adjusted for those two items, our pre-tax income for the quarter was USD18.3 million for a margin of 7.3%. Ex fuel, fixed fee service revenue went down USD53 million, that is an 18% reduction on a 19% reduction in block hour production on the removal of the Continental CRJs and seven 145 flying we did for United. It also includes the fact that our Midwest Connect operations are now reported as part of our branded operations rather than in the fixed-fee service as it was in first quarter 2009.

Fixed-fee unit costs rose to 8.07 cents, up from 7.8 cents in the year-ago period, largely resulting from the storms as well as the reduction in ASMs. "Adjust that out and you remove about two-tenths of a cent from our costs," Mr Bedford said. "The fixed-fee margins are down primarily because of the benign inflation environment which limits any increases in reimbursement from our partners. Because this business is not growing, we are seeing an increase for wages and benefits and maintenance vendor agreements outpacing the increase in reimbursement rates. We previously guided that our fixed-fee business would have 7.5%-8.5% pre-tax margins and now they will be more in the 7%-8% range for 2010. Clearly we have work to do in reducing fixed-fee costs."

Branded results; "strengthening RASM trends, especially in March", but +40% fuel prices hurt

The branded business earned total revenues of USD352 million for a unit revenue of 9.53 cents, versus the 10.12 cents in the year-ago quarter. Load factor was 75.7% compared to 71.8%. with aircraft 4% fuller on a 6% increase in capacity. "This underperformance was self-inflicted in January and February," Bedford explained. "But we saw strengthening RASM trends, especially in March. The momentum is building. In March, load factor was 84%, the highest in the company's history and that performance was achieved while increasing capacity almost 6%."

Perhaps the biggest part of the branded story, something Republic was not facing at all in 1Q2009, was fuel costs. Bedford said the branded operations spent an addition USD43 million on fuel, which was up 50% on what Frontier and Midwest spent in the year-ago quarter. The cost per gallon increased 40% to 2.32 cents compared to the 1.66 in the 1Q-2009.

"Operating costs, ex fuel and impairment items but with increased interest, were 7.63 cents," he said. "Fuel CASM was an additional 3.5 cents for a total CASM of 11.1 cents. Ex interest and integration expenses, CASM ex fuel was 7 cents, which was achieved on a fleet with an average fleet density of 98 seats per aircraft. So we are making good progress on costs. The pre-tax loss on the branded operations was USD8.5 million and there is a lot of noise in that including the negative impact from impairment charges on the selection of the Frontier brand which forced the write off of Midwest brand intangibles. There was also integration and aircraft return expenses of USD11.5 million and the weather impact which was USD5.5 million. Adjusting for these we had a pre-tax loss o USD42 million which includes other non-cash adjustments that totaled USD13 million. We ended the quarter with USD386 million in cash of which USD239 was restricted."

Frontier - lower costs than Southwest

Mr Bedford reported that even before adjusting for length of haul or seating density, Frontier turned in lower unit costs than Southwest in the first quarter. "AirTran's the real target," he said, adding that the unit cost target for the branded operations was below seven cents. For now, given the transition, the company would be happy at seven cents.

Republic's Guidance

Vice President of Revenue Management Greg Aretakis noted the actuals were coming in right in line with guidance for the branded operations.

"We guided to a 5-6% decline in TRASM from the first quarter 2009 but it was actually down 5.8%," he said. We expected capacity to increase 5-6% and came in at 5.6%. If you drill down into the quarter you get color on our revenue results with the disappointing results based on some things we were doing that had a negative impact. That included integrating the Frontier and Midwest brands and the struggles with codesharing between the two companies. In addition the revenue was depressed as we integrated the revenue management and scheduling systems. We also attempted a fare premium which was revenue negative and something we subsequently abandoned. Finally, we created an uncertainty in the market trying to promote two brands."

West network performing well

He reported that, moving through the quarter, January PRASM was down 8.2% while February's was down 4.5% leading to an increase in March of 4.4%. "In particular the West network, out of Denver, turned from a negative PRASM of 2.5% to a PRASM positive in March at 10.8%," he said. "So there is substantial traction in the West and we are pleased with the direction of the Denver operations."

East network yields down 29% due to competition

The East network's load factor was up 10% on 18% more ASMs, while yield was down 29% on increased competition and a 9% increase in the length of haul. He cautioned that this was largely owing to the switch out of Midwest aircraft to the Airbus in Milwaukee which drove up the average shell size 12% year on year.

Mr Aretakis reported a 5-7% drop in June quarter capacity, up 1% from guidance. "We expect to see TRASM down in the 1-2% range versus our guidance where we provided -3-5% range," he said. "We expect TRASM to result in 10.3 to 10.5 cents in the second quarter."

Bookings "up 14% for the balance of the quarter" and "stronger yields and revenue production"

He said demand strength was continuing and, from a demand perspective, Frontier set record load factors for Apr-2010 as well as Mar-2010, predicting second quarter load factors would exceed those in 2Q-2009, as will passenger yields. "Bookings will be up 14% for the balance of the quarter," he said. "Like the first quarter, we see stronger yields and revenue production strength in the West compared to the East. For the western network we are looking for a 2-4 point improvement in load factor compared to last year and a strong uptick in yield. In fact, we are expected double digit yield increases in unit revenue in each month of the second quarter. For the east network, we are expecting in improved load factor in the 3-5 point range, but yields will be down from last year but not as much as first quarter. It should be noted as we move into the June we will start to digest the competitive capacity increases that entered the market last year so the comps will get a little easier."

Mr Aretakis also reported that the pricing environment reflects a generally healthier demand environment. "While there continues to be regular sale activity, sale fare values are up from both the fourth quarter and first quarter," he said. "Apparently the industry is seeking higher fares. Since the beginning of year there have been 11 significant fare increases which were accepted, several of which were led by the low-fare segment. At this level of demand, frankly, we see no reason why fares can't continue to go up."

Frontier capacity to grow 6-7%, yields flat

Frontier's full-year capacity increase is still in the 6-7% range and it is still expecting to TRASM to be flat to down 2% for the year or 10.3-10.5 cents.

The company is expecting competitive capacity increases in the Milwaukee to be up 36% year on year in the second quarter and 25% in the third quarter year on year. Aretakis reported the brand business at Milwaukee was experiencing record load factors for the second straight month in April. "So people are flying out of Milwaukee," he said. "The airport is reporting its highest traffic numbers ever but at fares that are down USD60 from the national average per roundtrip."

In Feb-2010, Frontier's share of the Denver market was greater than half of the United share for the first time - meaning the airline was a solid number two in the market with over 23% of the passengers in and out of Denver. "We expect capacity to rise 2.5% in the second quarter and 5% in the third quarter."

Ancillaries - enhanced legroom product to deliver USD1 million a month

On the ancillary revenue side, Aretakis said it expects to make USD1 million a month from its enhanced legroom product introduced in February. All Airbus and E190 aircraft, for a total of 67 aircraft, have already been re-configured for the option. In February 31% of the stretch legroom capacity was sold and 36% in March. The airline is planning to tinker with the USD25 price, however.

Pleased with booking levels under expansion plan

Vice President, Planning and Strategy Daniel Shurz noted Frontier was now two thirds into its 17-market expansion and is pleased with the booking levels. "We are seeing strong traction in our new markets which include a lot of markets in which we are the first low-fare service in the market," he told analysts. "The 10 new routes from Denver brings to 61 the number of markets there, the largest number of markets Frontier has ever offered in Denver. The profile of growth for route overlap with nonstop low-cost competition is now 54%, lower than in previous quarters and we are about to start new nonstops to Fairbanks, Grand Rapids, Long Beach, New Orleans and Santa Barbara."

- Milwaukee, Mr Shurz said, has five new markets, bringing its total to 34 nonstop markets and 11 more destinations than its largest competitor there;

- Kansas City has added two new nonstop markets and the airline is continuing to look at other opportunities to take advantage of loyalty to the Frontier brand.

Milwaukee capacity growth in competitive overlap markets is expected to be 38% in the second quarter down from 48% in 1Q-2010. The trends, Shurz said, will continue to improve in 3Q-2010 with the elimination of Milwaukee-Tampa by Southwest and its 50% reduction of Milwaukee-Orlando.

He cited Frontier's route network diversification for helping with competitive capacity. "In our competitive markets capacity will grow slightly under 1% in the second quarter," he said. "The main competitive story is in Denver where Southwest continues to grow and United reduces capacity in the second and third quarters."

Fleet changes: to sell Lynx's Q400s - and Lynx

Analyst Duane Pfenningworth seemed anxious for Frontier to shed its less-than-100 seat aircraft, clearly not allocating their value. Mr Bedford reported no plans to switch them out for larger equipment, adding 15 E190s are now flying in Frontier with another 20 E170s added to the mix. In addition, 12 37- to 50-seat aircraft have been moved to branded operations from the fixed-fee side for a total of 47 E-jets in the branded operations.

Mr Bedford added that the only fleet change was to shed the Bombardier Q400s that were part of the Lynx operation. He added that passengers have consistently reported they prefer Southwest's competing B737s and United's regional jets to the turboprops. "Frankly, we need these jets," he said. "There are a lot of markets than can't absorb the amount of seats of a larger aircraft. These are markets like Appleton, Madison, Green Bay to Milwaukee and they are being served profitably with them."

The CEO also discussed the possibility the company would not only sell the six Q400s it owns, but the entire Lynx entity once it is phased out in the third quarter. However, he didn't sound as if any deal were anywhere near, although he reported some interest. He reiterated the company's decision to exit Lynx based on customer preference in Denver for jets over turboprops which resulted in a negative QSI share shift to Southwest and even United's regional jets. "We think that replacing the turboprops with E-Jets is going to be revenue positive," he said. "Secondly, Lynx was a niche operator of 11 aircraft which gave it higher unit costs than what we are going to have as network operating 130 EJets and clearly we think the P&L performance will be better on the unit cost side. So, we went on revenue and on costs in terms of deciding on a replacement."

The 1Q-2010 results in full: Republic's report

Republic Airways Holdings Inc. (NASDAQ: RJET) reported operating revenues of USD608.7 million for the quarter ended 31-Mar-2010, an 87.1% increase, compared to USD325.3 million for the same period last year. The increase in revenues is due to the acquisition of our branded carriers during 2009. The company also reported a net loss of USD36.5 million, or USD1.06 per diluted share, for the quarter ended March 31, 2010, compared to USD2.2 million of net income, or $0.06 per diluted share, for the same period last year.

During the first quarter of 2010, the company's pre-tax loss of USD58.5 million was negatively impacted by an USD11.5 million, non-cash impairment to write off the Midwest Airlines trademark and reduce the carrying value of other assets. The company also recorded a total of USD13.1 million of expenses related to the integration of the branded business and the return of Q400 and CRJ aircraft. Also, the severe winter storms in the first quarter of 2010 had an estimated USD7.5 million negative impact on pre-tax results.

Excluding all non-recurring items and the impact of the storms, the Company's pre-tax loss was USD26.4 million. Republic also recorded USD10.0 million of non-cash adjustments that reduced branded revenues and USD3.2 million of amortization for intangible assets associated with the purchase accounting for Frontier and Midwest. The non-cash adjustments to revenue are expected to continue in the second and third quarters of 2010 and the intangible amortization is expected to continue at current levels for the remainder of 2010.

First Quarter 2010 Highlights

Total fixed-fee service revenues of USD251.0 million declined USD70.7 million from prior year's first quarter. However, excluding fuel reimbursement from our partners, fixed-fee service revenues decreased USD53.3 million, or 18.4% for the first quarter of 2010 due to a 19.3% reduction in block hours. It have removed 44 aircraft from our fixed-fee operations since March 31, 2009: twenty-one 50-seat aircraft were removed from Continental; seven 50-seat aircraft were removed from United; sixteen 76-seat aircraft were transitioned to our branded business. Income before taxes on the fixed-fee operations was USD14.3 million for the quarter. CASM, including interest expense but excluding fuel increased to 8.07¢ for the first quarter of 2010, from 7.80¢ for the same quarter of 2009.

Branded Segment

Total revenues on our branded airlines were USD352.3 million for the quarter. Load factor was 75.7% for the quarter and total revenue per ASM (TRASM) was 9.53¢. The branded operations posted a loss before taxes of USD70.5 million for the first quarter. The branded business incurred non-recurring items totaling USD22.6 million and was also negatively impacted by approximately USD5.5 million due to the severe winter storms. Cost per ASM (CASM), including interest expense but excluding fuel and impairment charges, was 7.63¢ for the first quarter of 2010.

Other Segment

The company's "Other" business segment includes revenues from aircraft subleases, slot rentals and charter operations and expenses associated with those activities and any unassigned aircraft. The company reported a pre-tax loss of USD2.3 million in the first quarter on this segment related mostly to idle aircraft.

Fleet

During the quarter the company took delivery of one A320 aircraft and two E190 aircraft previously purchased from US Airways bringing the total operational fleet to 282 aircraft at March 31, 2010 from 290 aircraft at December 31, 2009. The three new aircraft are in service in the company's branded business and the 11 50-seat aircraft that were removed are being returned to the lessors or subleased offshore.

Balance Sheet Information

At March 31, 2010, the company had USD385.7 million in cash, of which USD239.4 million was restricted. This compares to USD350.2 million in cash, of which USD192.7 million was restricted as of December 31, 2009. Republic's debt decreased to USD2.76 billion as of March 31, 2010, compared to USD2.79 billion at December 31, 2009.